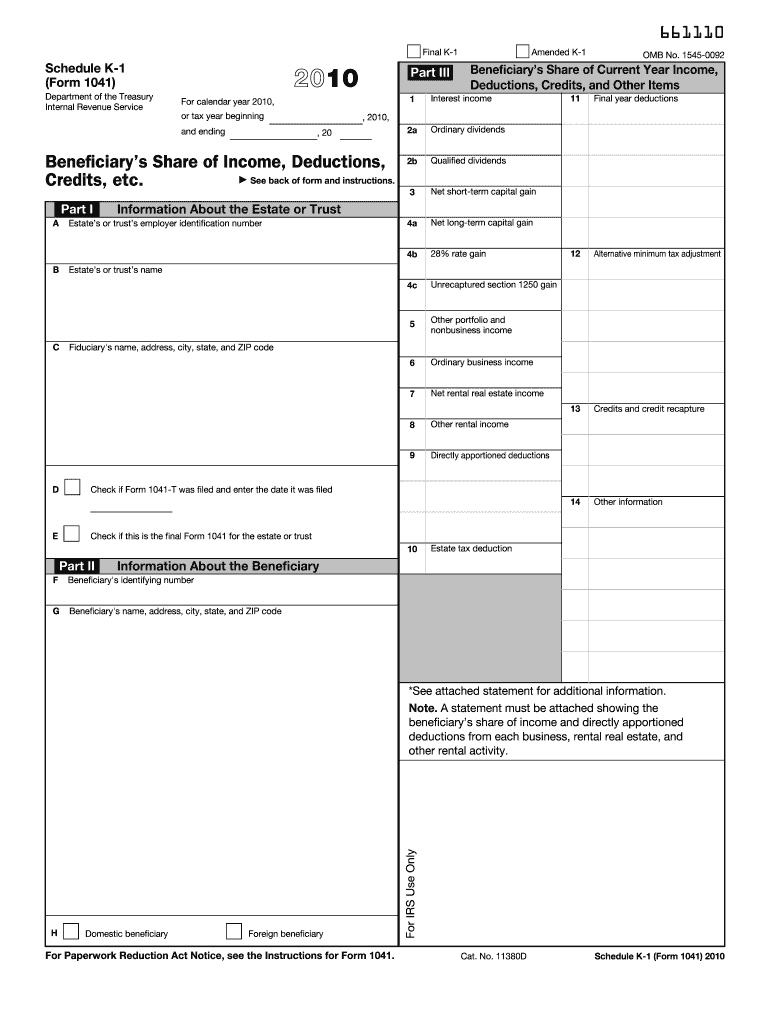

Definition and Purpose of the 2010 Form 1041

The 2010 Form 1041 is an essential tax document used by estates and trusts to report income, deductions, gains, and losses to the IRS. This form serves as the conduit for a fiduciary — such as a trustee or executor — to account for the financial activities of an estate or trust during a given tax year. By accurately filling out this form, fiduciaries ensure that both trust or estate earnings and distributions to beneficiaries are appropriately taxed, preserving compliance with U.S. tax regulations.

Typical Users and Applicability

Typically, the 2010 Form 1041 is utilized by fiduciaries responsible for managing an estate or trust. These fiduciaries include executors, administers, or trustees who oversee the financial matters of a deceased individual’s estate, including any income-earning assets not directly transferred to beneficiaries. Trusts established for family members or charities may also be required to submit this form annually as long as they generate income over the threshold set by the IRS.

Key Elements of the 2010 Form 1041

The form comprises various sections that collect detailed financial information. Key elements include:

- Income: Estates and trusts report all forms of income, such as interest, dividends, and capital gains, which require separate line entries.

- Deductions: Allowable deductions include expenses incurred in managing the trust or estate, such as fiduciary fees, attorney fees, and administration costs.

- Taxable Income: This is calculated by subtracting deductions from the total income, forming the basis for determining the tax due.

- Distributable Net Income: This section evaluates the net income available for distribution to beneficiaries, directly affecting each beneficiary's reported income.

Steps to Complete the 2010 Form 1041

Completing the Form 1041 involves several detailed steps:

- Gather Required Documents: Collect all financial statements that reflect income and expenses pertinent to the trust or estate.

- Calculate Income: Accurately assess all income streams, including capital gains and dividends.

- Determine Deductions: List applicable deductions to reduce taxable income.

- Compute Taxes: Utilize the form to calculate the tax liability of the estate or trust.

- Sign and Date: Ensure that the designated fiduciary or their representative signs the completed form.

IRS Guidelines for the 2010 Form 1041

The IRS provides straightforward guidelines for fulfilling this tax obligation. Fiduciaries must ensure that all income is reported honestly, and appropriate deductions are claimed. The IRS requires precise record-keeping to substantiate the reported information, maintaining transparency in managing trust or estate finances. Additionally, IRS guidelines specify the necessity for fiduciaries to supply beneficiaries with a Schedule K-1, detailing their share of income for individual tax reporting.

Obtaining the 2010 Form 1041

To obtain the form, fiduciaries can download it directly from the IRS website. Physical copies are also available at IRS Taxpayer Assistance Centers across the United States. Online tax preparation software may offer access to this form as part of their service packages, streamlining the completion process.

Filing Deadlines and Requirements

For the 2010 tax year, the deadline for filing Form 1041 was typically April 15, the same as individual tax returns. It is crucial for fiduciaries to meet this deadline to avoid penalties. If additional time is needed, fiduciaries can request an extension by filing Form 7004, granting them an extra six months to finalize the submission.

Penalties for Non-Compliance

Failure to timely file can result in significant penalties. The IRS may impose a penalty calculated based on the number of months the return is late, multiplied by the number of beneficiaries, up to the maximum penalty amount. Prompt attention to filing deadlines and requirements is essential in mitigating these risks.

Software Compatibility for Filing

Electronic filing for the 2010 Form 1041 can be facilitated through tax software compatible with IRS regulations, such as TurboTax, QuickBooks, and other recognized platforms. These tools help ensure accuracy and compliance by guiding users through complex calculations and reporting sections systematically and intuitively.

Examples and Real-World Scenarios

Consider an individual who passes away, leaving behind an estate with diverse investment holdings. The fiduciary is required to report all accrued dividend and interest income and ensure that such earnings, alongside distribution records to beneficiaries, are captured on the Form 1041. Similar principles apply to a charitable trust managing a portfolio of stocks, where capital gains need to be reported and distributed void of tax complications.

Legal Use and State-Specific Rules

Each state may have unique rules impacting the filing of Form 1041. Fiduciaries must be aware of state-specific regulations that affect estate or trust taxation beyond federal obligations. Some states require separate state income tax returns for estates and trusts, which may necessitate additional documentation and compliance measures.

Understanding these complexities and carefully adhering to both state and federal guidelines will help fiduciaries navigate the filing process efficiently, preventing legal complications associated with mismanagement or oversight in tax matters.