Understanding the Modelo SC 2745

What is the Modelo SC 2745?

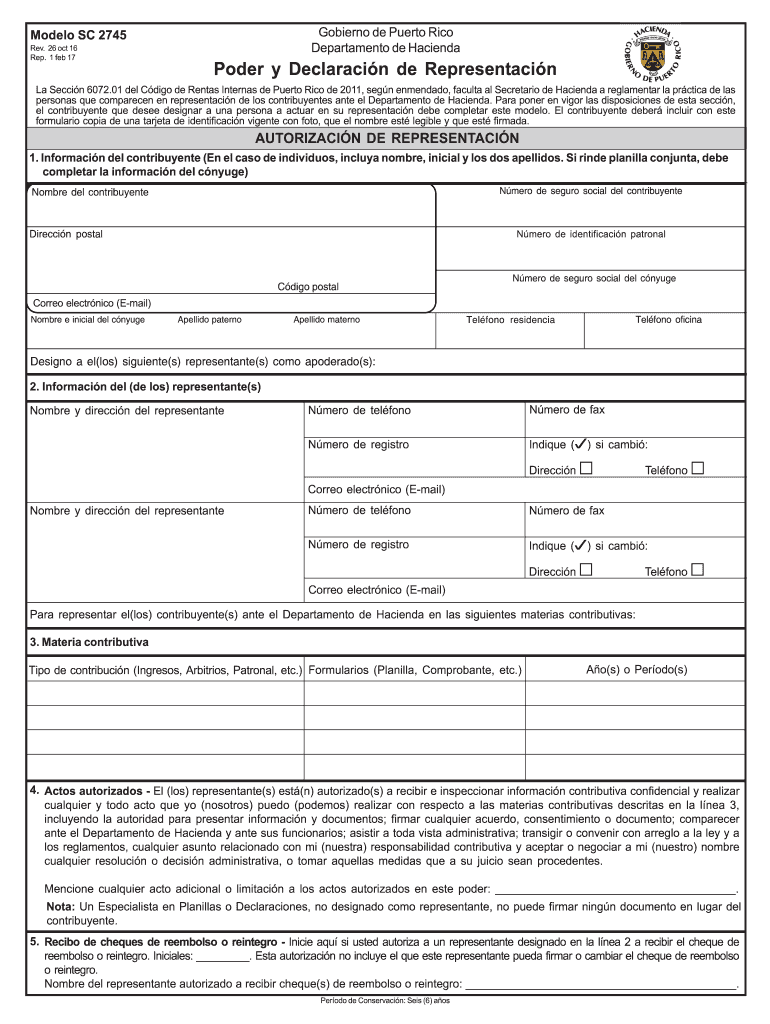

The Modelo SC 2745, also known as the "Poder y Declaración de Representación," is an official form utilized by taxpayers in Puerto Rico. This document enables a taxpayer to designate one or more representatives to act on their behalf before the Puerto Rico Department of Treasury (Hacienda). The form plays a crucial role in allowing representatives to manage tax matters, receive confidential information, and undertake other actions related to the taxpayer's responsibilities.

Sections of the Modelo SC 2745

The Modelo SC 2745 consists of several key sections that must be completed accurately for the form to be valid.

- Taxpayer Information: This section requires detailed information about the taxpayer, including the name, address, and identification number.

- Representative Information: Here, the taxpayer must provide similar details about the designated representatives, ensuring that those acting on the taxpayer's behalf are clearly identified.

- Scope of Representation: The form outlines specific matters that the representatives are authorized to manage. This delineation is crucial for setting boundaries and expectations.

- Confidentiality and Notifications: This section includes authorizations for the representative to receive confidential notifications, ensuring compliance with legal obligations.

- Revocation of Previous Authorizations: The Modelo SC 2745 allows taxpayers to revoke any prior designations, ensuring clarity and control over who may act on their behalf.

Completing the Modelo SC 2745

Filling out the Modelo SC 2745 involves specific steps to ensure all necessary information is captured correctly.

- Gather Necessary Information: Before starting the form, collect identification numbers and contact information for both the taxpayer and representatives.

- Fill in the Taxpayer Section: Enter the required taxpayer details accurately to avoid processing issues.

- Input Representative Details: Clearly list the representatives, ensuring all fields are filled, including their identification information.

- Specify the Scope: Indicate the specific matters the representatives are authorized to address. Be as detailed as possible to avoid confusion.

- Sign and Date: The form must be signed and dated by the taxpayer to authenticate the document.

Important Considerations When Using the Modelo SC 2745

Using the Modelo SC 2745 effectively requires an understanding of its implications and proper use.

- Legal Validity: The signature of the taxpayer is essential for the form's legal enforcement. Without it, the document is not considered valid.

- Expedited Processes: By designating a representative through the Modelo SC 2745, taxpayers can expedite their tax-related processes, ensuring timely compliance with regulations.

- Potential Consequences: Taxpayers must be cautious when granting representation, as this authority enables representatives to access sensitive information and make binding decisions.

Who Typically Uses the Modelo SC 2745?

The Modelo SC 2745 is relevant to various taxpayer scenarios, typically involving individuals or businesses seeking professional assistance with their tax obligations.

- Individuals Seeking Help: Taxpayers who may feel overwhelmed by the complexities of tax laws often rely on professionals to navigate their obligations.

- Businesses: Companies with intricate tax situations often designate accountants or tax advisers to handle compliance matters efficiently.

- Representatives of Estates or Trusts: Executors and trustees often use this form to ensure they can manage tax matters on behalf of the estates they represent.

Where to Obtain the Modelo SC 2745

Taxpayers can access the Modelo SC 2745 through several channels to ensure they have the correct version of the form.

- Department of the Treasury Website: The official Hacienda website provides the most current version, often available in PDF format for easy downloading and printing.

- Accountants and Tax Professionals: Many professionals have access to the form and can provide it, along with guidance on its completion.

Submission Methods for the Modelo SC 2745

Once completed, the Modelo SC 2745 must be submitted correctly to ensure it is processed.

- Online Submission: Some platforms may allow electronic submission if integrated with Puerto Rico’s tax systems.

- Mail Submission: Taxpayers can send the completed form via postal mail to the appropriate Department of Treasury office.

- In-Person Submission: Alternatively, presenting the form in person can facilitate immediate processing and confirmation.

Understanding the Implications of the Modelo SC 2745

Using the Modelo SC 2745 has several implications for taxpayers and their designated representatives, affecting how tax representation is managed.

- Boundary of Authority: The form clearly defines the limits of the representative's authority, which helps to prevent overreach and misunderstandings.

- Confidentiality Commitments: This form solidifies the obligations of the representatives regarding the confidentiality of the taxpayer’s information, ensuring compliance with privacy regulations.

- Revocations: Taxpayers can revoke the authority granted to a representative at any time by submitting an updated Modelo SC 2745, which can be particularly useful for those who change advisors.

Conclusion

The Modelo SC 2745 is a vital tool for establishing representation in tax matters within Puerto Rico. Understanding its components, process, and implications is essential for effective tax management and compliance.