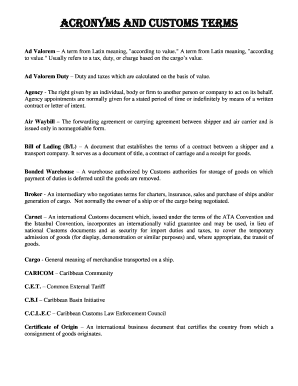

Definition and Purpose of Form 2EZ

Form 2EZ is the 2014 Montana Individual Income Tax Return specifically designed for residents of Montana who are filing as single or married jointly without dependents. This form aims to streamline the tax filing process for individuals with simpler financial situations by minimizing the number of sections and requirements. It covers basic components such as personal information, income reporting, tax liability calculations, deductions, and payment details.

Key Elements of Form 2EZ

- Personal Information: Capture essential data, including name, address, and Social Security number.

- Income Reporting: Report total income from various sources like wages, salaries, and interest.

- Tax Liability Calculations: Determine the amount owed based on reported income.

- Standard Deductions: Worksheets provided help calculate eligible standard deductions.

- Payment Details: Instructions for completing payment, if taxes are owed.

Steps to Complete Form 2EZ

- Gather Required Documents: Collect W-2s, 1099s, and other relevant income records.

- Fill Personal Information: Enter your name, address, and Social Security number.

- Report Income: Input earnings from all applicable sources.

- Calculate Taxes: Use the provided tax table to determine liabilities based on income.

- Determine Deductions: Apply standard deductions as per provided worksheets.

- Complete Payment Section: Indicate payment options if taxes are due.

- Review and Submit: Double-check entries for accuracy and submit via the appropriate method.

How to Obtain Form 2EZ

Residents of Montana can acquire Form 2EZ through several means, ensuring accessibility for all taxpayers.

- Montana Department of Revenue: Visit their official website to download the form.

- Local Tax Offices: Obtain a physical copy by visiting nearby tax offices.

- Professional Tax Preparers: Many tax professionals can provide or assist with obtaining the form.

Filing Methods and Deadlines

Submission Methods

- Online Filing: Submit electronically through the Montana Department of Revenue’s portal.

- Mail-In Option: Physical submission through postal services to the state’s designated tax processing center.

- In-Person Delivery: Some local offices may allow direct submission, though availability varies.

Important Deadlines

- Standard Filing Deadline: Typically due by April 15 of the following year.

- Extensions: Taxpayers may request filing extensions, which should be submitted by the standard deadline to avoid penalties.

Eligibility Criteria

Form 2EZ is specifically tailored for Montana residents with straightforward financial circumstances. Eligible individuals include:

- Filing Status: Single or married filing jointly without dependents.

- Income Sources: Primarily wages and simple interest income, with no need for complex deductions.

- Resident Status: Must be a resident of Montana for the entire tax year.

Taxpayer Scenarios

Form 2EZ serves various taxpayers in distinct situations, offering clarity and convenience.

Common Scenarios

- First-Time Filers: Young adults or recent college graduates entering the workforce.

- Retirees: With fixed or limited income from pensions or simple investments.

- Students: Working part-time with minimal income and no dependents.

State-Specific Rules and Legal Use

Montana residents must comply with state laws governing income reporting and tax submissions.

Legal Compliance

- Secure Data Handling: Use only secure methods to handle personal and financial data.

- Accurate Reporting: Ensure all income types are accurately reported to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 2EZ can lead to various penalties, impacting financial stability.

- Late Filing Penalties: Fees and interest may accrue on unpaid taxes.

- Inaccurate Reporting Fines: Misrepresentation or omission of income can result in audits and fines.

IRS Guidelines and Federal Implications

While Form 2EZ is specific to Montana, aligning tax filings with federal regulations is critical.

Federal Alignment

- Consistency: Ensure state and federal returns match regarding income reported.

- IRS Resources: Utilize IRS publications for clarity on reporting federally taxable income.

The comprehensive breakdown of Form 2EZ aims to equip taxpayers with necessary insights and steps, ensuring effective and compliant tax filings in Montana. This structured approach addresses potential scenarios and challenges, enhancing user readiness and compliance.