Definition of Dynasty Trust Template

A dynasty trust template is a legal document designed for establishing a trust that benefits multiple generations. This irrevocable trust allows the granter to pass wealth to their descendants, typically spanning over multiple generations, without incurring estate taxes at each generational level. The template outlines essential aspects, including the roles of the Grantor and Trustee, the management of the trust's assets, and the distribution of income or principal to beneficiaries.

- Purpose: The primary purpose of a dynasty trust is tax efficiency and asset protection, ensuring that funds remain within a family lineage.

- Duration: Some states, like South Dakota, allow dynasty trusts to exist perpetually, while others impose a maximum lifespan.

Understanding the definition and function of this template is crucial for anyone considering establishing such a trust.

Key Elements of the Dynasty Trust Template

Key elements within a dynasty trust template ensure effective asset management and secure wealth transfer:

- Grantor and Trustee Roles: Clearly defining the responsibilities of the Grantor (the person creating the trust) and the Trustee (the person or institution managing the trust).

- Beneficiary Designations: Specifying who will benefit from the trust, which can include children, grandchildren, or even future descendants.

- Distribution Guidelines: Outlining how and when distributions will be made to beneficiaries. This may include regular distributions or conditional distributions based on certain milestones.

- Spendthrift Provisions: Inclusion of clauses that prevent beneficiaries from squandering their inheritance or from creditors accessing trust assets.

- Powers of Appointment: Giving the Trustee or beneficiaries certain powers over the trust assets can help adapt to future needs.

These elements form the foundation of a dynasty trust, ensuring its functionality and compliance with legal requirements.

Important Terms Related to Dynasty Trust Template

Understanding the terminology associated with a dynasty trust template is crucial for effective operation:

- Irrevocable Trust: A trust that cannot be modified or terminated without the permission of the beneficiaries.

- Generation-Skipping Tax (GST): A federal tax imposed on transfers of property to beneficiaries who are two or more generations younger than the grantor.

- Discretionary Distribution: Allowing the Trustee to decide how much and when to distribute assets to beneficiaries.

- Grantor Retained Annuity Trust (GRAT): A type of trust that allows the grantor to transfer appreciation of assets to beneficiaries while retaining income for a specified term.

Familiarity with these terms is essential to navigate the complexities of estate planning effectively.

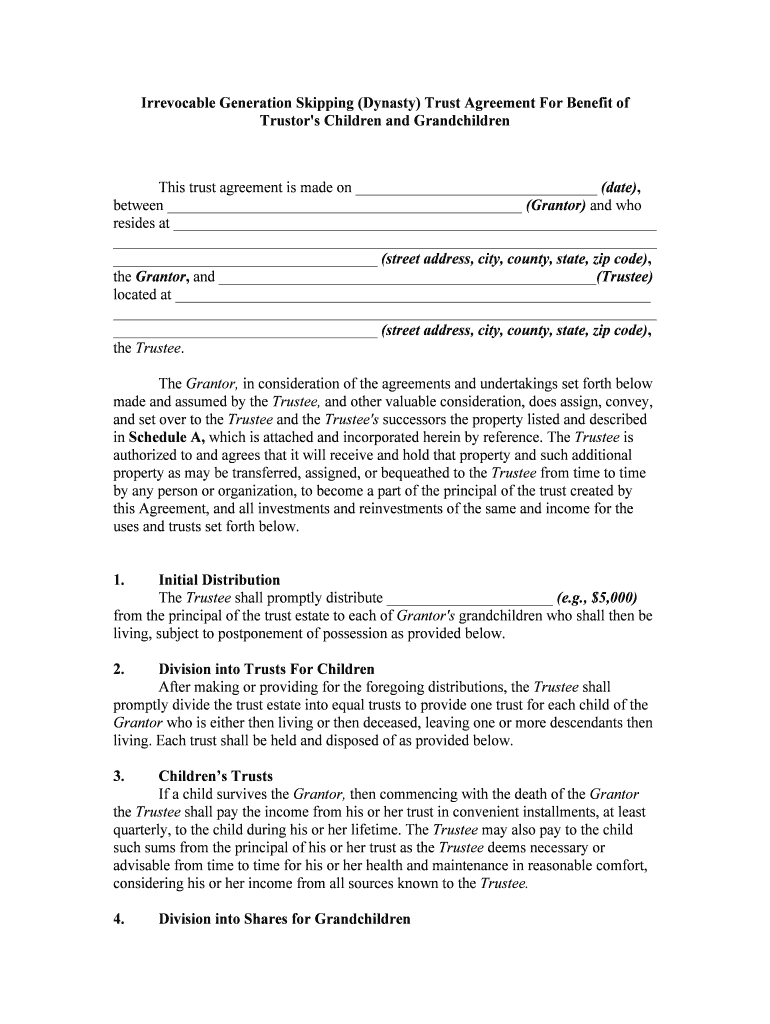

Steps to Complete the Dynasty Trust Template

Completing a dynasty trust template involves several methodical steps to ensure that it meets all legal requirements:

- Gather Necessary Information: Collect all relevant financial information, including assets, liabilities, and potential beneficiaries.

- Choose a Trustee: Decide on a trustworthy individual or institution who will be responsible for managing the trust.

- Draft the Template: Use a standard dynasty trust template or consult an attorney to create a tailored document, including all critical elements.

- Review and Sign: Both the Grantor and Trustee should carefully review the document before signing to ensure accuracy and compliance with state laws.

- Fund the Trust: Transfer assets into the trust to make it operational; this can include real estate, investments, or cash.

Following these steps carefully will help ensure that the dynasty trust is established correctly and effectively.

Examples of Using the Dynasty Trust Template

Real-world applications of a dynasty trust template illustrate its effectiveness in estate planning. Consider the following scenarios:

- Wealth Preservation: A wealthy family establishes a dynasty trust to ensure that their fortune is preserved for generations. By utilizing the trust, they avoid substantial estate taxes at each generational transfer.

- Educational Trusts: Parents can set up a dynasty trust aimed at financing education for future generations, positioning funds to be disbursed for approved educational expenses.

- Asset Protection: A family facing potential financial risks can use a dynasty trust to protect their assets from creditors, ensuring that beneficiaries receive their inheritances despite any financial difficulties.

These examples highlight the diverse applications of a dynasty trust template, demonstrating how it can be tailored to meet specific family needs.