Definition and Meaning of SC4868

The SC4868 form is a request document utilized by individuals and certain nonresidents who need an extension on filing their South Carolina Individual Income Tax Return (SC1040). This form signifies a formal application to the South Carolina Department of Revenue, aiming to secure additional time beyond the original tax filing deadline. An extension, however, only extends the filing period; it does not extend the time to pay any taxes due.

How to Use the SC4868 Form

To use the SC4868 form effectively, taxpayers should first assess their need for an extension on their tax filing. By completing this form accurately, an extension of six months can be granted to submit the South Carolina Individual Income Tax Return. It's essential to note that submitting this form does not waive any taxes owed. Taxpayers must calculate their estimated tax liability and make payments by the original deadline to avoid penalties and interest.

Obtaining the SC4868 Form

The SC4868 form can be obtained through multiple channels, ensuring accessibility for all applicants. It is available for download from the South Carolina Department of Revenue's official website, allowing taxpayers to print and fill out the form at their convenience. Additionally, tax preparation software might offer digital versions of this form, integrated within their e-filing systems for a seamless application process.

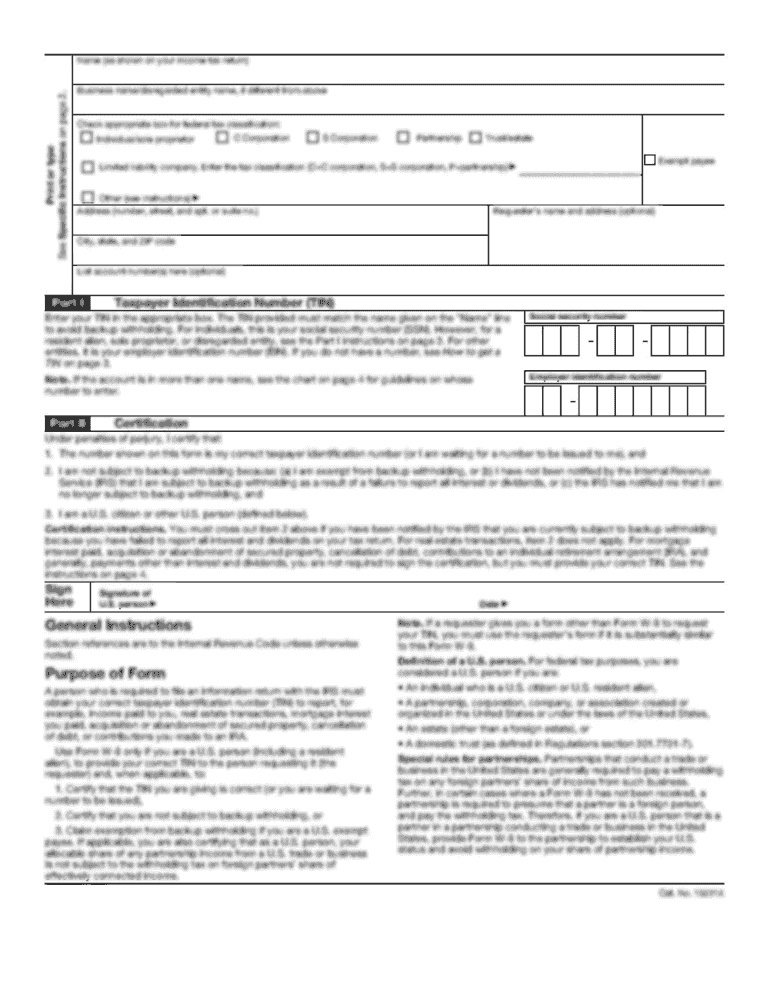

Steps to Complete the SC4868 Form

-

Personal and Contact Information: Begin by filling out your full name, social security number, mailing address, and any other identifying information required.

-

Tax Type and Tax Year: Specify the type of tax return (Individual Income Tax) and the year for which the extension is sought.

-

Estimated Tax Payment: Calculate and input any estimated tax payments already made for the year to ensure they are credited properly.

-

Signature and Date: Sign and date the form before submission to validate the application.

-

Submitting the Form: Once filled, the form can be submitted electronically or by mail. Select the appropriate method based on preference or convenience.

Why You Should Consider Using SC4868

Seeking an extension with the SC4868 form can be prudent for several reasons. Taxpayers experiencing personal hardships or awaiting additional financial documentation may require more time to file accurately. By securing an extension, these individuals can avoid filing incomplete or inaccurate returns, which could lead to audit-triggering discrepancies. An extension provides the necessary leeway to ensure all income and deductions are reported correctly.

Who Typically Uses the SC4868 Form

The SC4868 is predominantly used by taxpayers in South Carolina who are unable to meet the original tax filing deadline. This includes individuals with complex financial situations, out-of-state residents with South Carolina income, and nonresidents who earn income within the state. It is especially beneficial for those who encounter unforeseen circumstances, such as significant life changes, that impede their ability to file promptly.

State-Specific Rules for Using SC4868

When filing the SC4868, it's essential to adhere to South Carolina-specific tax regulations. Taxpayers must ensure that while the extension allows for a delayed submission of the tax return, it does not allow for a delayed payment of taxes due. Estimated payments must reach the Department of Revenue by the original deadline. Additionally, those applying for both federal and state extensions must file them separately, as a federal extension does not automatically apply to state taxes.

Important Terms Related to SC4868

- Extension of Time: Refers to the additional period granted for filing tax returns, typically six months.

- Estimated Tax Payment: Partial payments made towards the total tax liability for the year, intended to minimize interest and penalties.

- Nonresident: An individual who resides in another state but earns income within South Carolina.

- SC1040: The South Carolina Individual Income Tax Return that must be filed to report state income taxes.

- Tax Liability: The total amount of tax owed to the state based on earned income.

- Deadline: The final date by which the tax payments need to be made and the SC4868 submitted to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the SC4868 filing procedures can result in significant consequences. If taxpayers do not file for an extension and miss the original tax deadline, the South Carolina Department of Revenue may impose late filing penalties. Additionally, if the estimated taxes are not paid by the original due date, penalties and interest on the unpaid amounts will accrue, potentially leading to financial strain. It's crucial to comply with filing requirements to maintain good financial standing and avoid unnecessary penalties.

Filing Deadlines and Important Dates

Taxpayers intending to use the SC4868 form must be vigilant about key dates. Typically, the SC4868 should be filed by April 15, aligning with the federal tax deadline. By doing so, they ensure a six-month extension to file the SC1040. It’s important to remember that any taxes owed should still be paid by this date to prevent interest charges. Failure to adhere to these deadlines may result in penalties that could complicate the taxpayer's financial affairs.

Required Documents for Form SC4868

When preparing to file the SC4868, gather all pertinent financial documents to ensure accurate estimation of tax payments. Necessary documents may include:

- Previous year's tax return for reference.

- W-2 and 1099 forms to report income.

- Documentation of estimated tax payments already made.

- Records of deductible expenses, such as mortgage interest, charitable donations, and medical expenses.

Having these documents on hand facilitates a smooth filing process, allowing for precise calculations and an on-time submission.