Definition & Purpose of Form 3716

Form 3716 is a critical document typically used within the realm of business and tax administration. Its primary purpose is for entities to request the offset of tax refunds to pay off certain types of debts. It is mainly utilized within the context of the United States federal tax system. More specifically, the form allows state and federal agencies to be notified that a taxpayer's refund should be used to satisfy outstanding liabilities. These debts might include overdue child support, outstanding student loans, or other federal and state obligations.

How to Obtain Form 3716

To acquire Form 3716, entities can visit the Internal Revenue Service (IRS) website, where the form is available for download. Additionally, many tax software programs include Form 3716 as part of their package, allowing users to complete it electronically. Tax professionals typically have access to this form and can provide guidance on how to accurately fill it out. For those without internet access, contacting the IRS directly via phone or visiting an IRS office is an alternative way to receive a physical copy.

Steps to Complete Form 3716

-

Gather Necessary Information: Before starting, ensure you have all pertinent details such as taxpayer identification number, details of the debt to be offset, and any relevant financial information.

-

Fill Out Party Information: Begin by entering the required information about the taxpayer and the creditor agency, including names, addresses, and contact details.

-

Provide Debt Details: Clearly state the amount and nature of the debt to be offset against the tax refund.

-

Review for Accuracy: Verify all the entered information to ensure accuracy, as errors can lead to processing delays.

-

Submit the Form: Depending on your preference, submit the completed form either online, via mail, or in person at a designated IRS office.

Important Terms Related to Form 3716

- Offset: The amount of tax refund redirected to pay off a debt.

- Debtor: The entity or individual owing money or obligations.

- Creditor Agency: The agency holding the debt claim, which may include federal or state organizations.

- Taxpayer Identification Number (TIN): A unique identifier for the individual or business filing the form.

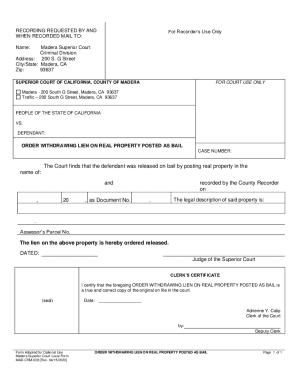

Legal Use of Form 3716

The Form 3716 must be used in compliance with existing federal taxation laws and regulations. It is typically used for legally binding offsets that the IRS and other government entities oversee. Misuse of the form—by providing misleading information or submitting fraudulent claims—can lead to significant legal repercussions, including penalties and potential criminal charges.

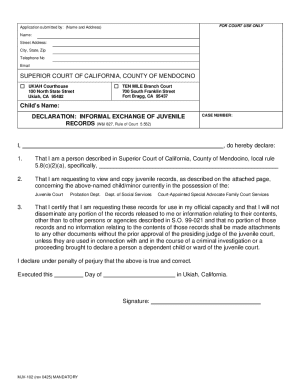

Key Elements of Form 3716

-

Section for Debtor Information: Includes details about the taxpayer whose refund is being offset.

-

Debt and Creditor Information: Specifies the amount and context of the debt, including the creditor agency's details.

-

Signature Section: Must be signed by an authorized individual to validate the form's contents and give consent for the offset process.

Filing Deadlines & Important Dates

While the IRS accepts Form 3716 throughout the year, certain deadlines must be adhered to concerning specific debts. For example, to ensure that an offset occurs during the current tax cycle, submitting the form before the annual tax filing deadline of April 15 is advisable. Failure to submit the form in a timely manner might mean that offsets will not be processed until the following cycle.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 3716 can carry significant financial penalties. For instance, providing false information can result in fines, while failing to submit the form for an obligated offset scenario might lead to interest accrual on unpaid debts. Legal action can also be pursued by creditor agencies in severe cases of non-compliance.

Who Typically Uses Form 3716

Form 3716 is commonly used by various taxpayer categories, including:

-

Individuals with Outstanding Debts: Especially those with obligations such as child support or federal student loans.

-

Businesses with Tax Liabilities: Entities required to settle specific debts via tax offsets.

-

Government Agencies: Utilizing the form to claim refunds on behalf of creditors needing to collect outstanding dues.

Software Compatibility

Form 3716 can be compatible with many popular tax software solutions, including TurboTax and QuickBooks. These platforms often include step-by-step instructions, alleviating the risk of errors during the form's completion. Using tax software may be beneficial for those seeking a streamlined, electronic submission process.

Examples of Using Form 3716

Consider a taxpayer who has an overdue federal student loan. In such cases, the taxpayer’s annual tax refund could be offset by completing and submitting Form 3716 to credit the refund towards settling the debt. Similarly, unpaid child support can trigger the use of this form to redirect refunds towards these obligations.