Definition and Meaning of the Form

"Can You Screen and Reject Potential Owners? Florida County" refers to a document typically used to evaluate and potentially refuse prospective property owners based on certain criteria in a Florida county. This process ensures property ownership is granted to individuals who meet specified standards and requirements, thereby maintaining the integrity and desirability of the community. The form serves as an essential tool for homeowners associations, property managers, and similar entities who have the authority to administer such evaluations.

How to Use the Screening Form

To effectively utilize the form, organizations need to establish clear guidelines and criteria that prospective owners must meet. These criteria often cover factors such as financial stability, background checks, and compatibility with community standards. The form should be distributed to applicants, who must provide detailed and accurate information to demonstrate they fulfill the necessary criteria. The reviewing body will assess these submissions, utilizing the form as a structured method to document and justify decisions regarding approval or rejection.

Steps to Utilize the Form

- Develop ownership criteria and guidelines.

- Distribute the form to prospective owners.

- Collect completed forms and supporting documents.

- Review and evaluate submissions based on established criteria.

- Document decisions and notify applicants of their acceptance or rejection.

How to Obtain the Screening Form

Interested parties can typically obtain the "Can You Screen and Reject Potential Owners? Florida County" form directly from the issuing body, such as a local homeowners association or property management firm. These organizations might provide the form via multiple channels—online through their official website, in person at their office, or via email upon request. It is crucial to ensure that any form acquired is current and specific to the applicable county to avoid potential legality issues or discrepancies.

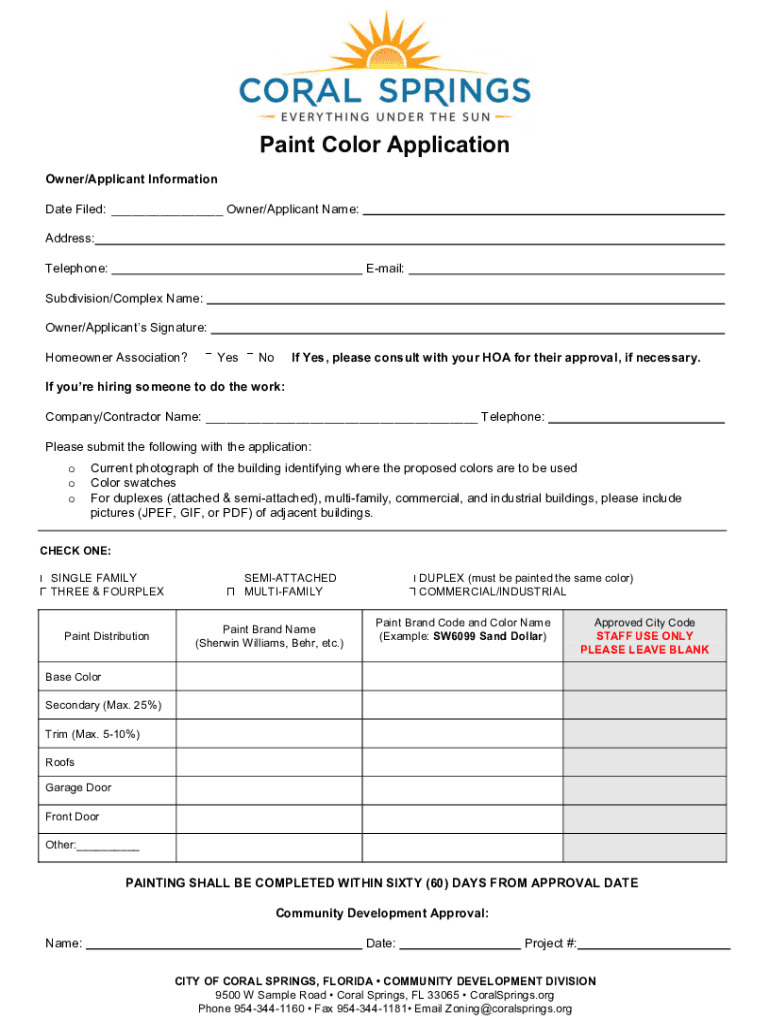

Steps to Complete the Form

Completing the form requires careful attention to detail and compliance with all requested information. Applicants must provide comprehensive responses to each section, ensuring accuracy and completeness. Typical sections include personal information, financial disclosure, background details, and affirmation of understanding the community's rules and guidelines. Supporting documents, such as identification copies or credit reports, should be attached as necessary. Once completed, the form should be returned to the issuing body promptly as per any specified deadlines.

Who Typically Uses the Screening Form

Primarily, homeowners associations, property management companies, and condominium boards in Florida utilize this form to screen potential property owners. These organizations aim to protect and enhance the quality of life and property values within their communities by ensuring only suitable individuals are granted ownership. By conducting thorough screenings, they can minimize risks associated with potentially problematic owners, such as financial instability or behavior incompatible with community standards.

Key Elements of the Screening Form

The form comprises several critical sections designed to gather comprehensive information about the applicant. These include:

- Personal Details: Full name, contact information, and identification documentation.

- Financial Information: Income sources, credit histories, and any outstanding debts or liabilities.

- References: Names and contact details of personal and professional references who can attest to the applicant's character and financial reliability.

- Background Checks: Authorization for conducting background checks, including criminal records if applicable.

- Applicant's Declaration: An affirmation that the information provided is accurate and truthful, with an understanding of the consequences of false declarations.

Legal Use and Compliance

When using the form, it is essential to adhere to local, state, and federal laws governing nondiscrimination and privacy. Entities administering the form must ensure they maintain compliance with the Fair Housing Act, which prohibits discrimination based on race, color, national origin, religion, sex, familial status, or disability. Additionally, these entities must handle all personal data confidentially and securely, in line with privacy laws and best practices.

Required Documents for Submission

Applicants need to provide various documents alongside the form to validate the provided information and demonstrate eligibility. Commonly required documents include:

- Proof of Identity: A government-issued ID, such as a driver's license or passport.

- Financial Statements: Recent pay stubs, tax returns, or other evidence of income.

- Credit Reports: An up-to-date credit score and credit history.

- Reference Letters: Letters from personal or professional acquaintances attesting to the applicant's suitability as a community member.

Thorough preparation and submission of these documents ensure a smoother evaluation process and demonstrate the applicant's transparency and readiness for property ownership.