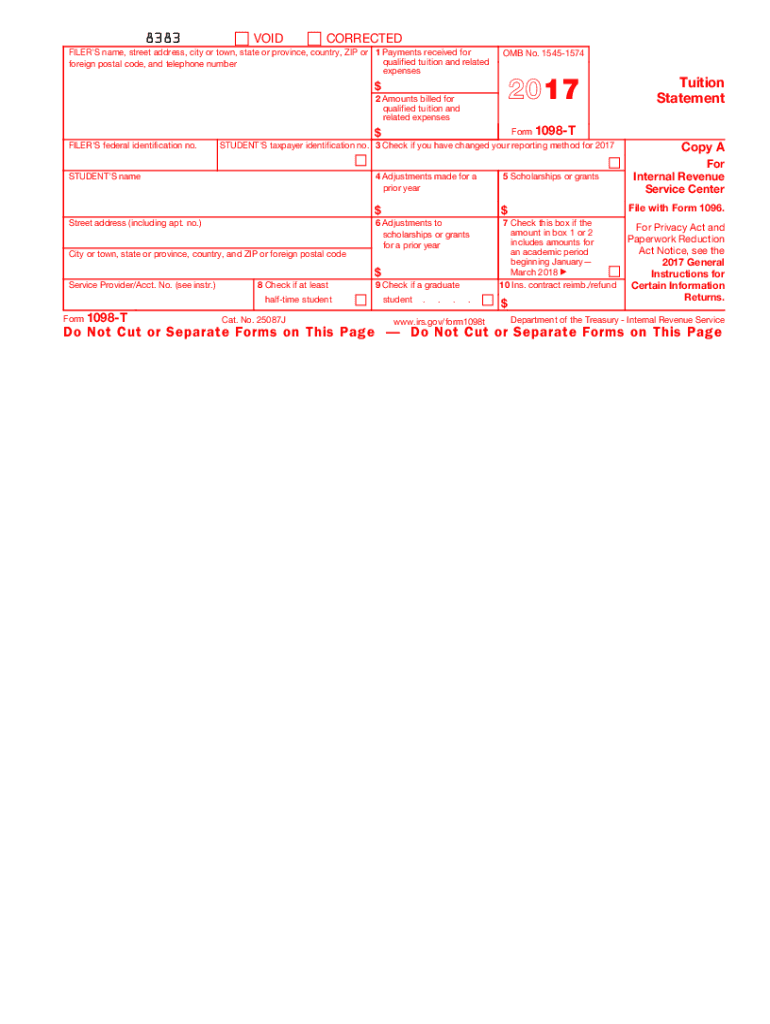

Definition and Meaning of Form 1098-T

Form 1098-T is an official IRS document used by eligible educational institutions in the United States to report information concerning qualified tuition and related expenses incurred by students. The form serves multiple purposes in the context of federal income tax, helping both schools and students to establish tax deductions or credits for education expenses. On the form, institutions report the amount of tuition paid, as well as any scholarships or grants awarded, thus enabling students to accurately report these figures when filing their personal tax returns.

Understanding Qualified Expenses

Qualified expenses generally include:

- Tuition and fees required for enrollment or attendance.

- Course-related expenses, such as books and supplies, if they are paid directly to the institution.

The form is essential for receiving tax benefits like the American Opportunity Credit or the Lifetime Learning Credit, which provide financial relief for those pursuing higher education.

How to Use the 1098-T Form

Using the 1098-T form effectively requires understanding its components and how they fit into the tax filing process. Students receiving a 1098-T should utilize the information reported on the form to complete their tax returns accurately.

Steps to Utilize the Form

- Review the form carefully for accuracy, ensuring that the reported amounts match your records.

- Determine if you or your dependents qualify for any education tax credits.

- Enter the relevant figures from the 1098-T into your tax software or paper tax return forms, specifically on IRS Form 8863, which is used to calculate education credits.

- Maintain copies of your 1098-T form along with other supporting materials, such as receipts for payments made and any other relevant tax documents, for future reference or audits.

How to Obtain the 1098-T Form

Eligible students should expect to receive Form 1098-T from their educational institutions, typically by the end of January following the tax year in which the expenses were incurred. Institutions may send the form via mail or make it available electronically through their student portals.

If the Form is Not Received

- Contact the financial services or registrar's office at your institution to inquire about your 1098-T status.

- Ensure that your school has your correct mailing address if you have moved since your last enrollment.

In case the institution is unresponsive, you can access the IRS website for guidance on determining eligibility for education tax credits without the form.

Steps to Complete the 1098-T Form

Completing the 1098-T form is primarily the responsibility of educational institutions, but students should be aware of how the form is populated. Institutions report qualified tuition and related amounts in specific boxes on the form.

Key Fields to Focus On

- Box 1: Amounts billed for qualified tuition and related expenses.

- Box 2: Amounts of scholarships or grants received.

- Box 4: Adjustments made for prior years, which can affect current year tax filings.

- Box 5: Adjusted expenses that should be noted for tax purposes.

Understanding these sections ensures students can accurately represent their financial situation to the IRS and maximize any potential benefits.

Important Terms Related to the 1098-T Form

Familiarity with terms associated with the 1098-T form can enhance understanding of education tax benefits and responsibilities.

Key Terms

- Qualified Tuition and Related Expenses: Costs eligible for tax credits, including any tuition and mandatory fees required for enrollment.

- American Opportunity Credit: A tax credit that offers substantial savings for qualifying students in their first four years of higher education.

- Lifetime Learning Credit: A tax credit applicable for any post-secondary education and courses taken to improve job skills, with no limit on the number of years it can be claimed.

- Scholarships and Grants: Financial aid that reduces the amount of tuition owed and may impact tax obligations.

An understanding of these terms helps clarify the overall education tax landscape and assists in accurate tax reporting.

Filing Deadlines and Important Dates for the 1098-T Form

It is crucial to adhere to the deadlines associated with the 1098-T form to ensure compliance with IRS requirements and to maximize education tax benefits.

Key Dates to Remember

- January 31: Deadline for institutions to send out Form 1098-T to students.

- April 15: Deadline for individual tax returns, correlating with the filing of tax returns that may include credits based on Form 1098-T.

- State-specific deadlines: Some states may have additional requirements or deadlines related to education forms and credits.

Timely filing ensures that you do not miss out on beneficial tax credits that can significantly impact your financial situation.

Examples of Using the 1098-T Form

Examples of practical use of the 1098-T form illustrate how it functions within the tax system.

Scenarios Illustrating the Use of Form 1098-T

-

Full-time Student Claiming Credit: A student enrolled full-time incurs $12,000 in qualified expenses and receives a $3,000 scholarship. The 1098-T indicates $9,000 in qualified costs after accounting for the scholarship. The student may qualify for the American Opportunity Credit, based on the net figure reported.

-

Non-Traditional Student: A part-time student takes a course related to job skills, incurring $2,500 in tuition. The 1098-T reports this amount, enabling the student to claim the Lifetime Learning Credit on the tax return.

These scenarios emphasize the importance of understanding how the 1098-T translates into potential tax benefits, ensuring students can leverage available credits.