Definition and Overview of the 1003 Form

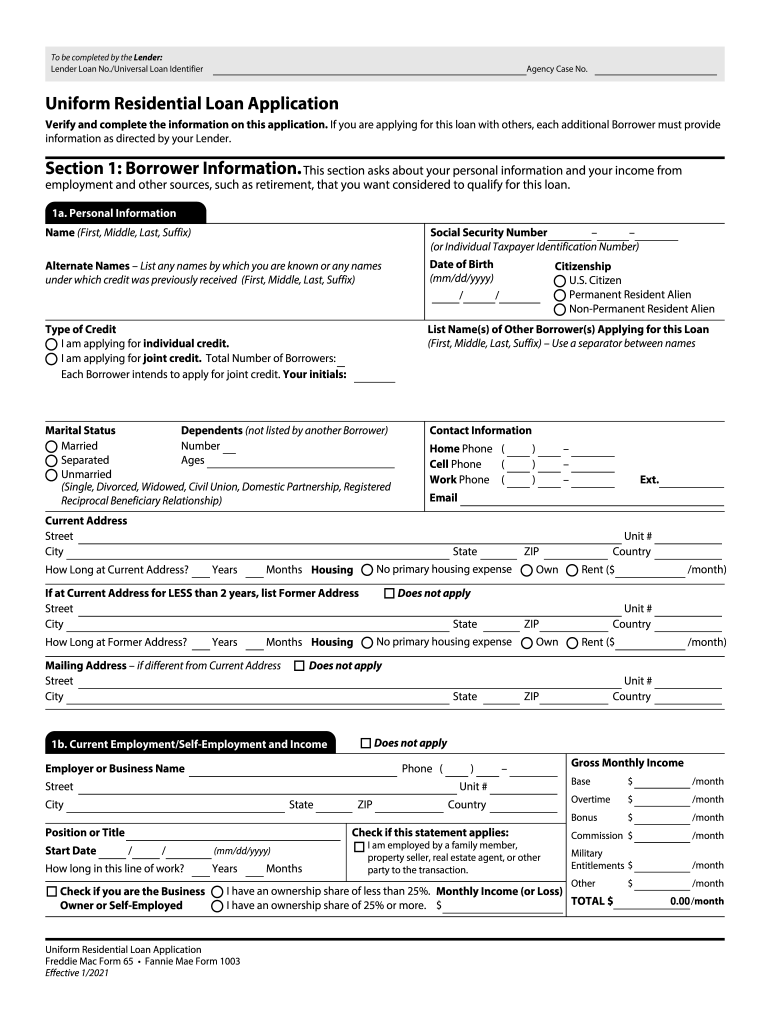

The 1003 form, known as the Uniform Residential Loan Application, serves as a crucial document in the mortgage lending process in the United States. This application form is utilized by borrowers applying for a mortgage loan and is standardized by Fannie Mae and Freddie Mac, providing a consistent and comprehensive structure for lenders to evaluate the applicant's financial background. The 1003 form collects detailed information regarding the borrower's financial situation, personal details, and the specifics of the requested mortgage.

The structure of the 1003 form contains various sections that guide the borrower through the application process, ensuring that all pertinent information is captured efficiently. Key sections typically include borrower and co-borrower details, employment history, income, assets and liabilities, property information, and intended use of the property. Completing a 1003 form is often the first step in securing a mortgage, making it vital for prospective homeowners to understand its significance and requirements.

Steps to Complete the 1003 Form

Completing the 1003 form requires careful attention to detail and specific information. Here’s a step-by-step guide to ensure accuracy:

-

Gather Necessary Documentation: Collect all relevant financial documents, including recent pay stubs, W-2 forms, tax returns, bank statements, and any other documents that demonstrate income and assets.

-

Fill Out Personal Information: Enter personal information for both the borrower and any co-borrowers, including full names, Social Security numbers, dates of birth, and current addresses.

-

Document Employment History: Provide a detailed employment history for at least the past two years. Include employer names, addresses, job titles, and dates of employment.

-

Disclose Income Information: List all sources of income, such as salary, bonuses, self-employment income, or rental income. It’s critical to ensure that this section accurately reflects your current financial situation.

-

List Assets and Liabilities: Complete sections detailing your assets (bank accounts, retirement accounts, real estate) and liabilities (credit card debt, student loans, mortgages). This section helps lenders assess your financial stability.

-

Include Property Details: Provide information about the property you intend to purchase or refinance, such as the address, the purchase price, and your intended use (primary residence, investment property).

-

Review for Accuracy: Double-check all information entered for accuracy and completeness to avoid delays in processing your application.

-

Submit the Completed Form: After thoroughly reviewing the application, submit the 1003 form along with any required documentation to your lender.

By following these steps, borrowers can ensure they provide their lenders with complete and accurate information, facilitating a smoother mortgage application process.

How to Obtain the 1003 Form

The 1003 form can be obtained through various means to ensure accessibility for borrowers. Here are several methods:

-

Lender Websites: Most mortgage lenders provide easy access to the 1003 form on their websites. This can usually be found in the resources or forms section.

-

Fannie Mae and Freddie Mac: The official websites of Fannie Mae and Freddie Mac offer downloadable versions of the 1003 form, ensuring that users are accessing the most up-to-date documentation.

-

DocHub and Other Document Sharing Platforms: Platforms like DocHub allow users to fill out a fillable 1003 form online. This provides a convenient option for those who prefer a digital workflow.

-

In-Person Request: Potential borrowers can also visit local lenders or mortgage brokers to request a physical copy of the form, ensuring they get personal assistance if needed.

Either method allows borrowers to locate and utilize the 1003 form efficiently, aligning with their application needs.

Key Elements of the 1003 Form

Understanding the key elements of the 1003 form is essential for both borrowers and lenders. The following are the main sections:

-

Borrower Information: Includes name, address, Social Security number, and marital status.

-

Employment and Income: Captures detailed work history, employer information, and income sources.

-

Asset Details: Lists all assets, including bank balances, retirement accounts, and real estate holdings.

-

Liabilities and Debts: Requires information on all existing debts, providing insight into the borrower’s financial obligations.

-

Property Information: Details the property being financed, including its current market value, purchase price, and intended use.

-

Declarations: A section where borrowers confirm their financial history and any potential legal issues, such as bankruptcies.

Understanding these elements helps streamline the application process and ensures that all necessary information is provided to the lender.

Important Terms Related to the 1003 Form

Several terms are frequently associated with the 1003 form and understanding them can aid borrowers in navigating the mortgage application process:

-

LTV Ratio (Loan-to-Value Ratio): Represents the loan amount compared to the value of the property, expressed as a percentage. A lower LTV typically indicates less risk for lenders.

-

DTI Ratio (Debt-to-Income Ratio): Compares monthly debt payments to gross monthly income. Lenders use this ratio to assess a borrower's ability to manage monthly payments.

-

Pre-Approval vs. Pre-Qualification: Pre-approval typically involves a more in-depth review of a borrower’s finances, while pre-qualification is an estimate based on self-reported information.

-

Escrow Account: An account established by the lender to hold funds for property taxes and insurance, separated from the mortgage payment.

Familiarity with these terms can help borrowers communicate effectively with their lenders and understand their financial responsibilities related to the loan application process.