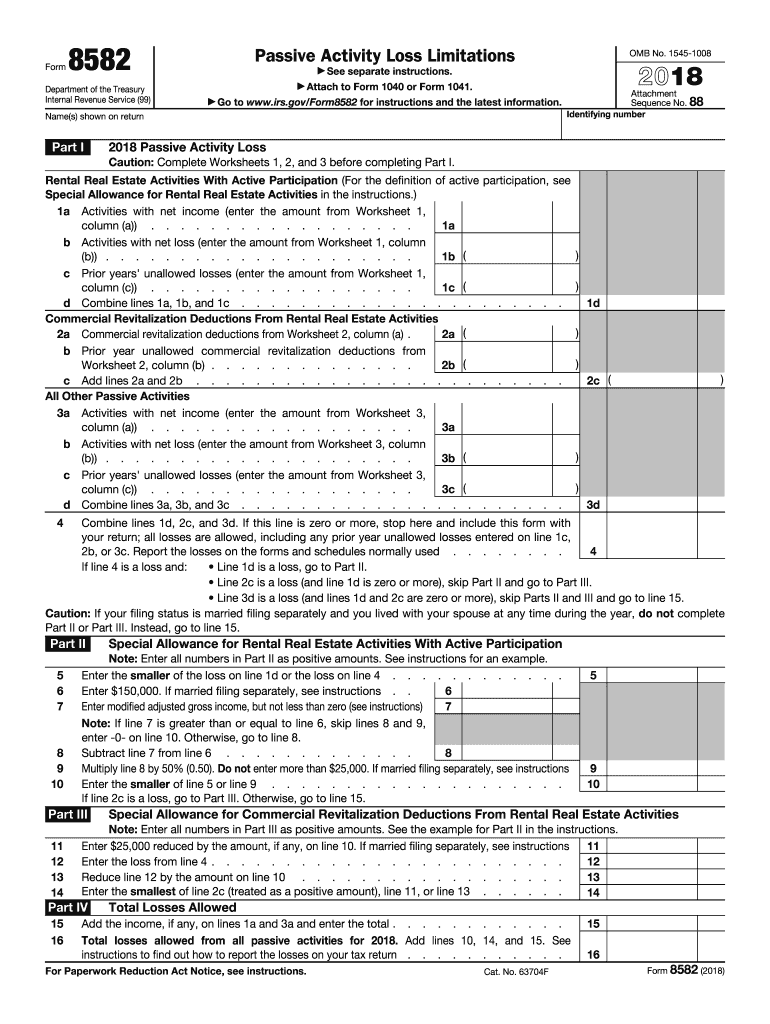

Definition and Purpose of Tax Form 8582

Form 8582 is a tax document utilized by the Internal Revenue Service (IRS) to report passive activity loss limitations for individuals, estates, and certain trusts. This form is specifically designed to help taxpayers determine the amount of passive losses they can utilize for tax deductions. The form focuses on activities that generate passive income, such as rental real estate, and it aids in distinguishing between active and passive participation in business activities. Understanding the purpose of this form is crucial for reporting accurately and optimizing potential deductions on tax returns.

Key Features of Form 8582

- Passive Activity Losses: This form allows taxpayers to report losses related to passive activities, which can only offset passive income.

- Loss Limitations: It provides a framework for calculating allowable losses against passive income, preventing taxpayers from using excess passive losses to offset ordinary income.

- Worksheets: The form includes relevant worksheets to assist in determining the amounts to report, helping streamline the calculation process.

How to Complete the Tax Form 8582

Filling out Form 8582 requires careful adherence to instructions to ensure compliance with IRS regulations. Here’s a step-by-step approach to completing the form accurately.

Step-by-Step Instructions

- Gather Necessary Documents: Collect all financial records related to passive activities, such as rental property income statements and expense records.

- Identify Passive Activities: List all activities that generated passive income or loss. Common examples include rental real estate and limited partnerships.

- Complete the Basic Information Section: Fill in your name, address, and Social Security number or Employer Identification Number (EIN).

- Use the Worksheets: Refer to the specific worksheets included within Form 8582 for calculating total losses and income from each passive activity.

- Input Data: Enter the calculated totals from the worksheets into the provided spaces on Form 8582.

- Review for Accuracy: Check your entries against your original documents to confirm that all calculations are correct.

- Attach to Your Tax Return: Once completed, the form should be attached to your main tax return (Form 1040, for example) before submission to the IRS.

Obtaining the Tax Form 8582 Instructions

The instructions for Form 8582 can be found easily through various means. Here’s how to obtain them:

Methods to Access Instructions

- IRS Website: The most straightforward way to obtain the instructions is by visiting the IRS website, where downloadable PDFs of the form and accompanying instructions are available.

- Tax Preparation Software: Many tax software programs, like TurboTax, provide integrated instructions as part of their filing processes, leading users step-by-step through the requirements.

- Tax Professionals: Consulting a tax advisor or accountant can also be beneficial, as they generally have access to the latest forms and instructions and can provide personalized guidance.

Important Terms Related to Tax Form 8582

A clear understanding of tax-related terminology enhances comprehension of Form 8582 instructions. Below are critical terms associated with this form:

Key Terms

- Passive Activity: Business activities in which the taxpayer does not materially participate. Examples include rental properties and limited partnerships.

- Material Participation: A level of involvement in an activity that allows taxpayers to treat the income as non-passive, which can affect tax liabilities.

- Loss Limitations: Restrictions imposed by the IRS that limit the amount of passive activity losses that can offset ordinary income.

Examples of Using Tax Form 8582

Understanding practical scenarios can clarify how to use Form 8582 effectively. Below are two illustrative examples:

Example 1: Rental Property Losses

A taxpayer owns a rental property generating $20,000 in rent and incurs $25,000 in related expenses, resulting in a passive loss of $5,000. By accurately completing Form 8582, the taxpayer can report this loss to offset passive income or carry it forward to future tax years, subject to IRS rules.

Example 2: Limited Partnership

Consider a taxpayer who has invested in a limited partnership activity showing a passive loss of $10,000. After determining their passive income from other investments, the taxpayer can utilize Form 8582 to report losses effectively and understand how much of it can be used to offset future passive income.

Filing Deadlines for Form 8582

Being aware of filing deadlines is crucial for compliance with IRS requirements. Here is a breakdown of important dates related to Form 8582:

Key Dates

- Tax Year Return Deadline: The deadline for filing Form 8582 coincides with the normal tax return deadline, typically April 15 of the following year.

- Extended Filing Deadline: If a taxpayer files for an extension, the extended deadline is usually October 15.

These deadlines highlight the importance of timely submission to avoid penalties and ensure accurate reporting of passive activity losses.