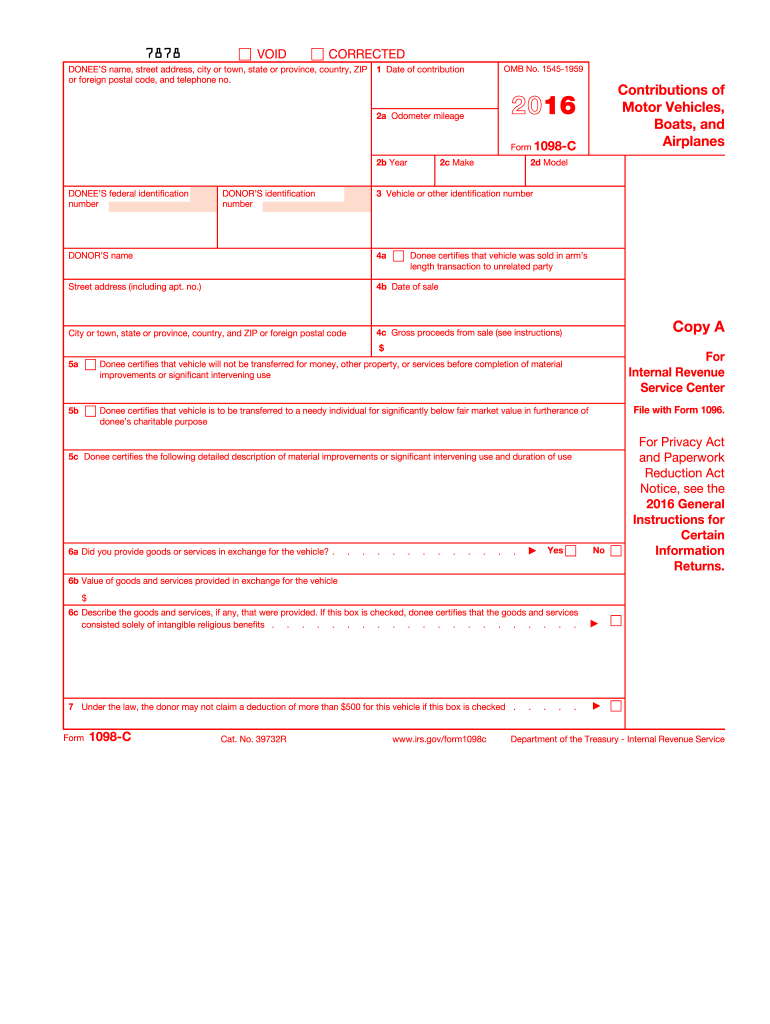

Definition and Purpose of the 2016 C Form

The 2016 C Form primarily serves as an informational report for the IRS, detailing specific types of charitable donations. It is essential for documenting contributions of motor vehicles, boats, and airplanes to eligible charitable organizations. This form helps the IRS track donations and ensures that donors adhere to rules while claiming deductions on their tax returns. Understanding its purpose aids both donors and donees in navigating the compliance landscape effectively. The form’s design also supports the reduction of tax fraud and ensures that contributions are accurately recorded and verified by relevant parties.

Importance of the 2016 C Form

Utilizing the 2016 C Form correctly is crucial for claiming tax deductions. This form is not only a tax obligation but also a reflection of legal compliance when contributing high-value items to charitable organizations. Failure to comply with IRS regulations, or errors while using this form, can lead to penalties or the rejection of your deductions. Therefore, knowing how to properly fill out and submit this form is vital for maximizing tax benefits and maintaining compliance with federal tax laws.

How to Obtain the 2016 C Form

You can obtain the 2016 C Form directly from the IRS’s official website or request a printed copy through their distribution service. Local IRS offices might also provide this form if you prefer obtaining it in person. Many tax software programs that integrate IRS forms will also include the 2016 C Form, allowing easy access and digital completion. Ensure that the version you acquire is updated and official to avoid any compliance issues.

Steps to Complete the 2016 C Form

- Gather Necessary Information: Obtain details about the donated vehicle, including make, model, year, and vehicle identification number (VIN).

- Determine Fair Market Value: Use reputable guides or dealership evaluations to ascertain the vehicle’s fair market value at the time of donation.

- Fill Out Donor Information: Provide personal and contact details accurately to avoid any errors in the submission.

- Complete Vehicle Donation Details: Include the specifics of the vehicle or other donated item, and if applicable, any related documentation the donee provides.

- Sign and Date: Ensure both donor and authorized charitable organization representative sign and date the form.

- Submit the Form: Send the completed form to the IRS and retain copies for your records, as well as for reference during tax filing.

Who Typically Utilizes the 2016 C Form

The primary users of the 2016 C Form are taxpayers who have made significant non-monetary donations to charity, especially those involving high-value items such as vehicles. Charitable organizations receiving these donations also use the form to verify received contributions, which helps maintain transparency and meet IRS requirements. Tax professionals assisting clients in filing their taxes may frequently handle this form to ensure proper compliance and deduction claims.

IRS Guidelines for the 2016 C Form

Proper adherence to IRS guidelines is mandatory when handling the 2016 C Form. IRS guidance outlines how valuations should be conducted, documentation requirements for both donors and donees, and specific filing instructions. It is critical to follow these guidelines to ensure that deductions are recognized and that no penalties apply due to non-compliance or inaccuracies. Understanding these guidelines can significantly mitigate risks associated with tax filing.

Required Documents When Filing the 2016 C Form

To successfully complete and file the 2016 C Form, ensure you have the following documents:

- Ownership documentation of the donated item, such as the title for a vehicle.

- A certified appraisal if the vehicle’s value exceeds a certain threshold, as specified by IRS requirements.

- Any receipts or documentation provided by the charitable organization, confirming receipt of the donation.

- Previous year tax returns for reference, if necessary, to verify deductible patterns or donation history.

Submission Methods for the 2016 C Form

The 2016 C Form can be submitted using various methods, reflective of the IRS’s flexibility with document submissions.

- Online Submission: Many find using the IRS’s e-file system or integrated tax software the most efficient method. This provides quick confirmation of delivery and reduces processing time.

- Mail Submission: Traditional mailing remains an option for those who prefer dealing with physical paperwork. Ensure you use the correct mailing address and retain proof of mailing.

- In-Person: Submitting the form during an in-person meeting with a tax advisor or at an IRS office can also ensure that all information is accurate and complete.

Penalties for Non-Compliance with the 2016 C Form

Non-compliance with the filing requirements of the 2016 C Form can lead to penalties, including disallowance of claimed deductions on your tax return. This can result in a higher tax liability and possible interest on unpaid taxes. Additionally, errors or insufficient documentation might trigger audits, leading to further scrutiny of your tax filings. Maintaining accuracy and adhering to all filing requirements can prevent these issues and ensure full compliance with tax laws.

Examples of Scenarios Using the 2016 C Form

Consider a donor wishing to deduct a donated car valued at $5,000. They must accurately complete the 2016 C Form, documenting all details. The associated charitable organization receives the form to confirm receipt, providing necessary information to the IRS. In scenarios where donors misvalue the contribution or fail to submit the form, they face potential audits and deduction disallowances. Proper usage of the form thus streamlines the donation process and ensures tax compliance.