Definition and Meaning of the PA Residency Certification Form

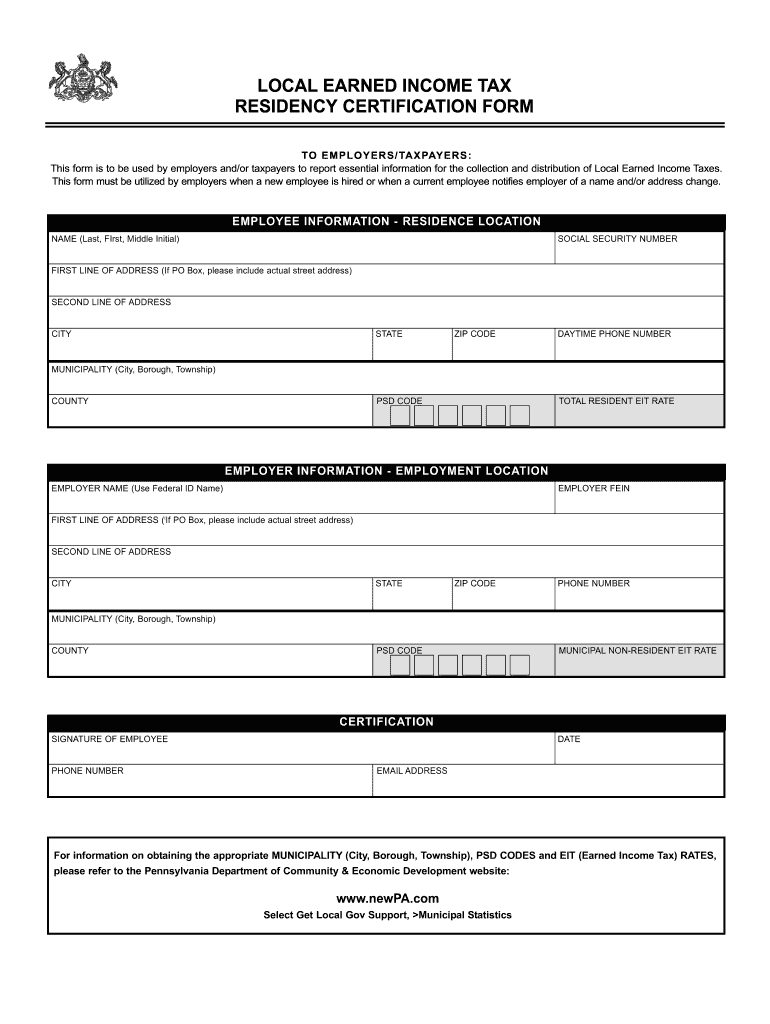

The PA residency certification form, specifically known as the Pennsylvania Local Earned Income Tax Residency Certification Form (CLGS-32-6), is a vital document used by employers and employees within the state of Pennsylvania. This form verifies the residency of employees for local earned income tax purposes. Understanding this certification is crucial for compliance with state tax laws and ensuring that employers withhold the correct local taxes from employee wages.

The residency certification form is required when hiring new employees or when current employees change their name or address. It gathers essential information such as the employee's address, municipality of residence, and corresponding local tax rates, which are determined by the local jurisdiction where the employee resides.

This document serves multiple purposes:

- It confirms the employee's residency status, which affects tax withholding.

- It helps employers comply with local tax regulations.

- It aids in proper tax reporting for local earned income taxes.

Steps to Complete the PA Residency Certification Form

Completing the PA residency certification form involves several straightforward steps to ensure accuracy and compliance:

-

Gather Required Information:

- Collect personal details, including the employee's full name, address, and Social Security number.

- Obtain employer information, including contact details and local tax identification number.

-

Identify Tax Municipality:

- Ascertain the employee’s municipality of residence and the applicable tax rates. This information is typically available through local government websites.

-

Fill Out the Form:

- Enter the employee's details accurately, ensuring to complete all required fields.

- Indicate the municipality of residence to ensure the correct local tax rate is applied.

-

Review for Accuracy:

- Double-check all information for errors, as inaccuracies can lead to improper tax withholdings.

-

Submission:

- The completed form must be submitted to the employer, who will keep a copy for their records. Some jurisdictions may require a copy to be sent to the local tax collector.

This careful attention to detail helps prevent issues during tax season and ensures compliance with local tax regulations.

Important Terms Related to the PA Residency Certification Form

Understanding specific terminology related to the PA residency certification form is essential for proper usage and compliance:

- Local Earned Income Tax (EIT): A tax levied on income earned within certain local jurisdictions in Pennsylvania.

- Municipality: A specific geographic area, such as a city or township, that imposes its own tax rates.

- Tax Collector: The individual or entity responsible for collecting local taxes in a municipality.

- Residency: The status of being a resident in a specific jurisdiction, impacting local tax obligations.

Familiarity with these terms will facilitate better navigation through the form and associated responsibilities.

Who Typically Uses the PA Residency Certification Form?

The PA residency certification form is primarily utilized by:

- Employers: Businesses hiring new employees need to collect this form to ensure proper local income tax withholdings are made.

- Employees: Current and prospective employees who want to ensure their local tax obligations are accurately reflected might need to complete this form.

- Tax Professionals: Accountants and tax advisors use the form as part of their compliance and reporting processes to local tax authorities.

These users benefit from a clear understanding of residency and local tax liabilities, minimizing risks associated with misreporting.

Legal Use of the PA Residency Certification Form

Legal compliance in Pennsylvania regarding local earned income tax necessitates the correct usage of the PA residency certification form. The form serves as a formal declaration of residency status, which is crucial for:

- Correct Tax Withholding: Employers must use the form to determine the correct local earned income tax rate based on an employee's residency.

- Preventing Tax Penalties: Accurate completion of the form helps avoid penalties associated with incorrect tax filings, which could burden both parties.

- Supporting Audits: In the event of an audit by local tax authorities, having properly completed residency certification forms can substantiate an employer's tax withholding decisions.

By adhering to the legal requirements for the use of this form, both employers and employees are better positioned to navigate Pennsylvania’s tax landscape.