Definition and Purpose of Form 1095-B

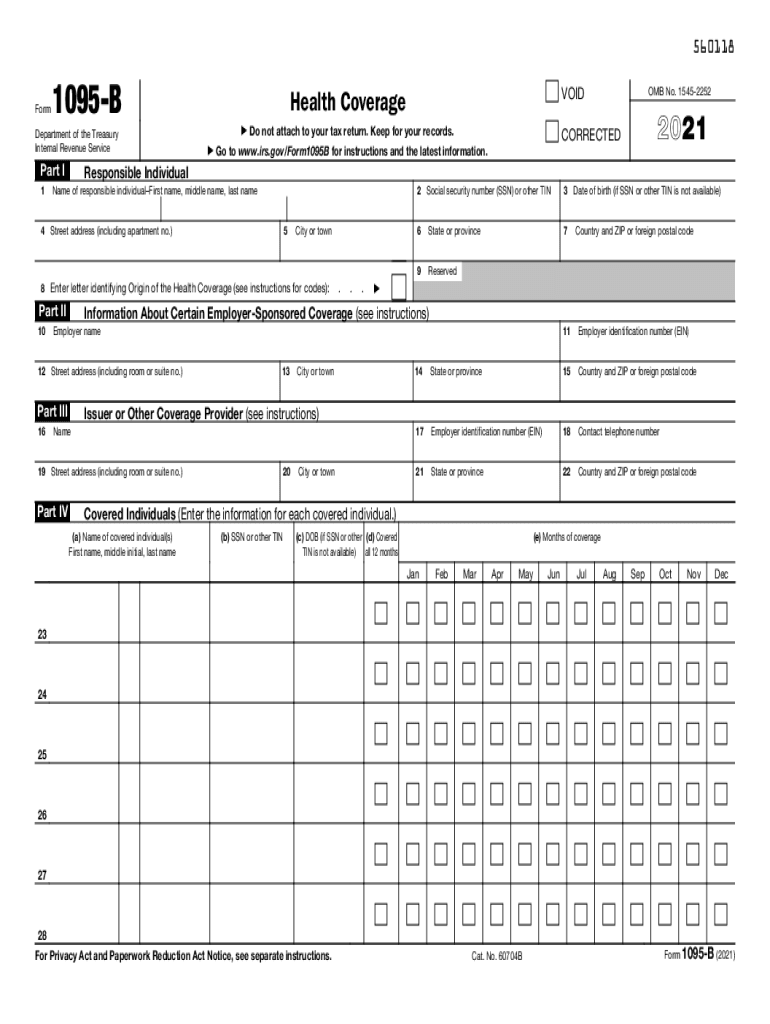

Form 1095-B is a document issued by the IRS that details the essential health coverage required under the Affordable Care Act (ACA). This form provides information about individuals who have received minimum essential health coverage during the tax year. The purpose of Form 1095-B is to report this coverage information to the IRS and to taxpayers, ensuring compliance with ACA mandates.

- Coverage Details: The form includes data about the responsible individual, such as name and address, along with the coverage provider's information.

- Purpose: Primarily intended for record-keeping, the form helps individuals verify their health coverage status for tax purposes.

- Not For Tax Returns: While important for your records, Form 1095-B does not need to be attached to your tax return.

How to Use Form 1095-B

Understanding the practical application of Form 1095-B helps taxpayers ensure compliance and informed decision-making.

- Review Your Coverage: Upon receipt, review the form to confirm that all sections are accurately filled out, reflecting the correct coverage periods.

- Maintain Records: Keep the form with your tax documents for reference. It serves as official documentation of your healthcare coverage.

- Verify Data: Check the section detailing covered individuals and ensure all is accurate. Contact your provider if discrepancies are found.

How to Obtain Form 1095-B

Acquiring Form 1095-B can occur through various standard methods depending on your health coverage provider.

- Health Insurance Provider: Typically, your insurance provider will mail the form to you. It generally arrives early in the tax season.

- Requesting a Copy: If not received by the expected date, contact your insurance company to request a copy or verify they have your correct mailing address.

- Digital Access: Some providers offer an electronic version accessible through their online account portals.

Steps to Complete Form 1095-B

Comprehending the process involved in handling Form 1095-B ensures all responsibilities are met efficiently.

- Receive and Inspect: Upon receiving the form, ensure all information is complete and accurate.

- Correct Errors: If errors are found, contact your issuer for assistance in filing corrections as soon as possible.

- File and Store: Store the form with other tax documentation even if not attaching it to your return.

Who Typically Uses Form 1095-B

Understanding who generally interacts with Form 1095-B helps clarify its relevance across different groups.

- Individuals with Employer-Sponsored Health Coverage: Those covered through employer plans may receive this form as proof.

- Self-Enrolled in Health Plans: People who purchase coverage individually through insurers will also receive Form 1095-B.

- Veterans and Military: Individuals covered under Veterans Affairs and some military plans may use this form for documentation.

IRS Guidelines for Form 1095-B

The IRS has established guidelines to ensure consistent processing and reporting of healthcare coverage through Form 1095-B.

- Issuance Requirements: Providers must send Form 1095-B to all individuals receiving minimum essential coverage.

- Purpose of Filing: The IRS uses this form to verify compliance with healthcare coverage mandates under the ACA.

- Updates and Corrections: Providers must also give corrected forms if initial submissions contained errors.

Filing Deadlines and Important Dates for Form 1095-B

Adhering to the timeline set by the IRS ensures compliance and proper record maintenance.

- January 31: Deadline for providers to mail Form 1095-B to individuals.

- March 31: Providers must file Form 1095-B with the IRS electronically if applicable.

- February 28: Deadline for paper filing with the IRS, should electronic filing not be feasible by provider standards.

Required Documents Alongside Form 1095-B

To fully utilize Form 1095-B, several supporting documents can aid in a thorough review and record-keeping.

- Previous Year's Tax Records: Helps in verifying annual information transitions.

- Insurance Policies and Enrollment Confirmation: Provides additional verification of continuous coverage.

- Personal Identification Information: Ensure details such as social security numbers are correct across all documents.

Penalties for Non-Compliance with Form 1095-B Requirements

Ignoring Form 1095-B mandates can lead to significant implications.

- Individual Reporting: Non-compliant taxpayers may face fines or penalties for not having adequate health coverage.

- Provider Responsibilities: Insurance providers failing to deliver forms timely face significant fines per form not issued or inaccurately filled out.

- Appeals and Extensions: Understanding the process for raising disputes or requesting deadline extensions can mitigate potential penalties.