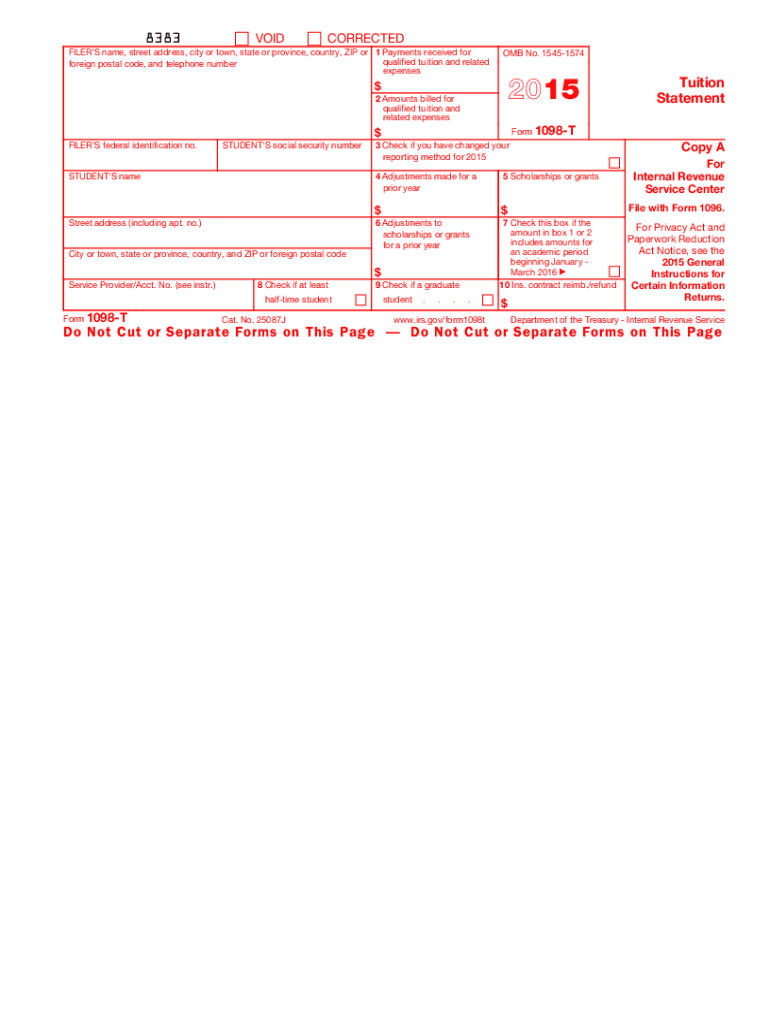

Definition & Meaning of the 1098-T 2015 Form

The 1098-T form, specifically the "2015 Form 1098-T", serves as a critical document used by eligible educational institutions to report qualified tuition and related expenses to the Internal Revenue Service (IRS) as well as to students. This reporting tool is essential for students who may claim education-related tax benefits, such as the American Opportunity Tax Credit or the Lifetime Learning Credit. The form plays a key role in helping students and their families understand their educational financial obligations while assisting the IRS in tracking educational expense deductions.

Key features of the 1098-T 2015 form include:

- It includes details of payments received and amounts billed for qualified tuition.

- It provides information about any scholarships or grants that may reduce the amount of tax benefits a student can claim.

- Adjustments from previous years are also reported, allowing for a comprehensive understanding of each student's educational financial journey.

How to Use the 1098-T 2015 Form

Using the 1098-T form effectively entails understanding how it impacts tax filings and educational benefit eligibility. Students should keep the form ready when preparing their annual tax returns, as it provides crucial information that may affect their tax calculations.

Steps for using the 1098-T form include:

- Collect the Form: Obtain the 1098-T form from your educational institution as it is typically made available by January 31st of each tax year.

- Review the Entries: Check the entries for accuracy, including your name, the institution's name, and amounts reported in various boxes related to tuition and expenses.

- Integrate into Tax Filing: When preparing your tax return, utilize the reported amounts to determine eligibility for educational tax benefits.

- Consult IRS Resources: Refer to the IRS guidelines on using the 1098-T to ensure compliance and maximize potential deductions.

Key Elements of the 1098-T 2015 Form

The 1098-T includes several critical boxes that present significant information for tax purposes. Understanding these elements helps taxpayers accurately report their educational expenses.

Important elements of the form include:

- Box 1: Reports payments received for qualified tuition and related expenses.

- Box 2: Previously reported amounts billed for qualified tuition expenses (not used starting in the 2018 form).

- Box 4: Indicates adjustments made to prior year amounts, which can affect current year tax benefits.

- Box 5: Reflects total scholarships or grants that the student received, influencing the net educational expense.

Each box provides specific and actionable information that students and parents can utilize for tax deductions and credits.

Filing Deadlines / Important Dates for the 1098-T 2015 Form

It is crucial to be aware of key dates relating to the 1098-T form to ensure compliance with IRS requirements and timely filing. While the 2015 form has specific deadlines, understanding the annual timeline remains relevant for future filings.

Important deadlines include:

- Form Availability: Educational institutions are required to provide students with the 1098-T form by January 31st.

- Tax Filing Deadline: Typically falling on April 15th, taxpayers should incorporate the 1098-T information into their annual tax filings before this date to avoid penalties.

- Extensions: If additional time is needed, a tax extension can be filed, but payments owed are still due by the original deadline to avoid interest and penalties.

Being aware of these dates ensures accurate tax filing and helps students maximize educational credits.

How to Complete the 1098-T 2015 Form

Completing the 1098-T form requires attention to detail, as the reported information is used for tax calculations. Understanding how to fill out the form can prevent errors that might lead to compliance issues.

Steps for completing the form include:

- Verify Student Information: Ensure that the student's personal information and the institution's name are accurately filled out.

- Input Qualified Payments: In Box 1, report all payments received during the tax year for qualified tuition and related expenses.

- Report Scholarships: Use Box 5 to enter any scholarships or grants awarded during the tax year, which affects the total reported in Box 1.

- Final Review: Double-check all entries, and iron out any discrepancies before submission to maintain accuracy.

By meticulously preparing the 1098-T form, students can facilitate accurate tax filing and maximize financial benefits related to their education.