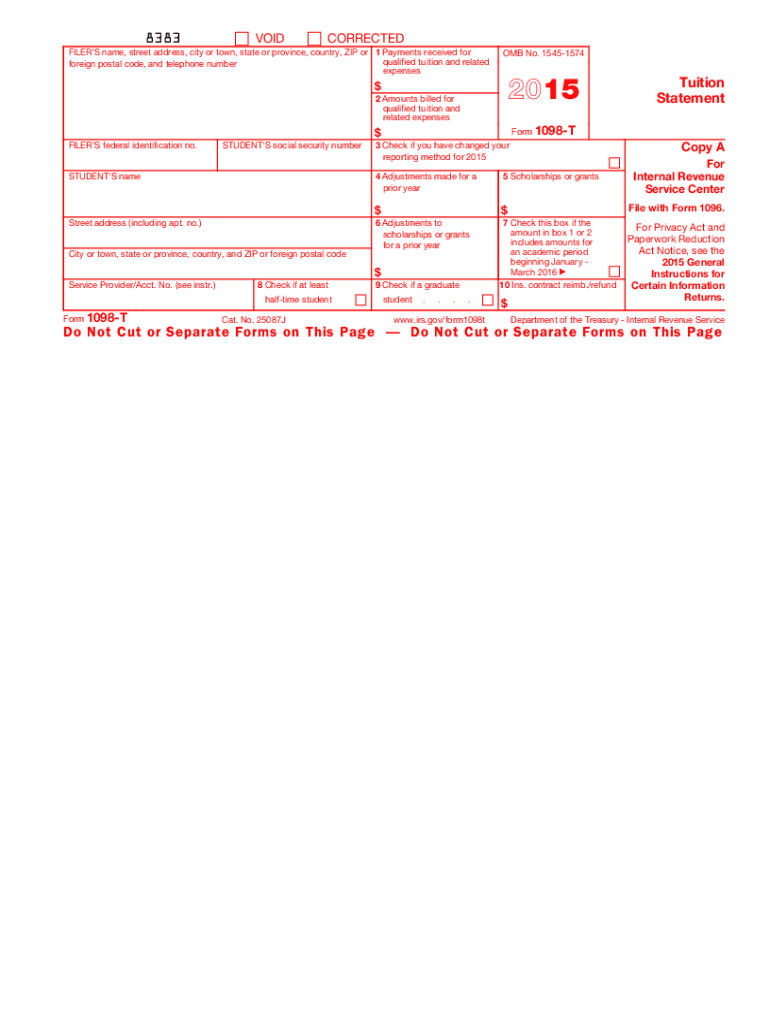

Definition and Meaning

Form 1098-T, officially known as the "Tuition Statement," is a tax document used by educational institutions to report qualified tuition and related expenses paid by students. The form is important for students and their families because it helps them calculate potential education-related tax credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit. Each educational institution generates a separate 1098-T form for every enrolled student who paid qualified tuition and fees during the tax year.

How to Obtain the 1098-T 2015 Form

Educational institutions typically provide the 1098-T form to students by January 31st each year. Students can usually access the form in several ways:

- Direct Mailing: Many institutions mail the form directly to the student's permanent address.

- Online Access: Some schools offer the form through their secure online portals, where students can download it.

- Registrar's Office: Students may pick up a physical copy from the registrar’s office upon request. For added convenience, some service providers offer electronic delivery options, such as through email.

Steps to Complete the 1098-T 2015 Form

Even though educational institutions fill out most of the information on Form 1098-T, students should still verify its accuracy. Follow these steps to complete the process:

- Cross-verify Personal Information: Ensure the student’s name, social security number, and address are correct.

- Review Box 1 and Box 2: These boxes show the payments received for qualified tuition versus the amounts billed. Note that due to IRS changes, Box 2 is obsolete for forms issued in 2015.

- Check Box 4 and Box 5: Box 4 indicates any adjustments to prior-year tuition, while Box 5 shows scholarships or grants received.

- Consult Box 9 and Box 10: These boxes indicate whether the student is enrolled in a graduate program or if insurance is paid for qualified expenses. If discrepancies are found, contact your school's financial office for immediate correction.

IRS Guidelines

The IRS provides specific guidelines for interpreting Form 1098-T. It is important for taxpayers to understand:

- Education Credits: Know the tax credits applicable using the form. The American Opportunity Tax Credit and the Lifetime Learning Credit are common.

- Box Differences: Interpretation of amounts in Box 1 versus Box 2 is crucial for correct reporting. For 2015 and later, details in Box 1 are more focused on payments made rather than amounts billed.

- Electronic Filing Requirements: If a student opts to file electronically, understanding the format and submission requirements is important to avoid penalties.

Filing Deadlines and Important Dates

To maximize the benefit of the 1098-T form, keep track of deadlines:

- January 31: Schools must provide Form 1098-T to students by this date.

- April 15: The standard deadline for filing individual tax returns is April 15, although extensions can be requested. Meeting these dates ensures students and families can claim any eligible credits and avoid penalties associated with late filings.

Who Typically Uses the 1098-T 2015 Form

The primary users of Form 1098-T are:

- Students: Those who have paid qualifying tuition expenses and aim to claim education credits.

- Parents/Guardians: If they are responsible for the dependent student’s tuition and wish to claim credits on their taxes.

- Educational Institutions: Required to issue the form to qualifying students as per federal regulations. This form is a necessity for families planning to leverage tax credits to offset higher education costs.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 1098-T can result in penalties:

- Failure to Furnish the Form: Institutions that do not provide the form to students by the deadline may face penalties.

- Incorrect Information: Providing incorrect information can lead to fines per form for educational institutions. Students found deliberately misreporting information may also face penalties and disqualifications from future credits.

Examples of Using the 1098-T 2015 Form

Consider two scenarios:

- Scenario One: Jamie, a full-time student, receives Form 1098-T showing $10,000 in Box 1 as paid tuition, and $3,000 in Box 5 for scholarships. Jamie can use the $7,000 net tuition to calculate education tax credits.

- Scenario Two: Lisa is enrolled part-time and paid $4,500 towards her tuition without any scholarships. Her 1098-T form reflects this in Box 1, making her eligible for education credits based on the IRS guidelines. Each of these examples highlights the utility of the form in claiming valuable tax credits, emphasizing the need for accurate and timely submission.