Understanding the Satisfaction of Mortgage in Florida

The satisfaction of mortgage document is a legal instrument used in Florida to formally acknowledge the full repayment of a mortgage loan. It serves several important functions:

-

Release of Lien: This document releases the lien that the mortgage placed on the property, effectively clearing the title. The mortgagee (lender) formally acknowledges that the borrower (mortgagor) has fulfilled their obligations under the mortgage agreement.

-

Notification to Authorities: The satisfaction of mortgage typically directs the Clerk of the Circuit Court to cancel the mortgage record, ensuring public records reflect that the mortgage has been satisfied.

-

Legal Protection: Once this document is recorded, it provides legal protection for the borrower against any future claims on the property concerning the satisfied mortgage.

It is critical that the satisfaction of mortgage is completed accurately to avoid complications in property ownership and future transactions.

Steps to Complete the Satisfaction of Mortgage Form

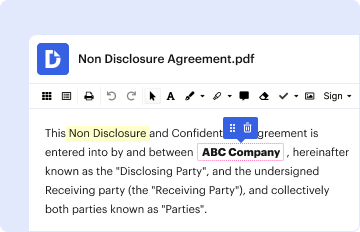

To effectively use the satisfaction of mortgage Florida PDF, follow these structured steps:

-

Gather Necessary Information: Collect all details regarding the mortgage, including the mortgage's original document number, the parties' full names, and the property legal description.

-

Complete the Document: Fill out the satisfaction of mortgage form accurately. Ensure it contains:

- Lender and borrower information

- Loan details, including the original amount

- Property description

-

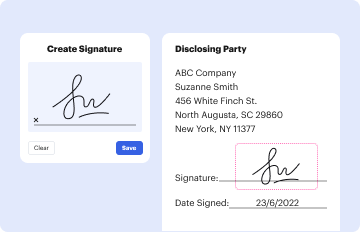

Signatures and Notarization: Obtain signatures from the mortgagee, and, in some cases, the mortgagor. Notarization is required to validate the document. Verify whether the notary's acknowledgment must accompany the signatures.

-

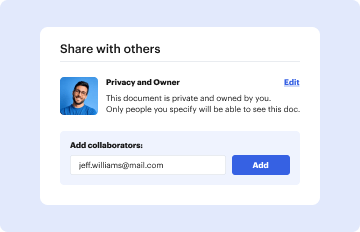

File with the Clerk of Circuit Court: Submit the completed satisfaction of mortgage to the local Clerk of the Circuit Court. There may be a nominal recording fee associated with this step.

-

Confirm Recording: After submission, confirm that the satisfaction has been recorded by checking public records. This ensures that the mortgage’s lien is officially removed from the property title.

Key Elements of the Satisfaction of Mortgage Document

A typical satisfaction of mortgage includes several essential components:

-

Identifying Information: It should begin with the names and addresses of the mortgagor and mortgagee, along with the date of the original mortgage agreement.

-

Property Description: The document must include a complete legal description of the property that was mortgaged.

-

Statement of Satisfaction: A clear statement indicating that the mortgage has been paid in full and that the mortgagee releases the lien.

-

Signatures: The document requires the signature of the mortgagee, and it may require the mortgagor’s signature, depending on the circumstances.

-

Notary Acknowledgment: A notarized section confirming the identity of the signing parties and that they executed the document willingly.

Why You Need a Satisfaction of Mortgage in Florida

The satisfaction of mortgage serves critical purposes for both the borrower and the lender:

-

Property Ownership Clarity: It clarifies ownership and ensures that no claims remain on the property, making it free for resale or transfer.

-

Credit Impact: Recording this document can positively impact the borrower’s credit history by showing that they have fulfilled their loan obligations.

-

Potential Future Transactions: Having a satisfaction recorded can make it easier for the borrower to secure future financing or sell the property without complications arising from unpaid mortgages.

Legal Use of the Satisfaction of Mortgage Form

The satisfaction of mortgage document is legally binding in Florida when completed and filed correctly. It must:

-

Comply with State Laws: Ensure it aligns with Florida Statutes regarding real estate transactions.

-

Serve Proper Notice: The lender must indicate that they have received full payment, including any potential late fees, ensuring all parts of the original agreement are settled.

-

Convey Rights Accurately: Ensure the document accurately reflects the agreement between the lender and borrower to avoid any disputes.

This form has significant legal implications, thus requiring careful attention to detail during creation and submission. Adhering to the established legal requirements helps prevent any potential challenges in property ownership in the future.