Definition and Meaning

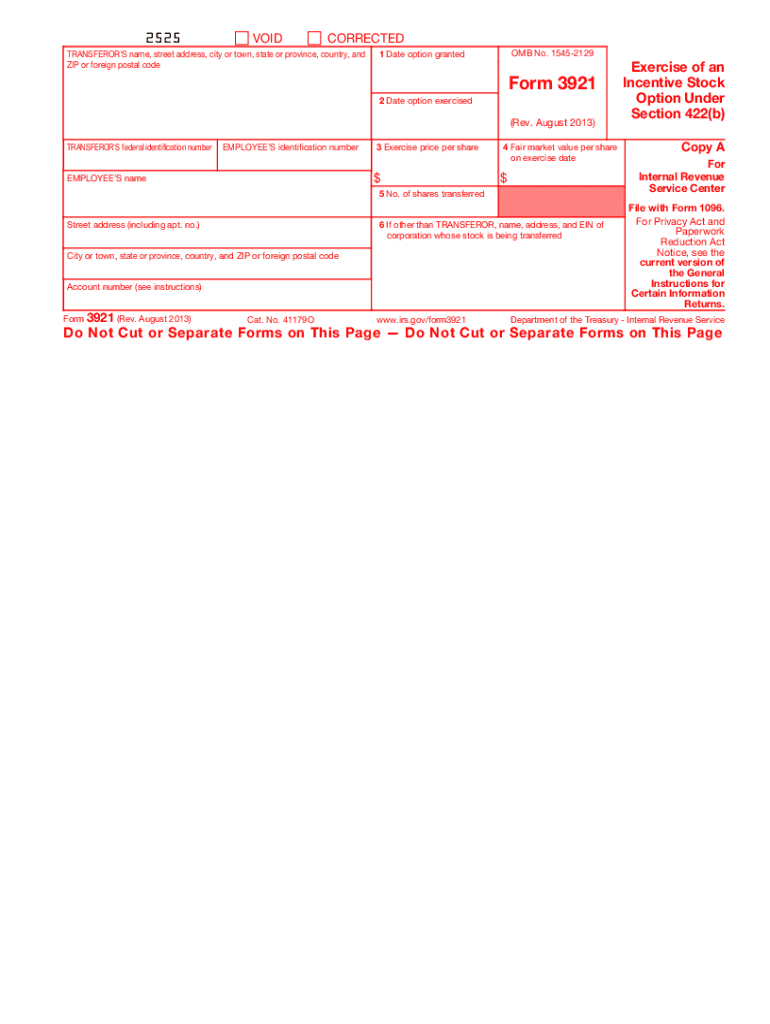

IRS Form 3921 is a vital document used to report the exercise of an Incentive Stock Option (ISO) under Section 422(b) of the Internal Revenue Code. Specifically, the form is employed by corporations to disclose information when an employee transfers stock gained from the exercise of the ISO. It is a critical component in tracking and reporting such transactions for tax purposes, ensuring transparency and compliance with federal tax regulations. This form assists both employees and the IRS in determining potential taxation areas related to the exercise and eventual sale of stocks acquired through the plan.

How to Use the Form 3

Form 3921 is primarily utilized by corporations upon the exercise of an ISO by an employee. Each instance of stock transfer through ISO must be reported using this form, which requires precise details about the transaction. Companies fill out Part I with the detailed identification of the transferor and the employee receiving the stock. Part II encompasses specifics like the date the option was granted, the date it was exercised, and the number of shares transferred. The form aids in tax reporting; although the taxpayer doesn't file it directly with their return, the information must be reported on related forms, impacting eventual capital gains upon selling the stock.

Steps to Complete the Form 3

Filling out Form 3921 involves several key steps to ensure accuracy:

-

Enter Employee Information:

- Begin with the employee’s complete name, address, and social security number.

-

Detail Transaction Information:

- Include the corporation’s name, address, and employer identification number (EIN).

- Specify the date the stock option was granted using the "Date option granted" field.

-

Document Exercise Details:

- Record the exercise date in the "Date option exercised" section.

- State the number of shares transferred.

- Indicate the exercise price per share and the fair market value on the exercise date.

-

Review for Accuracy:

- Double-check all fields for completeness and correctness before submission.

-

Submit the Form:

- Present the completed form to both the employee and the IRS to uphold compliance standards.

IRS Guidelines

Per IRS guidelines, Form 3921 should be furnished to employees by January 31 of the year following the calendar year of the stock transfer. Corporations are responsible for reporting this form’s information to the IRS by February 28 if filing by paper or by April 1 if filing electronically. Employers must ensure all details align with IRS standards to avoid discrepancies that could lead to penalties. Tax compliance regarding ISOs is essential, especially in validating whether any alternative minimum tax (AMT) obligations are applicable to the employee.

Legal Use of the Form 3

Form 3921 serves specific legal purposes in the tax context. It ensures the proper reporting of stock transfers resulting from ISO exercises, adhering to federal regulations. This mandatory reporting aids in creating accountability for tax authorities and prevents fraudulent stock transactions. The information assists the IRS in monitoring how employees benefit from such plans, subsequently affecting both personal income taxes and potential alternative tax considerations. Misuse or non-reporting of such details could incur significant legal and financial repercussions.

Penalties for Non-Compliance

Failing to accurately complete and submit Form 3921 can result in costly penalties. The IRS imposes fines for late filing and incorrect information. For the 2013 tax year, the penalties start at $50 per form for companies that miss the deadline or file incorrectly but can escalate if not corrected promptly. Persisting negligence or intentional disregard for filing standards can lead to steeper fines exceeding $250 per submission. Corporations must prioritize exact and timely filing to avert such financial consequences and maintain good standing with the IRS.

Important Terms Related to Form 3

-

Incentive Stock Option (ISO): A tax-advantaged stock option that offers employees the right to buy company stock at a preferential tax rate following specific conditions and timing.

-

Exercise Date: The date when the employee officially executes the option to purchase stock under the ISO agreement.

-

Exercise Price: The set price determined at the granting of the option, at which the employee can buy stock.

-

Fair Market Value: The stock's market price on the exercise date, significant for calculating any potential AMT (Alternative Minimum Tax) implications.

Filing Deadlines and Important Dates

Adhering to filing deadlines is crucial when dealing with Form 3921. Employees must receive their copy of the form by January 31 of the year following the exercise to ensure sufficient time for personal tax preparation. Corporations are required to file the IRS copy by February 28 for paper submissions or April 1 for electronic filings. Following these deadlines helps maintain compliance and prevents any unnecessary conflicts or fines from the IRS, emphasizing the importance of a structured reporting process within the corporation's tax procedures.