Definition and Meaning

The DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE is a document provided by financial institutions, primarily used to outline the specific terms, applicable charges, and conditions associated with a Certificate of Deposit (CD) account. This disclosure ensures transparency, allowing potential account holders to understand all the financial implications before committing to a CD. These certificates are fixed-term financial products that typically offer higher interest rates than standard savings accounts in exchange for leaving the deposit untouched for a set duration.

Important Terms Related to DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE

Understanding the components of the DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE is critical. Here are key terms you might encounter:

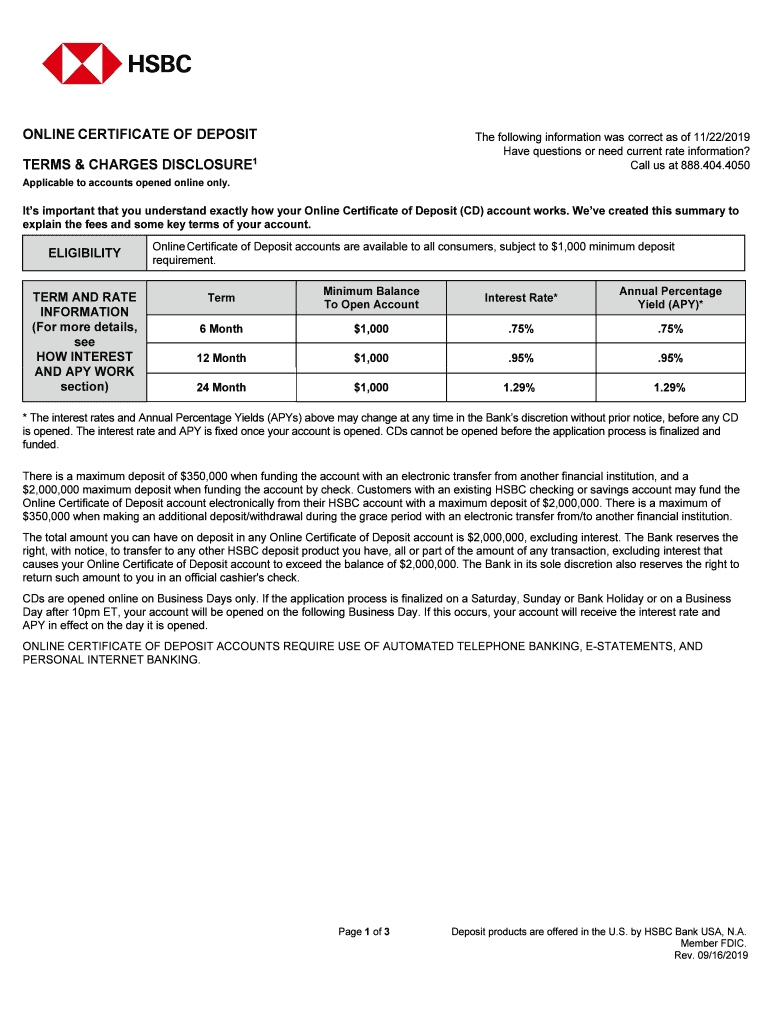

- Interest Rate: The annual percentage yield you earn on your deposit.

- Maturity Date: The end of the CD's term when you can withdraw funds without penalties.

- Early Withdrawal Penalty: Fees incurred if you withdraw funds before the maturity date.

- Renewal Policy: Options available once the CD reaches its maturity, often including automatic renewal.

Key Elements of the DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE

The document typically details several core elements to consider:

- Minimum Deposit Requirements: The minimum amount required to open the CD.

- Interest Calculation Methods: How interest is compounded and paid.

- Terms and Tenures Available: Various periods offered, ranging from a few months to several years.

- Withdrawal Policies: Conditions under which funds can be accessed before maturity.

How to Use the DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE

Effectively using the disclosure requires careful review and understanding:

- Review Terms Thoroughly: Ensure all terms are understood, particularly interest rates and penalties.

- Compare Offers: Use the document to compare CDs from different institutions for the best terms.

- Clarify Doubts: Contact the issuing bank to clarify any unclear terms or conditions.

How to Obtain the DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE

To acquire this form, consider these steps:

- Bank Website: Visit the bank's website and download the document from their CD section.

- In-Person Request: Visit a local branch and request a printed copy.

- Customer Service: Call the bank's customer service for assistance in obtaining the disclosure.

Steps to Complete the DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE

While the document itself does not require completion like an application, here’s how you should engage with it:

- Read Carefully: Go through each section to understand obligations and benefits.

- Check for Completeness: Ensure no sections are missing, and the document covers all aspects relevant to your decision.

- Highlight Concerns: Mark areas needing further clarification before opening the CD.

Legal Use of the DIRECT CERTIFICATE OF DEPOSIT TERMS & CHARGES DISCLOSURE

This disclosure is a legally required document designed to protect consumers:

- It provides a clear, concise presentation of fees and terms, supporting informed decision-making.

- Ensures compliance with the Truth in Savings Act, mandating transparency.

Eligibility Criteria

Eligibility to open a CD as detailed in the disclosure may include:

- Age Requirements: Generally, you must be a legal adult (18 years or older).

- Residency Status: U.S. residency might be necessary for domestic banks.

- Initial Deposit Amount: Meeting the minimum deposit threshold is required.

Application Process and Approval Time

The application process for a CD can often be straightforward, involving:

- Application Submission: Fill out the bank’s specific application form, either online or in-person.

- Identity Verification: Present required identification documents as specified.

- Deposit Funds: Transfer the required opening balance to complete the setup.

- Approval Duration: Most approvals are immediate or take a few business days.