Definition & Meaning

The "Oregon Department of Revenue: Welcome Page" serves as an informational gateway for taxpayers to access a variety of tax-related services and resources, specifically tailored to the state of Oregon. This page is designed to offer guidance on filing taxes, accessing forms, and understanding tax obligations within the state. It acts as the initial point of contact for taxpayers seeking assistance or information regarding their tax responsibilities in Oregon.

Importance of the Welcome Page

- Centralized Resource Hub: Provides all necessary tax-related information in one location, saving time for users.

- User Guidance: Offers step-by-step directions, ensuring taxpayers navigate their obligations seamlessly.

- Accessibility: Designed to be user-friendly, allowing easy access to resources, whether you're tech-savvy or not.

How to Use the Oregon Department of Revenue: Welcome Page

Navigating the Welcome Page efficiently involves understanding its layout and the services it provides. This section ensures that users can quickly find and utilize the information they need for their tax processes.

Navigating the Page

- Home Section: Offers a general overview of available resources. Essential announcements or updates are typically featured here.

- Forms & Publications: Locate and download necessary tax forms, instructions, and other publications.

- Online Services: Direct links to e-filing services, payment systems, and account management.

Utilizing Features

- Search Functionality: Use search bars or quick links to find specific forms or instructions.

- Contact Information: Direct access to the department's helpline or email support for personalized assistance.

Steps to Complete the Oregon Department of Revenue: Welcome Page

Once acquainted with the Welcome Page, completing any tax-related process requires following structured steps that ensure compliance and accuracy.

- Identify Required Forms: Determine which forms pertain to your situation (e.g., filing state taxes, making payments).

- Gather Necessary Information: Collect all pertinent personal and financial details before starting the process.

- Complete Forms: Fill out each section carefully, using guidelines provided on the page.

- Submit Completed Forms: Depending on the form, submit via the available online service or print and mail.

Additional Considerations

- Review for Accuracy: Double-check entries to avoid delays or complications.

- Track Submissions: Use any available tracking services to confirm receipt and processing.

Key Elements of the Oregon Department of Revenue: Welcome Page

Understanding the fundamental components of this page helps in navigating it effectively and efficiently.

Essential Sections

- Taxpayer Education: Offers tutorials and videos to enhance understanding of tax responsibilities and processes.

- Policy Updates: Lists the latest changes in tax laws and policies affecting filings.

- Support Services: Provides links to FAQs, live support chats, and other assistance tools.

Integration with External Systems

- Compatibility with Tax Software: Ensures smooth data transfer to and from platforms like TurboTax and QuickBooks for filing ease.

Eligibility Criteria

Various eligibility criteria determine who needs to interact with the Oregon Department of Revenue services, based on different factors such as income, employment status, and residency.

Common Eligibility Factors

- Residency Status: Oregon residents with varying degrees of income or those with property taxes may need specific forms.

- Income Level: Different thresholds may dictate the need for filing, payment plans, or available credits.

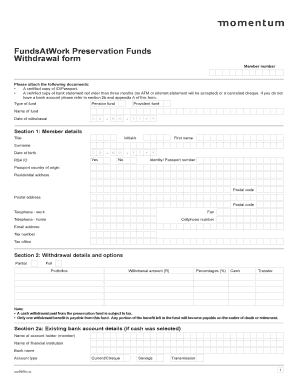

Form Submission Methods (Online / Mail / In-Person)

Tax forms can be submitted through diverse channels, each fitting different preferences or requirements.

Submission Channels

- Online: Fast, secure submission through e-filing portals, ideal for quick processing.

- Mail: Traditional submission for those preferring physical copies or lacking web access.

- In-Person: Direct submission at select locations for taxpayers needing assistance or immediate confirmation.

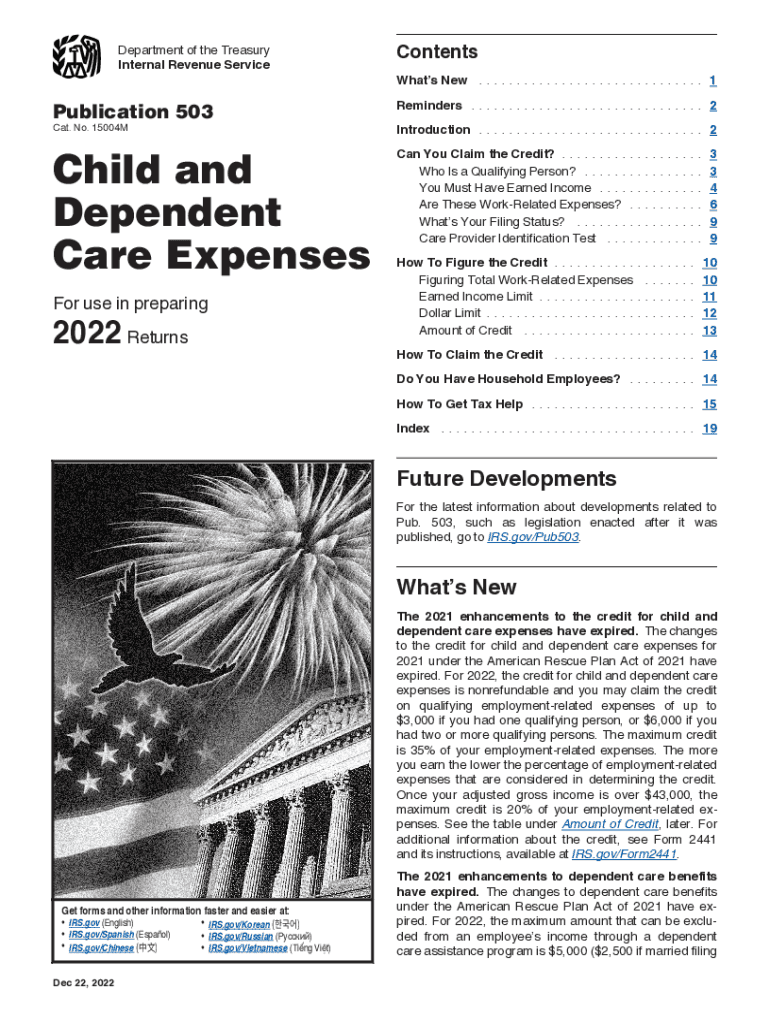

IRS Guidelines

While the Welcome Page centers on state-level taxes, alignment with IRS guidelines is crucial as federal and state taxes often intersect.

Key IRS Considerations

- Consistency in Filings: Ensures that state and federal submissions reflect accurate and consistent information.

- Tax Credits and Deductions: Awareness of federally recognized credits that may affect state tax obligations.

Filing Deadlines / Important Dates

Meeting filing deadlines is critical to avoid penalties and ensure compliance with Oregon tax law. These dates usually align with fiscal year cycles.

Key Dates to Remember

- Annual Tax Return Deadline: Typically aligns with federal deadlines around mid-April.

- Estimated Tax Payments: Quarterly deadlines for those with additional tax liabilities not covered by withholding.