Definition & Meaning

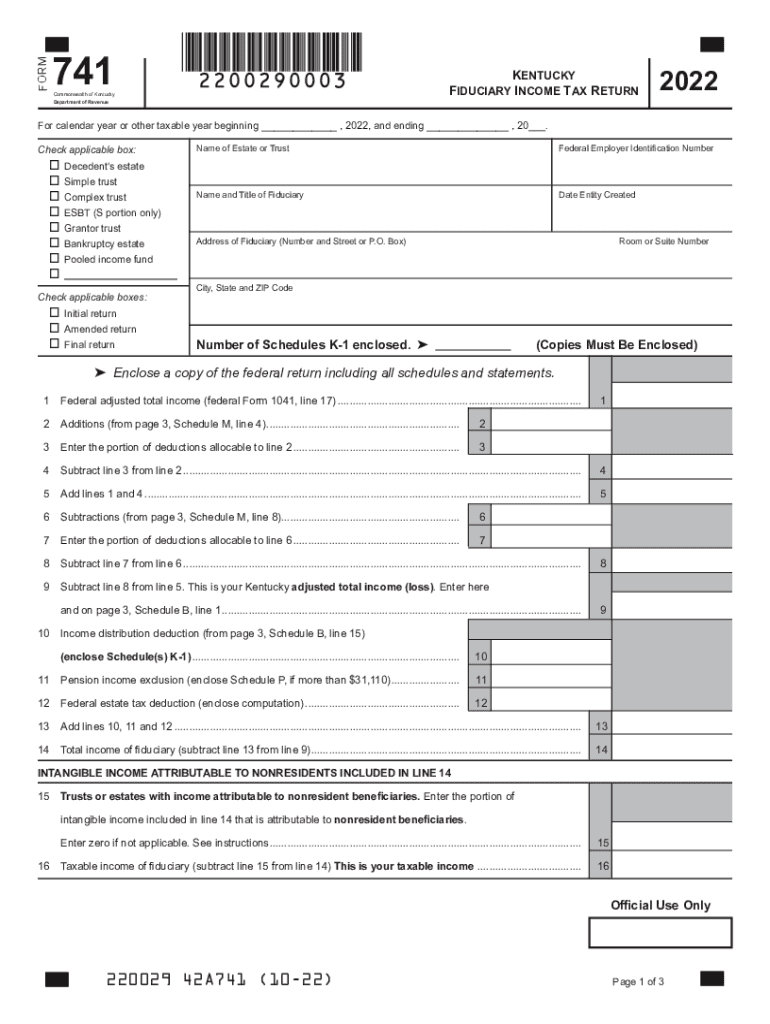

Form 1041, officially known as the U.S. Income Tax Return for Estates and Trusts, serves as a federal tax document required for estates and trusts to report their income, deductions, gains, and losses. These entities are obligated to file Form 1041 if they accumulate gross income of $600 or more during the tax year. By reporting such details, the form helps determine the estate's or trust's tax liability.

Key Components

- Income Reporting: Estates and trusts disclose income generated from various sources, such as interest, dividends, and rentals.

- Tax Deductions: Expenses related to property management, administrative fees, and fiduciary fees can be deducted.

- Gains and Losses: Capital gains or losses from sales of assets must be declared.

Steps to Complete Form 1041

Completing Form 1041 requires careful attention to detail to ensure accuracy and compliance with tax regulations.

- Gather Necessary Information: Collect details on the estate's or trust's income and expenses, along with any beneficiary distributions.

- Form Selection: Use the official IRS Form 1041 and refer to the IRS instructions specific to the form.

- Income Section: Report all income types, including interest and dividends, accurately in Part I.

- Deduction Sections: Enter allowable deductions in Part II, considering legal allowances for individual estates and trusts.

- Tax and Payments: Calculate the tax owed using the trust's tax rate, subtract taxes already paid or withheld.

- Beneficiary Information: Detail any income allocated to beneficiaries in Schedule K-1.

- Review and Submit: Double-check all entries for precision before filing electronically or via mail.

Who Typically Uses Form 1041

Form 1041 is employed by executors or personal representatives of estates, and by fiduciaries or trustees managing trusts. It is particularly relevant for those overseeing the financial affairs of a deceased individual's estate or a trust set up either during a person's lifetime or as part of their will.

Specific Scenarios

- Testamentary Trusts: Created upon someone's death based on terms in the will.

- Revocable/Irrevocable Trusts: These differ in terms of amendments allowed by the grantor and their impact on tax filing obligations.

Filing Deadlines and Important Dates

The filing deadline for Form 1041 is the 15th day of the fourth month following the close of the estate's or trust's tax year. For calendar-year entities, this means the due date is typically April 15.

Extensions

- An automatic five-and-a-half-month extension is available by filing Form 7004, extending the deadline to September 30 for calendar-year filers.

IRS Guidelines for Form 1041

The IRS provides detailed instructions that accompany Form 1041, specifying which incomes must be reported and deductions allowed.

Compliance Practices

- Adhere to IRS standards for recording capital gains, dividends, and allocable expenses.

- Follow the specific thresholds and exceptions applicable to particular forms of income and types of trusts.

Required Documents for Filing

Accurate completion of Form 1041 necessitates the following documents:

- Income Statements: 1099 forms covering interest, dividends, and miscellaneous income.

- Expense Records: Documentation for deductible expenses like fiduciary and legal fees.

- Prior Year’s Tax Return: Helps in providing comparison and continuity.

Form Submission Methods

Form 1041 can be submitted using multiple methods, depending on convenience and the resources available:

- Online Submission: Electronic filing through the IRS's e-file system or third-party tax software, ensuring faster processing and confirmation of receipt.

- Mail: Send the completed forms and related documents to the IRS address noted in Form 1041 instructions.

Penalties for Non-Compliance

Failure to properly file Form 1041 or meet the deadlines may result in various penalties:

- Late Filing: May incur a penalty calculated based on the tax due and the delay's length.

- Inaccurate Reporting: Misstatements can lead to audits, fines, or further scrutiny.

Each aspect of dealing with Form 1041 demands a precise understanding of IRS rules and timely action to ensure both legal compliance and financial accuracy.