Definition and Purpose of Income Tax Applications for Filing Extensions

Income tax applications for filing extensions, specifically the form provided by Tax.NY.gov, are designed to enable individuals and businesses to request additional time beyond the standard tax deadline to file their income tax returns. This form is critical for taxpayers who require more time to gather necessary documentation, organize financial information, or address unexpected circumstances that prevent timely filing. An extension does not extend the time to pay any taxes due, but it ensures that the filer avoids penalties associated with late filing if submitted on time.

Obtaining the Form for Filing Extensions

Taxpayers can access the form for filing an income tax extension by visiting Tax.NY.gov. It's available for download as a PDF, ensuring compatibility with various document management tools like DocHub. Accessing this form online provides convenience and flexibility, allowing users to print it or complete it electronically. Alternatively, taxpayers can request a physical copy from the New York Department of Taxation and Finance or access it through third-party software platforms compatible with NY.gov tax forms.

Steps to Complete the Income Tax Application for Extensions

- Identification Details: Begin by filling out personal or business identification information, including the name, address, Social Security number, or Employer Identification Number (EIN). This section must accurately reflect the taxpayer's details to avoid processing delays.

- Tax Type and Year: Specify the type of tax and the tax year for which the extension is requested. Common types include personal income tax for individuals and corporation tax for businesses.

- Estimate of Tax Liability: Indicate the estimated tax liability for the year. This estimate is crucial, as taxpayers are expected to pay at least 90% of the final tax owed to minimize interest charges.

- Payment Information: Include payment details if there's an estimated tax due upon filing the extension. This often involves entering bank account information for electronic withdrawal or specifying a check or money order payment.

- Certification and Signature: The taxpayer must sign and date the form to certify the accuracy of the provided information. Electronic signatures may be accepted, depending on the submission method.

Reasons to Use the Filing Extension Form

Filing tax extensions can provide significant benefits, such as allowing taxpayers additional time to accumulate necessary documentation, ensuring all eligible deductions and credits are claimed, and navigating life changes like relocation or financial hardship. For business entities, an extension can facilitate comprehensive accounting, especially when dealing with complex financial structures or when awaiting financial statements.

Eligibility Criteria for Extensions

Eligibility primarily requires timely submission of the form—by the original tax due date. While almost all taxpayers are eligible to request an extension, approval is not guaranteed if the taxpayer fails to comply with payment requirements for any estimated taxes owed. Specific eligibility discrepancies might occur for those involved in ongoing disputes or audits with tax authorities.

Filing Deadlines and Important Dates

Extensions must be requested by the original filing deadline, typically April 15 for individuals. However, the new deadline typically extends six months to October 15. Business deadlines might vary according to entity type and fiscal year schedules. It's crucial to mark these dates to avoid penalties or interest due to late submissions.

Submission Methods for the Application

- Online Submission: Tax.NY.gov provides an online portal where the form and any payments can be submitted electronically, offering quick confirmation and processing.

- Mail: Extensions can also be submitted through traditional mail, which is essential for those preferring physical documentation. Ensure ample mailing time before the deadline.

- In-Person: Direct submission might be possible at local tax offices, though availability varies and should be confirmed beforehand.

Legal and Regulatory Guidelines

Understanding the legal use of tax extension forms is essential, as they comply with both federal guidelines under the IRS and state-specific regulations by the New York Department of Taxation and Finance. Adherence to tax codes ensures that extensions are not used improperly to avoid taxes but solely to manage filing timelines.

Penalties for Non-Compliance

Failing to file an extension by the deadline or not paying the estimated taxes due results in penalties, usually a percentage of the unpaid amount. Interest accumulates on taxes owed until paid, making prompt extension filing and payment crucial to avoid financial strain.

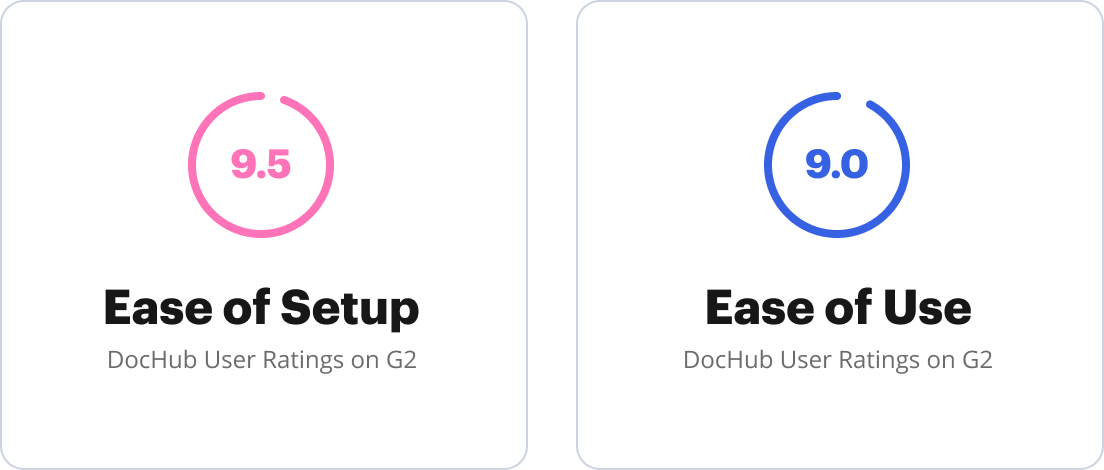

Software Compatibility for Managing Extensions

Platforms like TurboTax and QuickBooks often support extension forms, providing guided processes and ensuring compatibility with official tax documents. DocHub, for instance, can aid in filling, editing, and signing the forms electronically, streamlining document workflows.

Examples and Scenarios for Filing Extensions

Various taxpayer scenarios demonstrate the utility of extensions, including self-employed individuals with fluctuating income, corporate entities waiting for audit results, and retirees adjusting to changes in income sources. These scenarios highlight the adaptability and necessity of filing extensions in maintaining compliance while accommodating personal or business-specific needs.