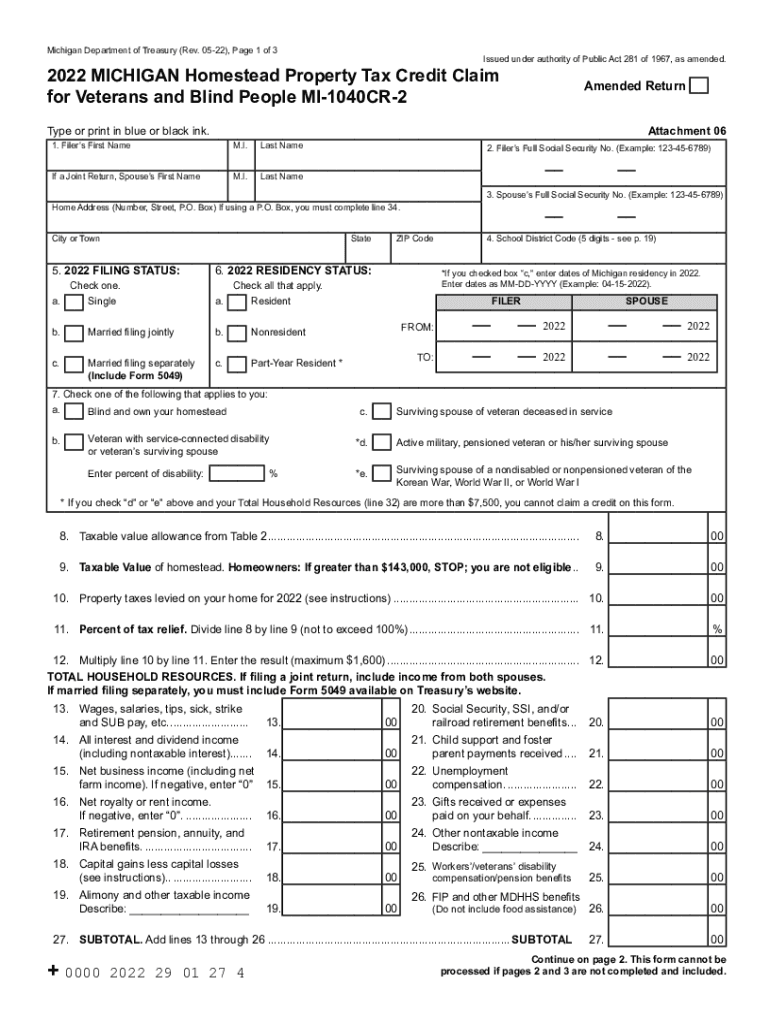

Definition and Purpose of the 2022 Michigan Homestead Property Tax Credit Claim

The 2022 Michigan Homestead Property Tax Credit Claim for Veterans and Blind Individuals, officially known as MI-1040CR-2, is a state-specific tax form designed to help eligible veterans and blind individuals receive a property tax credit. This credit can reduce the amount of property tax owed, effectively lowering the financial burden on qualifying residents. The form is essential for calculating and claiming these tax credits based on household resources and taxes paid.

Eligibility Criteria for the MI-1040CR-2

Eligibility for the Michigan Homestead Property Tax Credit is primarily determined by residency and the applicant's status as a veteran or blind individual. The applicant must:

- Be a Michigan resident for at least six months of the tax year.

- Occupy the homestead as their primary residence.

- Be a veteran or blind individual as defined by the state guidelines.

Additional eligibility factors include the total household resources and the amount of property tax or rent paid, both of which play a role in determining the credit amount.

Steps to Completing the Form

Filing the MI-1040CR-2 involves several key steps:

-

Gather Required Documents: Ensure you have all necessary documents, such as proof of income, property tax statements, and veteran or disability status documentation.

-

Calculate Income and Taxes Paid: Use the form to itemize and calculate total household resources and property taxes paid.

-

Complete the Form Sections: Fill out the form accurately, detailing all relevant financial figures and personal information.

-

Submit the Form: Choose a submission method that suits your circumstances—either electronically or via paper filing.

Required Documents for Submission

Submitting the MI-1040CR-2 requires documentation that supports the information entered on the form. Essential documents include:

- Proof of income statements, such as W-2s or 1099s.

- Statements of property tax paid.

- Verification of veteran status or blindness, which might include military service records or medical certifications.

- Rent receipts or lease agreements, if applicable.

Form Submission Methods

There are multiple ways to submit the MI-1040CR-2:

- Online: Most efficient, supporting e-filing through official state tax websites or compatible software like TurboTax.

- Mail: Traditional mail submission is accepted, requiring careful adherence to deadlines and mailing instructions.

- In-Person: Some may opt to submit at designated state tax offices, though local availability should be confirmed.

Important Terms Related to the MI-1040CR-2

Familiarity with key terms used in the form can promote accurate completion:

- Homestead: The primary residence where the applicant resides for the majority of the year.

- Household Resources: All income received by household members, crucial for determining tax credit eligibility.

- Property Tax Credit: The amount deducted from taxes owed based on eligible property payments.

Legal Usage and Compliance

Use of the MI-1040CR-2 must conform to Michigan's legal guidelines for property tax credits. Applicants should ensure:

- Accuracy in reporting all income and taxes paid.

- Timeliness in filing within the designated deadlines to avoid penalties.

- Full compliance with state tax laws to prevent denial or revision of claims.

Deadlines and Important Dates

Timely submission of the MI-1040CR-2 is critical:

- Annual Deadline: Aligns with state tax deadlines, often April 15. Extensions may apply but must be formally requested.

- Amendment Periods: Corrections or amendments to filed forms can generally be submitted within a specified timeframe, usually two to three years following the initial filing.

Application Process and Approval Time

The process for application and the subsequent timeline for approval encompass:

- Initial Submission: Expect processing within four to six weeks for online submissions or longer for mail.

- Review and Adjustment: The state may request additional documentation or clarification, which can extend the approval period.

- Notification: Successful applicants receive confirmation and details of the credit application to their tax liability.

These comprehensive details regarding the MI-1040CR-2 provide an understanding of its usage, filing process, and benefits offered to veterans and blind individuals in Michigan, ensuring a smooth tax credit application journey.