Definition and Purpose of the 2022 Insurance Premium Tax Information

The 2022 Insurance Premium Tax Information outlines the requirements and protocols related to insurance premium tax for insurers, particularly in the state of Florida. This document guides insurers in accurately assigning premiums to local taxing jurisdictions through a Department of Revenue database. The purpose is to ensure compliant tax filing and proper fund allocation according to state-specific laws. Key terms such as "premium allocation" and "local taxing jurisdiction" are critical for understanding this process. Insurers are expected to meticulously report figures to avoid discrepancies, fostering transparency and accountability in state tax contributions.

How to Use the 2022 Insurance Premium Tax Information

Insurers can use the 2022 Insurance Premium Tax Information to achieve accuracy and compliance in tax reporting. Follow these steps:

- Access Data: Utilize the Department of Revenue database for precise assignment of premiums.

- Check Compliance: Refer to the document for legal obligations and ensure all actions are within state laws.

- Prepare Schedules XII and XIII: Complete these schedules with attention to detail, specifically focusing on premium allocations to the correct jurisdictions.

- Review Process: Engage in a review for significant variances in reported figures, as outlined in the document.

These steps are fundamental in maintaining correct tax practices and preventing potential penalties due to non-compliance.

Steps to Complete the 2022 Insurance Premium Tax Information

Successfully completing the 2022 Insurance Premium Tax Information requires careful attention to detail:

- Gather Necessary Data: Collect all relevant financial data needed for accurate reporting.

- Organize Documents: Sort and prepare documents required for tax filings, such as Schedules XII and XIII.

- Use Tools and Forms: Utilize prescribed forms and ensure all details align with state regulations.

- Submit the Form: Ensure submission through the appropriate channel, whether online or by mail, following any additional state-specific instructions.

- Verify All Information: Double-check for accuracy and completeness before final submission to avoid penalties.

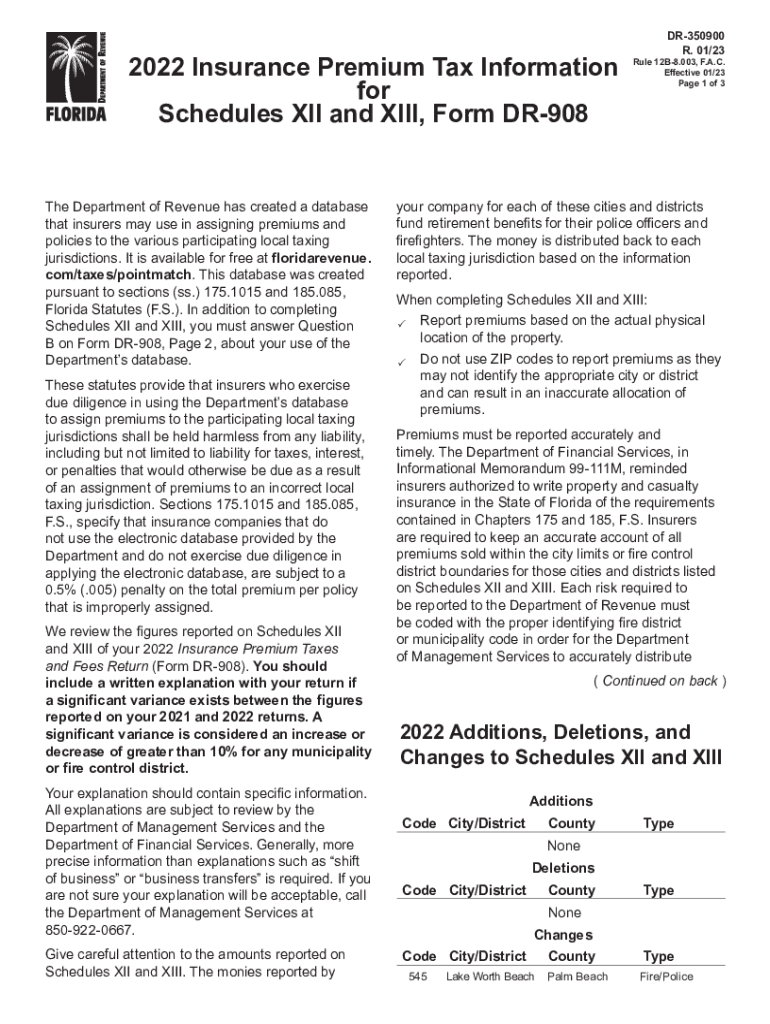

Key Elements of the 2022 Insurance Premium Tax Information

The document is structured around several key elements vital for proper tax documentation:

- Premium Allocation: Ensures premiums are assigned to the correct taxing jurisdiction.

- Compliance Requirements: Strict adherence to state laws and reporting standards.

- Penalties for Inaccuracy: Outlines possible financial penalties if reports are non-compliant or inaccurate.

- Review Protocols: Provides guidance on how to handle variances and reviews for factual correctness.

- Department of Revenue Involvement: Emphasizes the role this agency plays in regulating and assisting with accurate tax assignment.

Each element is essential for understanding and meeting insurance premium tax obligations.

Penalties for Non-Compliance

Failure to comply with the 2022 Insurance Premium Tax Information can lead to several penalties:

- Financial Penalties: Monetary fines may be imposed for inaccuracies or late submission.

- Legal Repercussions: Potential legal action for deliberate non-compliance or misreporting.

- Reputation Damage: Insurers may face reputational harm, diminishing trust among clients and stakeholders.

It is crucial for insurers to understand these consequences fully and adhere strictly to the reporting requirements detailed in the document.

Legal Use of the 2022 Insurance Premium Tax Information

The proper legal use of the 2022 Insurance Premium Tax Information involves adherence to specified guidelines by the Florida Department of Revenue. Insurers must use the document legally to ensure premiums are correctly allocated and taxes paid accordingly. This involves:

- Utilizing Official Databases: For correct premium allocation.

- Following Established Protocols: For completion of documents and submission.

- Confidentiality and Accuracy: Maintained throughout the filing process.

Filing Deadlines and Important Dates

Critical to filing the 2022 Insurance Premium Tax Information are deadlines that ensure timely compliance:

- Annual Filing Deadlines: Generally aligned with federal tax deadlines, though state-specific dates may apply.

- Periodic Reviews and Updates: Required to ensure ongoing accuracy and compliance.

- Notification of Changes: Promptly report any relevant changes to the Department of Revenue as specified in the document.

Adhering to these timelines helps prevent penalties and ensures insurers' obligations are met.

Digital vs. Paper Versions of the Form

The 2022 Insurance Premium Tax Information is accessible in both digital and paper formats:

- Digital Version: Allows for electronic submission, providing efficiency and immediate acknowledgment of receipt.

- Paper Version: An option for those who prefer traditional mail; however, processing times may be longer.

Each version should be used based on the submitter's capabilities and preferences while ensuring adherence to all submission guidelines.