Definition & Meaning of Credit Disposition

Credit disposition refers to the decision-making process involved in managing credit or loans, including the approval, denial, or conditional acceptance of an applicant's request for credit. This process often involves a detailed evaluation of the applicant's creditworthiness, financial history, and ability to repay the loan. In the context of financial documents, credit disposition might also relate to how credit-related information is handled or modified within a document.

The concept of credit disposition is crucial for lenders, as it helps in minimizing risks associated with lending. It involves various analysis techniques and models to determine the potential success or failure of a loan agreement. For individuals and businesses alike, understanding credit disposition can be key to managing financial options and making informed decisions.

How to Use Credit Disposition

Understanding how to effectively utilize credit disposition is essential for both borrowers and lenders. For borrowers, it highlights the variables that influence their credit approvals, such as income level, credit score, and debt-to-income ratio. Conversely, lenders use credit disposition to guide their lending practices and maintain the quality of their credit portfolios.

- Borrowers can improve their chances of a favorable credit disposition by maintaining a strong credit score, diversifying their credit types, and demonstrating consistent repayment behavior.

- Lenders may establish specific credit criteria and scoring models to formalize the credit disposition process. This can include automated systems that evaluate credit applications using standardized metrics and historical data.

Steps to Complete the Credit Disposition

Credit disposition completion typically follows a standardized procedure, ensuring fairness and consistency in the decision-making process. Here’s an outline of these general steps:

- Application Submission: Borrowers submit a credit application detailing their financial situation.

- Credit Evaluation: The lender reviews the applicant’s credit score, credit history, and other financial details.

- Risk Assessment: Potential risks are assessed based on the borrower’s ability to repay the loan.

- Decision Making: A decision is reached, which could be an approval, denial, or request for additional information.

- Notification: The borrower is informed of the decision and any conditions associated with the approved credit.

Required Documents for Credit Disposition

Obtaining a credit disposition typically requires the submission of various documents that justify the credit request and show the applicant's financial reliability:

- Income Proof: Payslips, tax returns, or financial statements.

- Credit History: Credit report summary.

- Identification: Government-issued ID such as a driver’s license or passport.

- Collateral (if necessary): Documents proving ownership of assets.

- Other financial obligations: Current loan statements or financial liabilities.

Legal Use of the Credit Disposition

Legal usage of credit disposition ensures compliance with financial regulations and safeguards the interests of both lenders and borrowers. It involves adherence to laws such as the Fair Credit Reporting Act (FCRA), which governs how credit information is acquired, used, and shared.

- Privacy Protection: Handling of applicants' credit information must adhere to privacy laws.

- Fair Lending Practices: Ensures no discrimination in credit disposition decisions based on race, gender, or other non-financial factors.

Important Terms Related to Credit Disposition

Understanding key terms associated with credit disposition is vital for those engaging with this process:

- Credit Score: A numerical representation of an individual’s creditworthiness.

- Debt-to-Income Ratio: A metric that compares total debt to total income.

- Collateral: An asset pledged against a loan for security.

- Underwriting: Process of evaluating the risk of insuring a loan.

- Lien: Legal right of a lender to claim a borrower’s asset in case of default.

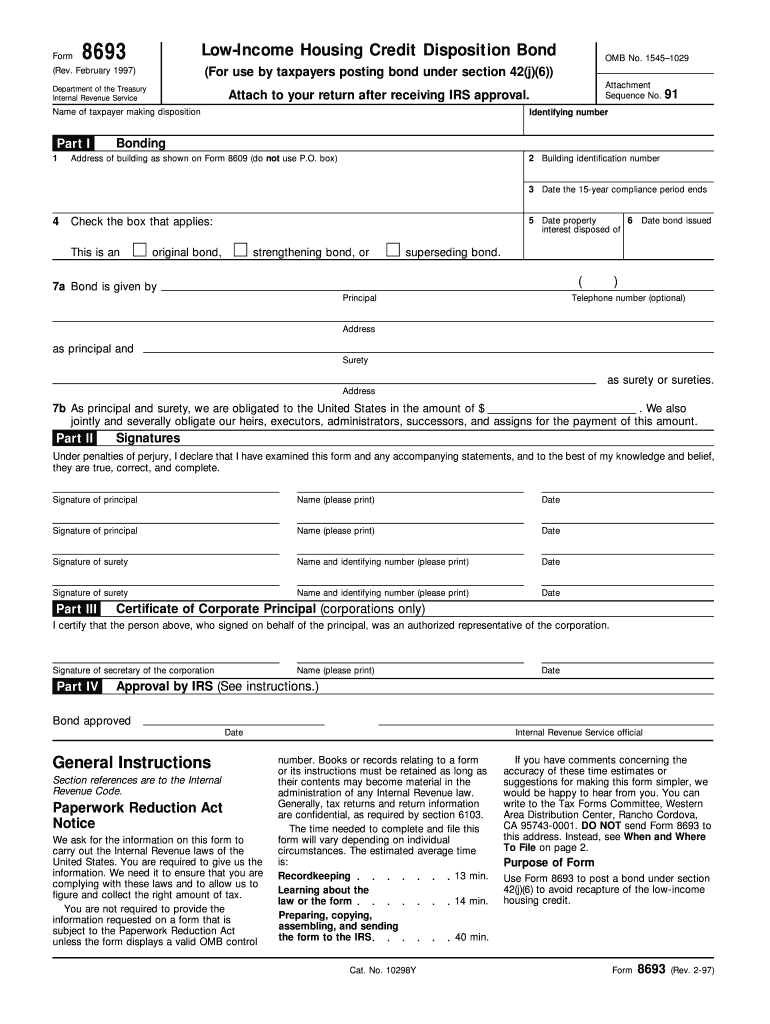

IRS Guidelines

The IRS provides specific guidelines for the tax implications of credit disposition, addressing issues related to loan interest deductibility, forgiven debts, and reporting obligations.

- Loan Interest: Usually deductible if related to business activities.

- Forgiven Debt Reporting: Any canceled debt must be reported as income.

- Record Keeping: Detailed records should be maintained to verify credit disposition activities and related tax filings.

Digital vs. Paper Version

In modern financial transactions, digital credit disposition processes have become popular due to their efficiency, while paper versions still serve specific scenarios.

- Digital Advantages: Faster processing, less paperwork, and easier storage and retrieval.

- Paper-Based Specificity: Provides a tangible trail which some individuals or entities may prefer for documentation and compliance purposes.