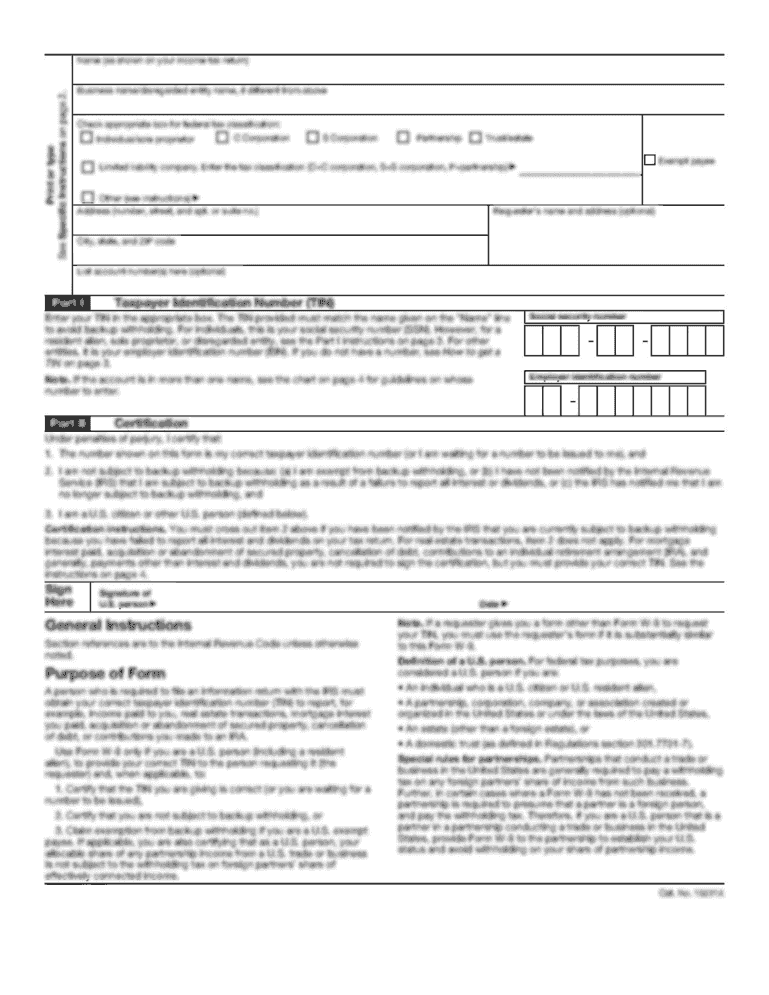

Definition and Purpose of IRS Form 10492

IRS Form 10492 is primarily used to issue a Notice of Federal Taxes Due. This important form is a formal notification by the Internal Revenue Service (IRS) alerting an escrow holder or fiduciary that a taxpayer has unpaid federal taxes. It outlines the amount owed, types of taxes involved, relevant assessment dates, and potential penalties. The notice aims to ensure timely payment, minimizing any additional interest or penalties.

How to Use IRS Form 10492

Effectively using IRS Form 10492 involves understanding its components and acting promptly once received. Here are key steps:

- Verify Information: Check the form details, such as the amount due and related dates. Ensure all data matches your records.

- Understand Penalties: Note the penalties and interest rates for late payment.

- Plan Payment: Arrange for timely payment using accepted methods, clearly stated in the form.

- Communicate with IRS: If discrepancies or issues arise, contact the IRS for clarification or dispute resolution.

How to Obtain IRS Form 10492

IRS Form 10492 is generally issued directly by the IRS to an escrow holder or fiduciary. However, if needed for record-keeping or informational purposes, here are ways to obtain it:

- Direct Request: Contact the IRS for a copy if you or your representative does not have one.

- Official IRS Channels: Download related guides or informational resources via the official IRS website for a comprehensive understanding of the form’s context.

Steps to Complete IRS Form 10492

When handling IRS Form 10492, accuracy is vital. Although you usually receive this notice rather than complete it, here’s what to keep in mind if providing information to the IRS:

- Review Accuracy: Ensure all taxpayer information is correct, reflecting the IRS records.

- Update Documentation: Submit any missing or revised tax documentation to support amendments.

- Confirm Amounts: Double-check amounts to ensure they are accurate based on your tax history and current filings.

Who Typically Uses IRS Form 10492

The form primarily concerns specific parties involved in financial oversight:

- Escrow Holders: Receive this form to manage funds relating to unpaid taxes.

- Fiduciaries: Handle the form for clients or estates with pending tax dues.

- Taxpayers: Indirectly engaged as the form details their unpaid tax obligations to these parties.

Key Elements of IRS Form 10492

Several components constitute this form, crucial for its intended purpose:

- Tax Amount Due: Exact sums currently owed by the taxpayer.

- Types of Taxes: Includes income, estate, or other applicable tax categories.

- Assessment Dates: Specifies when the taxes were initially assessed, guiding payment deadlines.

Penalties for Non-Compliance

Failure to adhere to information on IRS Form 10492 can lead to various penalties:

- Interest Accrual: Continues to rise on unpaid balances.

- Additional Penalties: Financial or legal penalties may apply if payments are ignored post-notification.

IRS Guidelines

Adhering to IRS guidelines is critical for managing IRS Form 10492:

- Payment Methods: Follow clearly outlined payment methods, e.g., electronic, mail.

- Response Protocol: Address any required disclosures or responses promptly to avoid exacerbating penalties.

Filing Deadlines / Important Dates

Deadlines on IRS Form 10492 must be strictly adhered to:

- Payment Due Date: Failure to meet this date results in compounded interest or penalties.

- Follow-Up Periods: Note any specific IRS instructions for follow-up actions or documentation submissions.

Required Documents

Ensure the following when responding to or addressing IRS Form 10492:

- Proof of Payment: Provide receipts or confirmations of submitted payments.

- Tax Records: Maintain updated records to resolve any disputes with IRS amounts.

Taxpayer Scenarios

Different taxpayer scenarios affect interaction with IRS Form 10492:

- Self-Employed: Must ensure comprehensive record-keeping due to varied income streams.

- Estates: Typically engage fiduciaries for managing tax obligations using this form.

Software Compatibility

Financial or tax management software can aid in handling information related to IRS Form 10492:

- Integration: Tools like QuickBooks can help users track financial activities relevant to tax dues.

- Data Consistency: Ensure compatibility for importing/exporting data to and from IRS records.

Key Takeaways

IRS Form 10492 provides a crucial financial notice. Key takeaways include:

- Prompt Reaction: Immediate and accurate response minimizes penalties.

- Verification: Thoroughly check all issued details against your records.

- Compliance: Follow IRS-guided methods for managing unpaid dues efficiently.