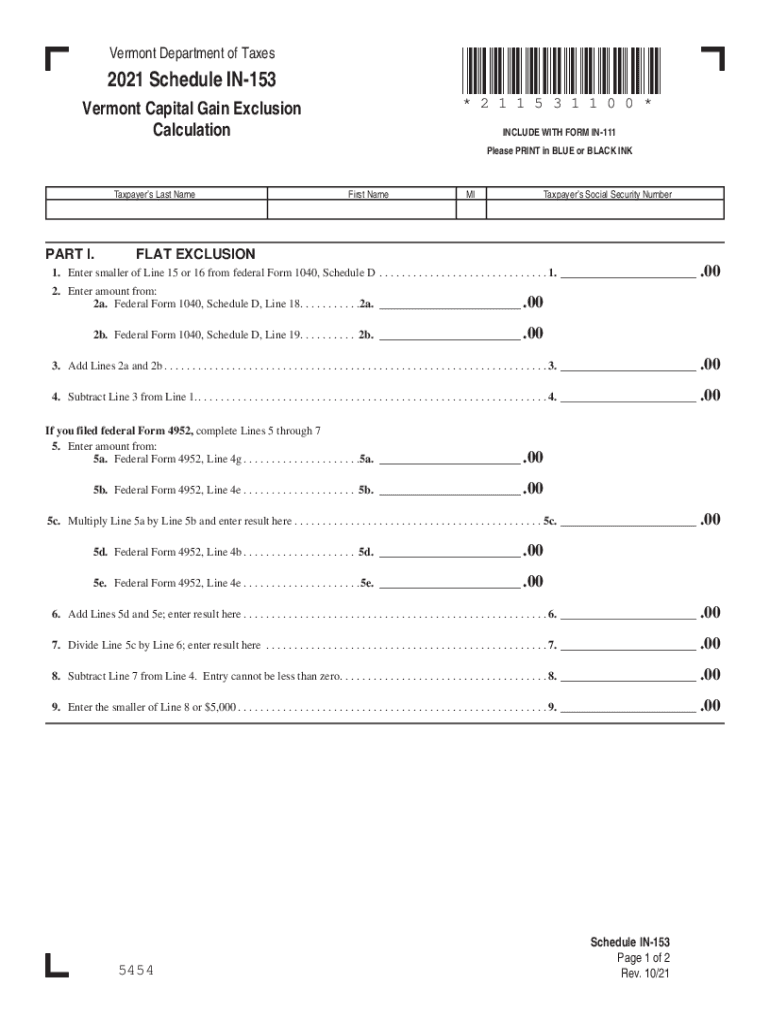

Definition, Purpose, and Overview of Schedule IN-153

Schedule IN-153, issued by the Vermont Department of Taxes, is designed to calculate the Vermont Capital Gain Exclusion. It aids taxpayers in determining their capital gains and applicable exclusions, aligning these calculations with federal tax forms. It is divided into three main sections: Flat Exclusion, Percentage Exclusion, and Capital Gain Exclusion. Each part has specific calculation guidelines to help taxpayers determine their eligible exclusion amount, ensuring they comply with state regulations.

Steps to Complete the 2021 Schedule IN-153

-

Gather Relevant Financial Information:

- Collect all necessary federal tax documents, such as Schedule D from Form 1040, which detail your capital gains and losses.

- Ensure these documents are accurate as they will serve as the basis for calculations on Schedule IN-153.

-

Calculate the Flat Exclusion:

- Using the Flat Exclusion section, apply the specified flat amount directed for eligible capital gains.

- This step involves simple subtraction from your total capital gains amount.

-

Determine the Percentage Exclusion:

- Proceed to the Percentage Exclusion section to apply a predefined percentage to your capital gains.

- Multiply your total capital gains by the percentage to find the amount eligible for exclusion.

-

Conclude with Capital Gain Exclusion:

- Add amounts from both exclusions above to determine your total exclusion.

- Subtract this total from your overall capital gains to determine the taxable portion.

Obtaining the 2021 Schedule IN-153

- Online Availability: Access the form directly from Vermont's Department of Taxes website. Download and print the PDF version for manual completion.

- Local Tax Offices: Visit local Vermont tax offices for physical copies or assistance in obtaining the form.

- Tax Software Platforms: Integrated tax software often includes automatic access to state-level forms, including the IN-153, facilitating a streamlined filing process.

Important Terms Associated with Schedule IN-153

- Capital Gain: The profit from the sale of property or an investment; taxable but eligible for exclusions.

- Exclusion: A portion of income or gain that is exempt from taxation.

- Filing Status: The tax category that defines the return submitter (e.g., single, married), impacting exclusion calculations.

Taxpayer Scenarios for Using Schedule IN-153

- Individuals with Significant Investments: Taxpayers who have realized gains through stock sales or real estate transactions.

- Retirees: Utilizing the form to manage gains from investments or property liquidations for retirement fund balance.

- Small Business Owners: Applying the form to exclude capital gains from selling business assets or stakes.

State-Specific Rules for the Schedule IN-153

- Eligibility Criteria: Confirm eligibility based on Vermont-specific guidelines to prevent errors or penalties.

- Exclusion Limits: Vermont may have distinct thresholds or limits on the amount of capital gain subject to exclusion, differing from federal standards.

IRS Guidelines and Vermont Coordination

Although Schedule IN-153 is a state-level document, it must closely correlate with IRS guidelines for capital gains. Ensure information from your federal returns seamlessly aligns with state formulas and figures, thus maintaining compliance and preventing discrepancies.

Filing Deadlines and Important Dates

- Tax Submission Deadline: Typically aligned with the federal tax deadline in April; ensure timely submission for both documentation and payments.

- Amendment Period: Be aware of deadlines to amend returns if errors or omissions are identified after submission.

Submission Methods for Schedule IN-153

- Online Submission: File electronically through approved platforms partnering with the Vermont Department of Taxes for convenience and speed.

- Mail: Send completed forms to the state tax department; include any necessary attachments and forms.

- In-Person: Submit directly at a local Vermont tax office, suitable for those desiring face-to-face assistance.

Penalties for Non-Compliance

- Late Filing: Expect fines for untimely submission of forms or payment of taxes associated with Schedule IN-153.

- Inaccurate Reporting: Penalties may also apply for errors or misreported information; rigorous verification of entries is paramount.

This guide aims to provide a comprehensive understanding of the Schedule IN-153, facilitating accurate completion and compliance with Vermont's tax regulations. It is essential to take into account all relevant information and follow each step precisely to ensure proper filing and to leverage available exclusions efficiently.