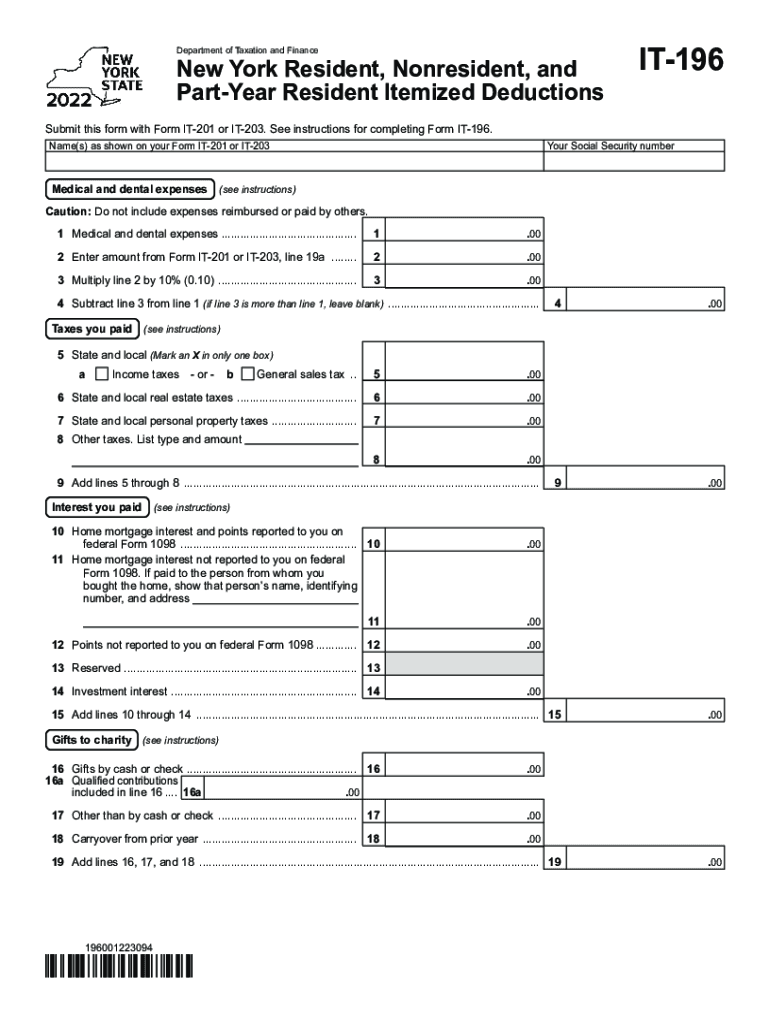

Definition and Meaning of Form IT-196

Form IT-196 is a tax document issued by the New York Department of Taxation and Finance. Officially titled "New York Resident, Nonresident, and Part-Year Resident Itemized Deductions," it enables individuals to report itemized deductions for state income tax purposes. The form is used primarily by those who wish to specify detailed deductions as opposed to opting for standard deductions. Through this process, taxpayers can reduce their taxable income by reporting various expenses.

Key Categories of Deductions

- Medical and Dental Expenses: These include costs for medical care, prescriptions, and other related health expenses not covered by insurance.

- Tax Payments: Covers state and local income taxes, real estate taxes, and personal property taxes.

- Home Mortgage Interest: This involves interest paid on mortgaged properties, critical for homeowners itemizing deductions.

- Charitable Contributions: Contributions to qualifying charitable organizations can be deducted.

- Casualty and Theft Losses: Includes losses from unexpected events or theft.

- Job-related Expenses: Can include unreimbursed employee expenses related to the taxpayer’s job.

How to Use Form IT-196

Utilizing Form IT-196 involves understanding the sections of the form related to itemizing deductions. Taxpayers must accumulate and organize necessary documentation that supports their claims for deductions. The form must be attached to the main state tax forms, such as Form IT-201 for residents or Form IT-203 for nonresidents and part-year residents.

Step-by-Step Instructions

- Gather Documentation: Collect invoices, receipts, and other proof of expenses related to eligible deductions.

- Complete Relevant Sections: Use your documentation to fill in expenses under applicable categories laid out in the form.

- Calculate Total Deductions: Sum up all itemized deductions on the form to determine the total deduction amount.

- Transfer Totals Appropriately: The final step involves entering the total deductions onto the related state tax form, ensuring consistent figures across all documents.

How to Obtain Form IT-196

Form IT-196 can be acquired through multiple avenues. It is commonly accessed online through the New York State Department of Taxation and Finance website. Paper versions can also be obtained at selected tax preparation events or ordered by mail for those filing manually.

Steps to Complete the Form IT-196

Completing Form IT-196 requires careful attention to detail and verification of each deductible item.

- Identify Applicable Items: Review each deduction category to determine what applies.

- Accurate Entry of Amounts: For each item, enter precise amounts as supported by your records.

- Verify Deductions: Double-check entries for accuracy to prevent filing errors.

- Calculate Subtotals and Totals: Totals should accurately reflect the summation of individual deductions.

- Attach to Main Tax Return: Ensure the form is securely attached and submitted with your primary state tax return.

Why You Should Use Form IT-196

Choosing to itemize deductions using Form IT-196 can be financially advantageous for taxpayers with deductions that surpass the standard deduction threshold. This method allows for a detailed representation of eligible expenses, often leading to a lower taxable income and potentially reducing state tax liabilities.

Benefits

- Maximizing Deductions: By itemizing, you might capture all eligible deductions relevant to your financial situation.

- Tax Savings: Individuals with high deductible expenses can significantly benefit from a lower taxable income.

- Control Over Tax Reporting: Provides the autonomy to report specific expenses rather than a standardized amount.

Who Typically Uses Form IT-196

Form IT-196 is generally used by residents of New York, as well as nonresidents and part-year residents who have taxable income sourced from the state. It is suitable for:

- Individuals with significant medical, tax, or charitable expenses

- Homeowners paying mortgage interest

- People suffering losses due to theft or casualty

- Employees with substantial job-related unreimbursed expenses

Key Elements of Form IT-196

The form encompasses distinct sections for various categories of itemized deductions. Each section is designed to capture specific types of eligible expenses, and correct completion is mandatory to claim deductions.

Breakdown

- Section 1: Medical and Dental Expenses

- Section 2: Taxes You Paid

- Section 3: Interest You Paid

- Section 4: Gifts to Charity

- Section 5: Casualty and Theft Losses

- Section 6: Job Expenses and Miscellaneous Deductions

The delineation ensures taxpayers can distinguish between different deductible costs.

Important Terms Related to Form IT-196

Understanding terminology unique to Form IT-196 is vital for proper completion. Key terms include:

- Itemized Deductions: Federal and state deductions specified and reported by the taxpayer.

- Casualty Loss: Financial loss due to unexpected or sudden events.

- Adjusted Gross Income: Total gross income minus specific deductions, crucial for calculating limits on certain itemized deductions.

- Threshold: The minimum amount required for particular deductible expenses to be eligible.

Familiarity with these terms aids in interpreting form instructions and accurately reporting deductions.