Definition & Meaning

Arizona Form 140ES is specifically designed for individuals to make estimated income tax payments to the state of Arizona. This form is crucial for taxpayers who anticipate owing Arizona state taxes but do not have sufficient withholding through their employer or other means to cover their anticipated tax liability for the year. Estimated payments are typically required for those who expect to owe more than five hundred dollars in state tax after subtracting credits and withholdings. The importance of timely and accurate payments cannot be overstated, as the form assists taxpayers in managing their annual tax obligations.

Using Form 140ES allows individuals to break down their tax burden into manageable installments throughout the year—specifically due on a quarterly basis. Each payment reflects the expected tax liability based on current income estimates, providing an avenue for individuals to stay compliant with state tax regulations and avoid penalties associated with underpayment. By making these estimated payments, taxpayers can also mitigate the impact of owing a large sum during the tax filing season.

How to Obtain the Arizona Form 140ES

Obtaining Arizona Form 140ES is a straightforward process that can be accomplished through several channels. The form is available for download from the Arizona Department of Revenue's official website. Additionally, individuals can find this form through tax preparation software.

To access and print the form directly:

- Visit the Arizona Department of Revenue website.

- Navigate to the "Forms" section and search for "Form 140ES."

- Download the PDF version of the form.

- Print the form as needed.

Choosing to file electronically not only provides convenience but also can streamline the payment process, making it easier to keep track of submissions.

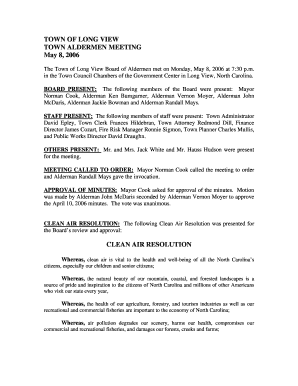

Steps to Complete the Arizona Form 140ES

Completing the Arizona Form 140ES requires careful attention to detail to ensure accuracy and compliance. The following steps outline the process:

- Gather Necessary Information: Collect all financial information, including projected income, deductions, and other relevant tax information for the tax year.

- Determine Your Tax Liability:

- Use the worksheet included with the form to estimate your annual taxable income.

- Calculate the expected tax due by applying the appropriate rates set by the Arizona Department of Revenue.

- Fill Out the Form:

- Provide personal information, such as your name, address, and Social Security number.

- Enter the estimated income, deductions, and resulting taxable income derived from the worksheet calculations.

- Based on your calculations, fill in the estimated tax payments due for each quarter.

- Select Your Payment Method:

- Indicate how you will make your payment (online, by mail, or in-person).

- If mailing, ensure that you include the necessary payment method and any documentation required.

- Review and Submit: Double-check all entries for accuracy, sign the form, and submit it via the chosen method.

Regularly reviewing estimated payments and adjusting as necessary throughout the year is advisable, especially if income fluctuates.

Filing Deadlines / Important Dates

Filing deadlines for Arizona Form 140ES are critical for maintaining compliance and avoiding penalties. Payments are typically due on the following schedule:

- First Quarter Payment: Due April 15

- Second Quarter Payment: Due June 15

- Third Quarter Payment: Due September 15

- Fourth Quarter Payment: Due January 15 of the following year

It is essential to stay informed about any changes to deadlines and to ensure that payments are made on time. Filing extensions are not available for estimated tax payments, so individuals must plan to meet these deadlines or face potential penalties.

Key Elements of the Arizona Form 140ES

Understanding the key elements of Arizona Form 140ES helps taxpayers utilize the form effectively:

- Identification Section: Collects personal information, including name, address, and Social Security number.

- Estimated Income: Requires taxpayers to estimate their expected income for the year.

- Deductions and Credits: Allows for the reporting of applicable deductions and tax credits.

- Quarterly Payment Calculation: Provides fields to calculate and report the estimated tax due for each quarter.

- Payment Options: Details available methods for submitting payments, enhancing user convenience.

These components are essential for ensuring accurate reporting and compliance, aiding taxpayers in organizing their tax payments throughout the year.

Important Terms Related to Arizona Form 140ES

Familiarity with key terms can enhance understanding and facilitate the completion of the Arizona Form 140ES:

- Estimated Tax: The amount a taxpayer expects to owe for the year, which must be paid in quarterly installments.

- Tax Liability: The total amount of tax owed to the state after considering deductions, credits, and payments.

- Withholding: Taxes withheld from wages or other income sources that can reduce the amount of estimated tax payments owed.

- Penalties: Financial consequences for failing to pay sufficient estimated taxes on time; penalties may include interest on unpaid amounts.

- Tax Year: The calendar year for which taxes are calculated, typically aligning with the federal tax year.

Understanding these terms is fundamental for navigating the tax landscape and ensuring compliance with state tax regulations.

State-Specific Rules for the Arizona Form 140ES

Arizona has specific rules governing the use of Form 140ES, which individuals must adhere to:

- Filing Requirements: Taxpayers with income exceeding a certain threshold must file estimated tax payments quarterly.

- Non-Compliance Penalties: Failure to make timely estimated payments may result in penalties, emphasizing the importance of compliance with state deadlines.

- Adjustments: Taxpayers may need to adjust their estimated payments if income fluctuates or if tax law changes impact their liabilities.

- Use of Form: The form should only be utilized for estimated payments, not for any delinquent or prior-year amounts.

Being aware of these state-specific regulations can further aid taxpayers in effective tax planning and compliance.

Examples of Using the Arizona Form 140ES

Several scenarios illustrate the practical application of Arizona Form 140ES in different taxpayer situations:

- Self-Employed Individuals: A freelance graphic designer who anticipates earning significant income throughout the year would use the form to make quarterly payments based on projected earnings.

- Investors: An individual expecting capital gains from stock transactions may need to file estimated tax payments to cover anticipated taxes on those gains.

- Real Estate Professionals: A real estate agent who has variable income based on commission sales may utilize the form to manage their estimated tax payments more effectively.

Each of these scenarios highlights the importance of Arizona Form 140ES for individuals whose tax situations do not allow for standard withholding. Understanding these use cases aids taxpayers in recognizing the benefits of timely compliance.