Definition and Meaning of the AR TX Border City Exemption Form

The AR TX border city exemption form serves as a critical document for residents of specified border cities in Arkansas and Texas. This exemption allows eligible taxpayers to apply for a reduced income tax rate based on their residency in designated areas that benefit from cross-border economic activity. By categorizing these locations—such as Texarkana—as border cities, the form reduces the overall tax burden for qualifying residents, fostering economic development and incentivizing local investments.

Eligible residents include those living within designated border city limits, enabling them to apply for the exemption, which helps promote a balanced economic environment between two states. Understanding this form's definition and implications is vital for those residing in applicable areas, as it directly impacts annual tax filings.

How to Obtain the AR TX Border City Exemption Form

Obtaining the AR TX border city exemption form is straightforward for residents in qualifying cities. The form can typically be accessed from the Arkansas Department of Finance and Administration’s official website or directly through local government offices in municipalities like Texarkana. Additionally, forms may be available at various state tax offices for in-person assistance.

Steps to Access the Form:

- Visit the Arkansas Department of Finance and Administration’s official website.

- Navigate to the taxation section related to border city exemptions.

- Find and download the AR TX border city exemption form in PDF format, or request a physical copy at local tax offices.

Residents are encouraged to ensure they are using the most current version of the form, especially when filing for tax returns in 2023 or for previous years.

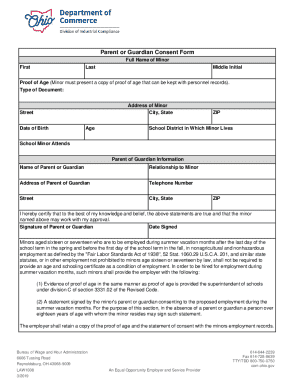

Steps to Complete the AR TX Border City Exemption Form

Filling out the AR TX border city exemption form requires careful attention to detail to ensure compliance with state guidelines. Follow the steps outlined below for a successful submission.

Step-by-Step Instructions:

- Personal Information: Enter your full name, address, and Social Security number accurately, ensuring it matches your legal identification.

- Residency Verification: Indicate your residency status in the designated border city. This may involve providing verification such as utility bills or lease agreements as supporting documents.

- Income Reporting: Detail your total annual income, making sure to differentiate between income earned in Arkansas and external sources, if applicable.

- Exemption Calculation: Calculate the exemption amount to which you are entitled based on defined state guidelines. This may involve specific formulas or figures provided in the form instructions.

- Signature and Date: Sign and date the form to certify that all information is correct. An unsigned form may be subject to rejection.

Completing these steps diligently and accurately is crucial for a successful application.

Important Terms Related to the AR TX Border City Exemption Form

Understanding the terminology associated with the AR TX border city exemption form is essential for effective navigation and compliance. Here are a few key terms:

- Eligible Resident: A person residing within the designated border city boundaries who meets the criteria for tax exemptions.

- Exemption Amount: The specific reduction in taxable income granted to qualifying residents, promoting economic growth in border areas.

- Income Tax Liability: The total amount of tax a resident is obligated to pay based on earned income, which can be reduced through exemptions.

Becoming familiar with these terms can significantly alleviate the complexities involved in filing taxes and leveraging available benefits.

Filing Deadlines and Important Dates

Staying mindful of filing deadlines and important dates for the AR TX border city exemption form is crucial for timely tax compliance.

Key Dates to Remember:

- Filing Start Date: Residents can typically begin filing their taxes for the year on January first.

- Submission Deadline: The exemption form should be submitted by April fifteenth, aligning with the annual income tax return deadline.

- Extended Filing Options: In cases of extensions granted by the IRS, residents may also request additional time for filing their exemption forms.

Being aware of these dates ensures residents can take full advantage of the exemptions available to them.

Digital vs. Paper Version of the AR TX Border City Exemption Form

The AR TX border city exemption form comes in both digital and paper formats, providing flexibility for how residents choose to submit their applications.

Digital Version:

- Access: Available online through the Arkansas Department of Finance and Administration.

- Advantages: Allows for electronic completion, storage, and submission; reduces the risk of lost documents.

Paper Version:

- Access: Obtainable through local tax offices or downloaded and printed from the state’s website.

- Advantages: Provides a tangible copy for those who prefer traditional methods; useful for individuals less comfortable with digital forms.

Choosing between digital or paper formats may depend on individual preferences or technical capabilities.