Definition and Meaning of Arizona Form 140A

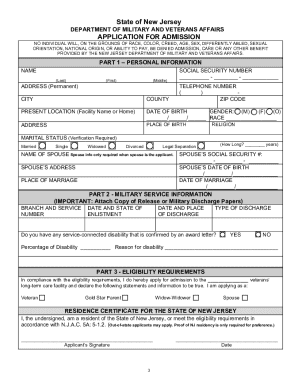

The Arizona Form 140A, officially known as the Resident Personal Income Tax Return (Short Form), is a simplified tax return utilized by residents of Arizona for reporting personal income for the tax year 2012. This form is designed for individuals whose taxable income does not exceed $50,000. It facilitates the process of filing personal income taxes by consolidating necessary information such as personal identification, income details, and applicable deductions and credits into a condensed format.

The main goal of Form 140A is to streamline the filing process for qualifying taxpayers, allowing them to report income, claim deductions, and optimize their tax obligations with ease. Electing to use this form typically involves fewer requirements compared to the standard Arizona Form 140, which is needed for higher income brackets.

Key Features of Arizona Form 140A

- Income Reporting: Captures various income types such as wages, interest, and dividends.

- Deductions and Credits: Allows taxpayers to claim standard deductions and applicable tax credits.

- User-Friendly Design: Simplified format for easier navigation and quicker completion.

- Eligibility Requirements: Primarily intended for individual residents with taxable income limits.

How to Use the Arizona Form 140A (2012 Fillable Version)

Utilizing the Arizona Form 140A requires specific steps to ensure accuracy and compliance with state tax regulations. The fillable version of the form enhances user experience, allowing for digital completion and submission.

Step-by-Step Guide for Using Form 140A:

- Download the Form: Obtain the fillable Form 140A from a reliable source, such as a tax service or governmental website.

- Gather Necessary Information: Compile all relevant documents, including W-2s, 1099s, and other income statements.

- Complete Personal Information: Enter your name, address, and social security number at the top of the form.

- Report Income:

- Input total wages, interest, and dividends in the appropriate sections.

- Ensure accurate summation of all income sources.

- Claim Deductions: Identify and fill out applicable deductions—these might include standard deductions or itemized deductions, depending on your eligibility.

- Calculate Taxable Income: Follow the instructions to arrive at your total taxable income by subtracting deductions from total income.

- Review and Submit:

- Double-check all entries for accuracy.

- Save the completed form and print or electronically submit it as required.

Utilizing the fillable version allows taxpayers to avoid handwriting errors and ensures that calculations are more straightforward due to built-in functionalities.

How to Obtain the Arizona Form 140A (2012 Fillable)

To obtain the Arizona Form 140A for the 2012 tax year, there are several channels available to taxpayers. The fillable version is especially accessible for convenience, allowing for easier completion and submission.

Methods to Acquire Form 140A:

- Official Arizona Department of Revenue Website: The most reliable source. Visit the website to find the fillable form directly, typically located in the tax forms section.

- Tax Preparation Software: Many software programs include the Arizona Form 140A as part of their tax filing capabilities, making it easier to access while preparing your return.

- Local Tax Offices: Visit or contact local tax offices, libraries, or governmental agencies to obtain physical copies of the form printed for public distribution.

Downloading the fillable version usually allows for a smoother filing process compared to paper forms, given the digital functionalities that assist in calculations.

Key Elements of the Arizona Form 140A

Understanding the essential components of the Arizona Form 140A can greatly aid in accurate completion and ensuring compliance with tax obligations.

Core Components of Form 140A:

- Personal Information Section: Requires entry of name, address, and social security number, pivotal for identification and tax record purposes.

- Income Reporting Section:

- Details of various income sources, allowing seamless aggregation of total income.

- Specific fields for wages, interest, and dividends.

- Deductions and Credits Section:

- Designates areas for itemizing deductions or claiming the standard deduction.

- Allows credits to be applied directly to the calculated tax liability.

- Tax Calculation Area: Outlines a structured method for computing total taxes due after all deductions and credits are factored in.

Each section must be completed accurately to ensure correct tax filing and to minimize potential reconciliation issues with the Arizona Department of Revenue.

Who Typically Uses the Arizona Form 140A?

The Arizona Form 140A is tailored for a specific demographic of taxpayers, primarily those who meet certain income thresholds and filing statuses.

Typical Users Include:

- Individual Taxpayers: Residents of Arizona with a taxable income below $50,000 who prefer a simplified filing option.

- Students or Young Professionals: Individuals entering the workforce with modest income levels often find this form suitable for their tax needs.

- Retirees: Seniors with limited income based on pensions or Social Security often utilize this form due to its straightforward nature.

- Sole Proprietors: Small business owners with simple income structures may choose Form 140A for ease of reporting personal income derived from business activities.

Understanding the typical user base aids in determining the appropriateness of using Form 140A based on individual circumstances and income levels.