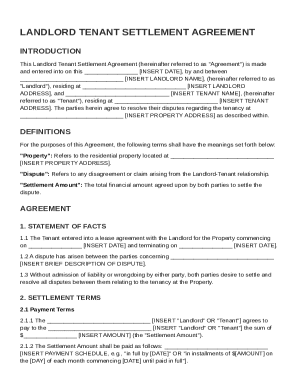

Definition and Purpose of Enclosing Form OW8P with Your Return

Enclosing this form and Form OW-8P with your return is essential for individuals or businesses that need to report specific information to the IRS or a state tax authority. The OW-8P is typically a document that helps establish taxpayer eligibility for certain tax benefits, claims, or for reporting specific income types that may not be covered in the standard tax return.

By enclosing this form, you are ensuring compliance with tax regulations and reducing the likelihood of delays or issues with your tax filing. This form can be particularly relevant for those individuals who have unique tax situations, such as non-resident aliens or taxpayers claiming certain exemptions.

The importance of this process lies in its role in facilitating correct and complete tax returns, which is key in avoiding audits, penalties, or payment delays.

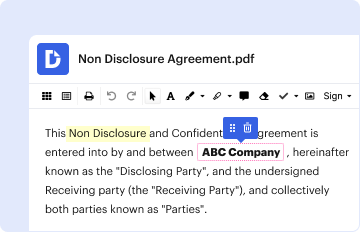

Steps to Complete the Enclosure of Form OW8P with Your Return

Completing the enclosure process involves several clearly defined steps that ensure you meet all filing requirements.

-

Gather Required Documentation: Compile all necessary forms, including Form OW-8P. Ensure you have accurate financial records to support the information provided on your tax return.

-

Complete Your Tax Return: Fill out your standard tax return form. If you are using tax software or consulting a tax professional, follow their guidance for filling in your information accurately.

-

Fill Out Form OW-8P: Provide the requested information on Form OW-8P. This may include your personal identification details, income data, and any relevant deductions or credits.

-

Review the Documents: Before enclosing, meticulously check both your tax return and Form OW-8P for accuracy. Mistakes or omissions can lead to processing delays.

-

Enclose the Forms Together: Place Form OW-8P and your tax return together in the specified order. Some forms may have specific instructions on how to organize them.

-

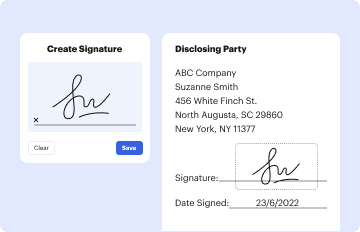

Sign and Date Your Return: Ensure you sign and date your tax return, as this is a requirement for it to be processed.

-

Submit the Enclosure: Follow the guidelines for submission—either electronically if permitted or via mail. Ensure you understand the deadlines for submission to avoid penalties.

By following these steps, you reinforce the completeness of your tax submission and comply with IRS requirements, which can help mitigate future complications.

Important Terms Related to Form OW8P

Understanding key terms is crucial for successfully navigating the tax filing process, particularly when dealing with Form OW-8P.

-

Taxpayer Identification Number (TIN): A TIN is often required to validate your identity and tax status. This can be a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN).

-

IRS Compliance: Compliance means adhering to the rules and regulations set forth by the IRS regarding tax filing, including the proper enclosure of forms.

-

Filing Status: This determines the tax rate and standard deduction you are eligible for based on your marital status and dependents.

-

Exemption: An exemption reduces your taxable income. Form OW-8P might be used to claim certain exemptions relevant to your tax situation.

These terms form the foundation for understanding how to effectively use Form OW-8P in conjunction with your tax return and ensure compliance with tax regulations.

Filing Deadlines and Important Dates for Form Submission

Meeting filing deadlines is critical to avoid penalties or interest on overdue payments. Here are pertinent dates to keep in mind:

-

Annual Tax Filing Deadline: Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline shifts to the next business day.

-

State Submission Deadlines: If Form OW-8P is required by a state tax authority, be aware that state deadlines can differ. Each state has its own submission dates that must be adhered to.

-

Extension Requests: If necessary, you may apply for an extension, which usually allows for additional time (typically six months) to file, though any tax owed still must be paid by the original due date to avoid penalties.

-

Estimated Tax Payment Deadlines: If you are self-employed or have significant non-W-2 income, keep in mind the quarterly estimated tax payment due dates, which can affect how you use Form OW-8P and your overall filing strategy.

Staying informed about these dates is essential to ensure that your tax matters are handled in a timely and compliant manner.

Examples of Situations Requiring the Use of Form OW8P

Various scenarios warrant the submission of Form OW-8P alongside your main tax return. Here are some practical examples:

-

Non-Resident Aliens: If you are a non-resident alien working in the U.S. and claiming tax exemptions based on tax treaties, you would need to include Form OW-8P to validate your claims.

-

Claiming Deductions: Taxpayers who have eligible deductions not typically reported on the standard tax return might need to provide Form OW-8P to justify their claims.

-

Business Entities: Partnerships and corporations claiming income exclusions or credits must include this form to detail the basis for their claims properly.

-

Special Situations: Students or individuals in unique life circumstances often have specific filing requirements where Form OW-8P clarifies their tax status.

These examples illustrate the relevance of Form OW-8P in various tax filing scenarios, emphasizing its utility in efficiently managing diverse taxpayer needs.

Who Typically Uses Form OW8P?

The intended audience for Form OW-8P includes a range of taxpayers, each with potential needs for this specific documentation.

-

Self-Employed Individuals: Those running their own businesses who must report varied income sources may need to utilize this form to ensure that they meet all necessary tax obligations.

-

Foreign Nationals: Non-residents working in the U.S. who may benefit from tax treaties will use this form to claim the applicable exemptions.

-

Students: Individuals attending school while working may face unique tax situations requiring the use of Form OW-8P to report income while ensuring compliance with tax laws.

-

Small Business Owners: Companies that receive income from diverse channels or that operate across state lines might also find this form beneficial for accurate reporting.

Understanding the demographics that use Form OW-8P can help clarify its purpose and underscore its significance in various tax situations.

Legality and Compliance of Using Form OW8P

Using Form OW-8P in conjunction with your tax return is compliant with IRS regulations, provided it is filled out correctly.

-

IRS Approval: The form adheres to guidelines established by the IRS for documentation that supports certain claims or exemptions.

-

Legal Use Cases: This form is legally permitted in scenarios that require substantiation of claims made on tax returns. Misuse or failure to provide it when required could result in penalties or audits.

-

Documentation Integrity: To maintain compliance, it’s essential that all information provided on the OW-8P is accurate, complete, and well-supported by documentation where necessary to validate claims or statements made.

Understanding the legal framework surrounding Form OW-8P reinforces the necessity of careful and diligent handling of tax documents to ensure adherence to IRS rules.