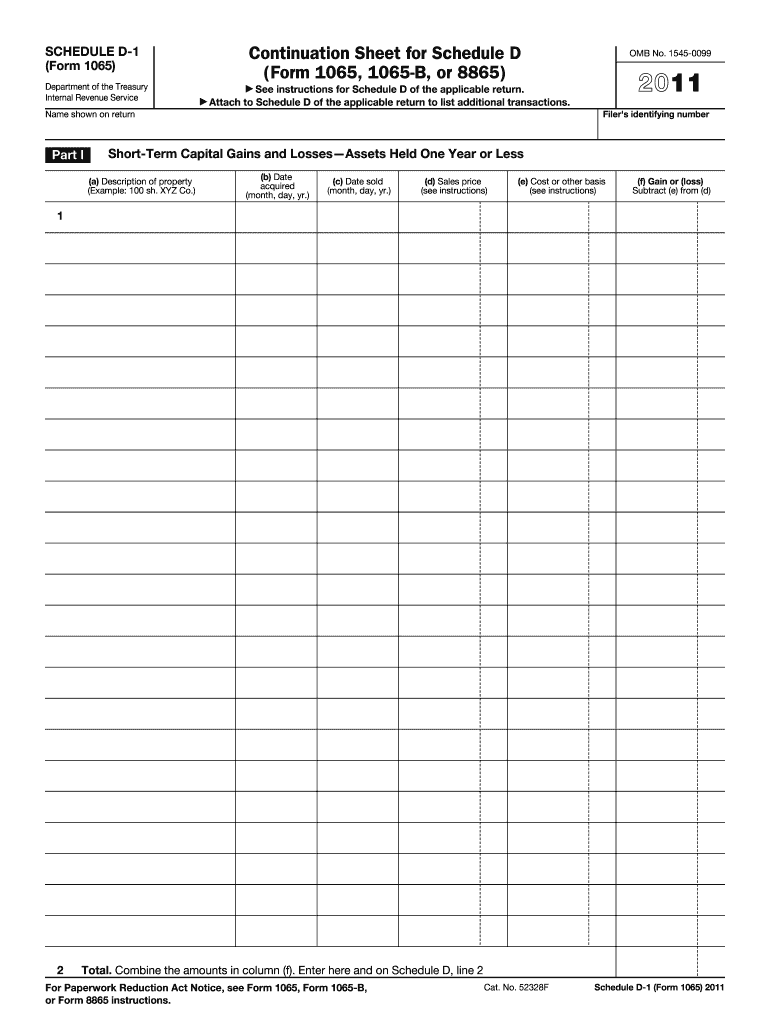

Definition and Purpose of the IRS D1 Sheet

The IRS D1 Sheet serves as a continuation sheet for Schedule D of Forms 1065, 1065-B, or 8865. This document is a vital component used by the Internal Revenue Service to report both short-term and long-term capital gains and losses from asset transactions. It provides taxpayers with sections to detail property descriptions, acquisition and sale dates, as well as sales prices. The sheet also includes areas for costs or other bases and calculates resulting gains or losses. This precise reporting is crucial for maintaining accuracy in tax responsibilities and helps in assessing the net taxable income for businesses and partnerships.

How to Use the IRS D1 Sheet

Using the IRS D1 Sheet involves several organized steps to ensure correctness and compliance with tax regulations. Initially, accurate documentation of each asset transaction is necessary, including dates of acquisition and sale. Taxpayers must include sale prices and the original acquisition costs or other basis, which can affect the loss or gain outcome. The sheet must be completed accurately to ensure all information is correctly transferred to the pertinent sections of Schedule D. Users can leverage online document management systems, like DocHub, to edit, manage, and store their IRS D1 Sheet securely online, facilitating collaboration with accountants or tax advisors without losing data integrity.

Steps to Complete the IRS D1 Sheet

-

Gather Required Documents: Ensure all necessary documents and records, like property purchase and sale receipts, are available.

-

Detail Property Information: Fill in each asset's detailed description, ensuring clarity for verification purposes.

-

Input Acquisition and Sale Dates: Precisely enter the dates you acquired and sold each asset to determine short-term or long-term gain/loss.

-

Determine Costs and Sales Prices: Record the acquisition costs and sales prices, deduct any related expenses, and consider depreciation if applicable.

-

Calculate Gains or Losses: Compute the difference between the asset’s sale price and original cost, recording the result as either a gain or a loss.

By following these steps accurately, taxpayers can ensure compliance with IRS requirements and minimize potential errors in their tax filings.

Key Elements of the IRS D1 Sheet

The IRS D1 Sheet includes several critical components that ensure comprehensive reporting of asset transactions. These elements encompass:

- Property Description: A brief yet precise summary of the asset involved.

- Acquisition and Sale Dates: Documenting these dates is crucial for the calculation of capital gains or losses.

- Sales Price: The final selling price of the asset needs to be recorded accurately.

- Cost or Other Basis: Include all acquisition and additional costs to determine the total basis.

- Gain or Loss Calculation: Use the sales price and basis to find the realized gain or loss.

These features collectively offer a structured approach to documenting transaction details, which is critical for accurate tax assessments.

Legal Use and Guidelines of the IRS D1 Sheet

The IRS mandates the use of the D1 Sheet for applicable taxpayers to maintain transparency and accuracy in tax filing. Legal guidelines emphasize the form’s role in discerning accurate capital gains and losses, essential for calculating the correct taxable income. Taxpayers must adhere to IRS guidelines, which specify the formatting and procedural compliance when completing this form. Misrepresentation or errors can lead to penalties or audits, underscoring the importance of detailed attention when filling out the sheet.

Filing Deadlines and Important Dates for the IRS D1 Sheet

The IRS D1 Sheet must be submitted alongside Schedule D and the relevant tax forms, such as Forms 1065, 1065-B, or 8865, according to the standard filing deadline, typically March 15 for partnerships. However, extensions could apply, extending deadlines to September 15 if Form 7004 is filed. Staying aware of these dates is crucial to ensure that filings occur within the required timeframe, avoiding potential penalties for late submissions.

Software Compatibility: Digital vs. Paper Version

The IRS D1 Sheet is compatible with various tax software solutions, such as TurboTax or QuickBooks, allowing for electronic filing and integration with financial records, which can reduce manual entry errors. Both digital and paper versions demand the same level of accuracy, but the digital version provides benefits like easier edits, backups, and error-checking capabilities. Tax software often includes validation checks that can help identify missing information before submission.

Penalties for Non-Compliance with the IRS D1 Sheet

Failing to properly complete and submit the IRS D1 Sheet can result in immediate penalties, such as fines or interests on unpaid taxes due to incorrect loss or gain calculations. Severe non-compliance might also trigger audits or further legal scrutiny. Incorrect filings can compound, influencing financial health by overstating or understating tax liabilities. Therefore, precision and adherence to guidelines are paramount not only to comply with legal standards but also to maintain financial integrity.

These sections provide a comprehensive understanding of the IRS D1 Sheet, highlighting its integral role in accurate tax filings and its implications for various stakeholders. With this guide, users can navigate the preparation and submission of this essential form more effectively.