Definition and Purpose of the 2014 763 Form

The 2014 763 form, officially known as the Virginia Nonresident Income Tax Return, is specifically designed for individuals who derive income from Virginia sources but do not reside in the state. This form allows nonresidents to report their Virginia-sourced income accurately and ensures compliance with state tax regulations. Filing this form is essential for nonresidents as it determines the amount of tax owed to the state based on income earned within Virginia.

The primary purpose of the 2014 763 form is to enable the Virginia Department of Taxation to assess the tax liability of nonresident individuals. This form captures various income types, such as wages, salaries, tips, and business income that nonresidents earn while working or conducting business in Virginia. Additionally, it helps facilitate the calculation of allowable deductions and credits, which can influence the final tax amount owed or refunded.

Steps to Complete the 2014 763 Form

Completing the 2014 763 form involves several important steps to ensure accurate reporting and compliance with Virginia tax laws. Follow these steps closely:

-

Obtain the Form:

- You can download the 2014 763 form directly from the Virginia Department of Taxation website or access it through various tax preparation software platforms.

-

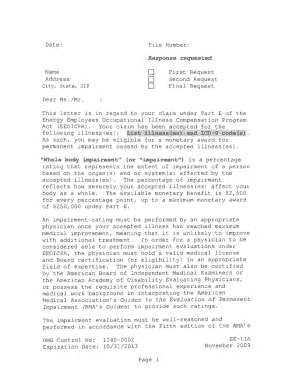

Enter Personal Information:

- Fill in the required personal details, including your name, address, Social Security number, and the tax year.

-

Report Income:

- List all Virginia-sourced income earned during the year. This includes wages, salaries, commissions, and any business-related income.

-

Calculate Adjusted Gross Income (AGI):

- Deduct any eligible adjustments from your total income to determine your AGI. Ensure that you have documentation for each deduction claimed.

-

Claim Deductions and Credits:

- Familiarize yourself with available deductions and credits specific to nonresidents. Common deductions may include certain business expenses and contributions to retirement accounts.

-

Determine Tax Due or Refund:

- Calculate the tax owed by referring to the tax tables provided or applicable tax rates. If you overpaid through withholding or prepayments, you may be eligible for a refund.

-

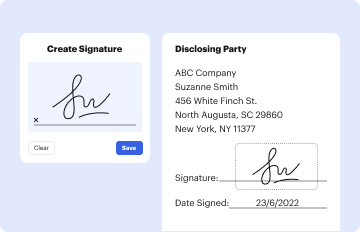

Sign and Date the Form:

- It is crucial to sign and date your return. If you’re filing jointly with a spouse, your spouse must also sign.

-

Submit the Form:

- File your 2014 763 form by the specified deadline, which is typically May 1st of the year following the tax year. You can file by mail, online, or using approved tax software.

Important Terms Related to the 2014 763 Form

Understanding key terms associated with the 2014 763 form is essential for ensuring successful completion and compliance with state tax laws. Here are several important terms to recognize:

- Nonresident: An individual who resides outside Virginia but earns income within the state.

- Virginia-Sourced Income: Any income earned from work performed, businesses operated, or services rendered within Virginia.

- Adjusted Gross Income (AGI): The total income after the subtraction of specific deductions or adjustments as allowed by law.

- Deductions: Specific expenses that can be subtracted from total income to reduce taxable income, such as business expenses or retirement contributions.

- Credits: Amounts subtracted from total tax liability, which may come from various state tax credits available to nonresidents.

Familiarizing yourself with these terms can facilitate the completion of the form and enhance your overall understanding of the filing process.

Legal Use and Compliance of the 2014 763 Form

When filing the 2014 763 form, it’s important to adhere to applicable laws and regulations to ensure compliance. The form is in accordance with the Virginia Income Tax Code and is used to report income accurately while fulfilling tax obligations. Nonresidents who derive income from Virginia sources are legally required to file this form if their earnings exceed the established threshold for the tax year.

To maintain compliance, nonresidents should:

- Keep Accurate Records: Maintain accurate records of all income sources and related deductions to ensure the integrity of the return.

- Understand Filing Requirements: Familiarize yourself with the filing requirements and deadlines to avoid penalties. Noncompliance can result in interest charges and potential legal action.

- Utilize Official Resources: Refer to guidance from the Virginia Department of Taxation for clarification on rules, updates, or changes to tax regulations relating to nonresidents.

- Consult Professionals: Tax laws can be complex, and consulting a tax professional can assist in navigating any nuances specific to your situation.

Legal compliance not only protects against penalties but also contributes to a smoother tax filing experience.

Filing Deadlines and Important Dates for the 2014 763 Form

Meeting filing deadlines is crucial for avoiding penalties and ensuring timely processing of your tax return. For the 2014 763 form, nonresidents should adhere to the following important dates:

- Tax Year End: The tax year for which the 2014 763 form applies is the calendar year ending December 31, 2014.

- Filing Deadline: Nonresidents must file the form by May 1, 2015. Extensions may be available, but it is essential to check the specific requirements for applying for an extension in Virginia.

- Payment Due Date: If you owe any taxes, payment must be made by the filing deadline to avoid interest and penalties.

Timely submission of forms and payments ensures compliance and avoids unnecessary complications.

Examples of Using the 2014 763 Form

Understanding real-world scenarios can enhance comprehension of how the 2014 763 form is utilized. Here are a few examples:

- Scenario One: A Maryland resident who works remotely for a Virginia-based firm earns $60,000. As income is sourced from Virginia, they are required to file the 2014 763 form to report this income and calculate taxes owed.

- Scenario Two: A self-employed consultant based in Washington, D.C., provides services to clients in Virginia, earning $30,000. They will also need to file the 2014 763 form to account for their Virginia-sourced earnings.

- Scenario Three: A nonresident artist holds an exhibition in Virginia, earning $15,000 in commissions from sales. The artist must report this income through the 2014 763 form to satisfy state tax obligations.

These scenarios demonstrate the necessity of filing the form for a range of nonresidents engaging in various income-generating activities within Virginia.