Understanding Form 1099-Q: Key Elements and Usage

Form 1099-Q is a document issued to report distributions from qualified education programs under Sections 529 and 530 of the Internal Revenue Code. Understanding this form is essential for recipients and payers alike, as it provides critical information regarding educational savings accounts and their taxation. This overview covers essential elements related to the form, including its purpose, who typically uses it, and legal considerations surrounding its use.

Purpose of Form 1099-Q

The primary function of Form 1099-Q is to report payments made from qualified tuition programs (QTPs), which include 529 plans and Coverdell Education Savings Accounts (ESAs). It provides taxpayers with important information necessary for accurately reporting educational expenses and ensuring compliance with IRS regulations.

- Tax Reporting: Recipients of distributions must include the amounts reported on this form when filing their tax returns.

- Qualified Expenses: The form details whether the distributions were used for qualified education expenses, which helps avoid taxation on gains when used appropriately.

Who Uses Form 1099-Q?

The recipients of Form 1099-Q typically include individuals who have received funds from a 529 plan or Coverdell ESA. This includes parents, students, and even educational institutions.

- Parents or Guardians: Often the account holders, they will receive Form 1099-Q if the funds are withdrawn for their child's education.

- Students: Students who directly use funds from these accounts for their educational expenses are also recipients.

- Beneficiaries: If distributions are made to a beneficiary, the form is issued to the beneficiary or their account holder.

Essential Elements of Form 1099-Q

Understanding the various elements of Form 1099-Q is crucial for proper completion and compliance. Key components include the following:

- Payer Information: This section identifies the institution administering the qualified education program.

- Recipient Information: Details about the recipient, including name, address, and taxpayer identification number.

- Distribution Amounts: Clearly outlines the total distributions made as well as the part of the distribution that is taxable and nontaxable.

Legal Considerations Surrounding Form 1099-Q

Form 1099-Q is governed by specific legal requirements that ensure proper reporting and compliance with IRS guidelines. Using the form inaccurately may lead to penalties and tax liabilities.

- Tax Compliance: Recipients should ensure they report the amounts accurately to avoid potential audits or penalties from the IRS.

- Changes in Tax Law: Keeping abreast of any changes in tax law regarding educational expenses and qualified programs is essential for proper filing.

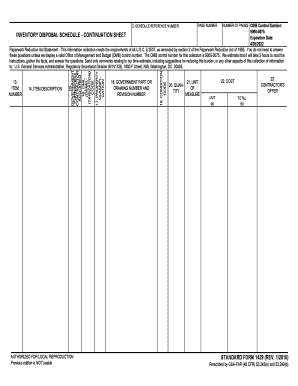

Filing Requirements and Deadlines

Filing Form 1099-Q comes with specific requirements and deadlines, which include:

- Deadline for Issuance: The form must be provided to recipients by January 31 of the year following the distribution.

- IRS Submission: If filing by paper, entries must be submitted to the IRS by the end of February. If filing electronically, the deadline extends to the end of March.

Procedural Steps for Completing Form 1099-Q

Completing Form 1099-Q requires attention to detail to ensure compliance and correct reporting. Follow these steps:

- Gather Payer Information: Collect details for the entity administering the qualified education program.

- Complete Recipient Information: Enter accurate details for both the payer and the recipient.

- Report Distribution Amounts: Clearly distinguish between taxable and nontaxable portions of the distribution.

- Review for Accuracy: Check all entries for accuracy before issuing the form to recipients or filing with the IRS.

IRS Guidelines Regarding Form 1099-Q

The Internal Revenue Service provides specific instructions for educators and taxpayers regarding Form 1099-Q. Key guidelines include:

- Eligibility for Tax-Free Treatment: Educators and recipients must ensure that funds withdrawn qualify as education expenses under IRS rules.

- Maintaining Records: Recipients should retain a copy of Form 1099-Q for their records in case of any future inquiries or audits from the IRS.

Consequences of Non-Compliance with Form 1099-Q

Failing to comply with the reporting requirements of Form 1099-Q can lead to significant consequences, including:

- Penalties: Both the payer and recipient may face financial penalties if the form is not properly filed or completed.

- Tax Liabilities: Improper reporting may result in unexpected tax liabilities, as the IRS may tax amounts deemed unqualified.

Conclusion

Form 1099-Q plays a vital role in reporting educational disbursements, particularly from 529 plans and Coverdell ESAs. Understanding its components, usage, and associated compliance requirements is essential to ensure a seamless tax reporting experience for recipients and payers alike. Proper management of this form not only facilitates transparency but also supports adherence to tax regulations.