Overview of the 2014 Colorado Form 105

The 2014 Colorado Form 105, also known as the Colorado Fiduciary Income Tax Return, is used by estates and trusts to report income, deductions, and credits associated with their tax obligations in the state. This form is essential for fiduciaries who wish to comply with Colorado tax laws and fulfill their responsibilities in reporting taxable income. Commonly filed by executors, administrators, and trustees, Form 105 ensures that the entity's income is properly assessed and taxed according to state regulations.

Steps to Complete the 2014 Colorado Form 105

To effectively complete the 2014 Colorado Form 105, follow these detailed steps:

-

Gather Required Information:

- Collect documentation regarding all income received by the trust or estate, including dividends, interest, and rental income.

- Gather details about any deductions that can be claimed, such as administrative expenses and distributions to beneficiaries.

-

Obtain the Form:

- Download the 2014 Colorado Form 105 from the Colorado Department of Revenue's website or access it through approved tax software.

-

Fill Out the Form:

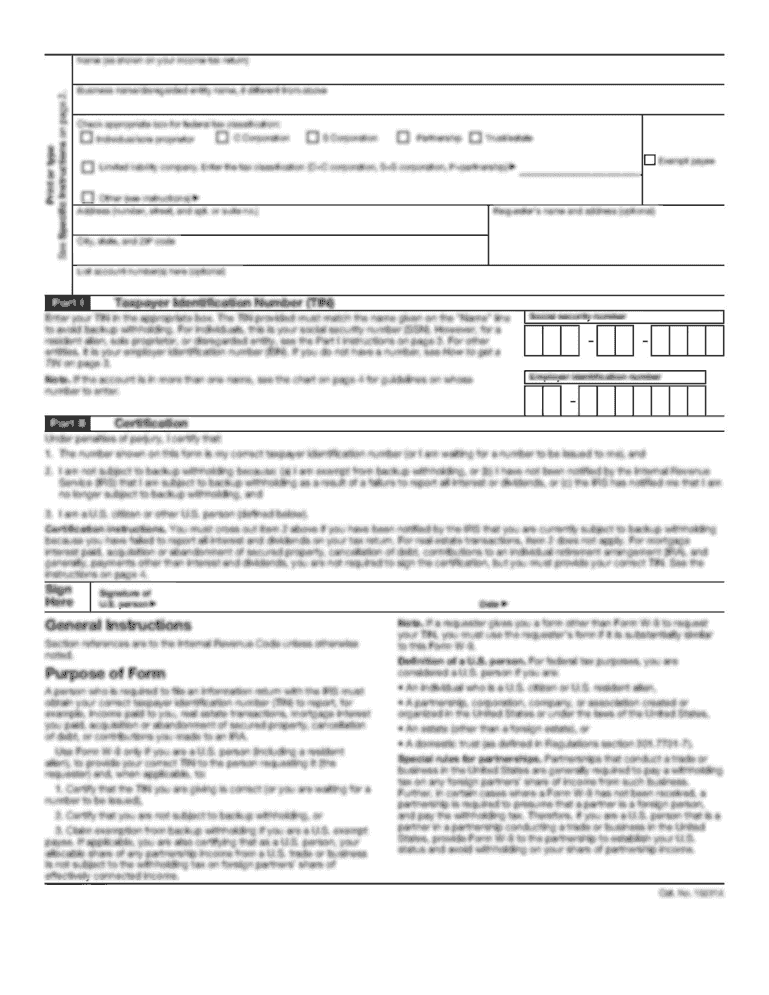

- Begin by entering basic information about the estate or trust, including the name, address, and federal identification number.

- Report total income, making sure to accurately add all sources of revenue.

- Deduct allowable expenses and take note of the specific credits available for fiduciaries.

-

Review and Sign:

- After completing the form, review it carefully for accuracy. Any errors may lead to delays or penalties.

- The fiduciary, or an authorized person, must sign the form to validate it.

-

File the Form:

- Submit the completed Form 105 electronically through the state’s e-filing system for quicker processing, or mail it to the designated address provided on the form.

By thoroughly gathering information and following the required steps, fiduciaries can ensure that they properly report the income of the estate or trust, thus fulfilling their tax obligations efficiently.

Important Terms Related to the 2014 Colorado Form 105

Understanding the terminology associated with the 2014 Colorado Form 105 is crucial for fiduciaries. Below are key terms related to this specific tax form:

- Fiduciary: An individual or organization that manages assets on behalf of another party. In the context of Form 105, this refers to executors or trustees.

- Tax Liability: The amount of tax owed to the state based on the income reported on the form.

- Deductions: Expenses that can be subtracted from total income to reduce taxable income, such as administrative costs.

- Beneficiary: A person or entity entitled to receive distributions from the estate or trust.

Familiarizing oneself with these terms can facilitate a smoother filing process and help fiduciaries effectively manage tax responsibilities.

Filing Deadlines for the 2014 Colorado Form 105

Timely filing of the 2014 Colorado Form 105 is critical for compliance with state tax laws. The following important dates and deadlines should be noted:

- Filing Deadline: The standard deadline for filing Form 105 is the fifteenth day of the fourth month following the end of the tax year. For entities with a fiscal year ending December 31, the deadline would be April 15.

- Extensions: Fiduciaries can file for an extension to submit their Form 105, which may offer an additional six months. However, it’s important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Adhering to these deadlines ensures that fiduciaries remain compliant while adequately preparing for their estate or trust tax obligations.

Legal Use of the 2014 Colorado Form 105

The legal use of the 2014 Colorado Form 105 involves compliance with state tax laws that govern fiduciary responsibilities. Here are some key points to note:

- Legally Required: The completion and submission of Form 105 is mandatory for all estates and trusts earning income during the tax year.

- Audits and Reviews: When properly completed, the form serves as a legitimate document that tax authorities can review during audits, ensuring all income and deductions are reported accurately.

- Fiduciary Duties: By utilizing Form 105, fiduciaries fulfill their legal obligations to report income honestly, safeguarding the beneficiaries' interests and ensuring that all tax liabilities are met.

Proper understanding and usage of Form 105 can prevent legal complications and maintain the integrity of fiduciary management.

Digital vs. Paper Version of the 2014 Colorado Form 105

The 2014 Colorado Form 105 is available in both digital and paper formats. Each version has distinct advantages and considerations:

-

Digital Version:

- Allows for electronic filing, which is typically faster and reduces the likelihood of errors during submission.

- Provides instant acknowledgment of receipt from tax authorities, streamlining the filing process.

- Many modern tax software options feature integrated tools for accurately completing the form.

-

Paper Version:

- Applicable for those who prefer traditional methods or do not have online access.

- Requires physical mailing, which could potentially result in longer processing times due to postal delays.

- Still widely accepted but may not provide the conveniences of immediate confirmation.

Choosing between the digital and paper versions depends on personal preferences and available resources; however, utilizing digital filing is generally recommended for efficiency.