Definition & Meaning

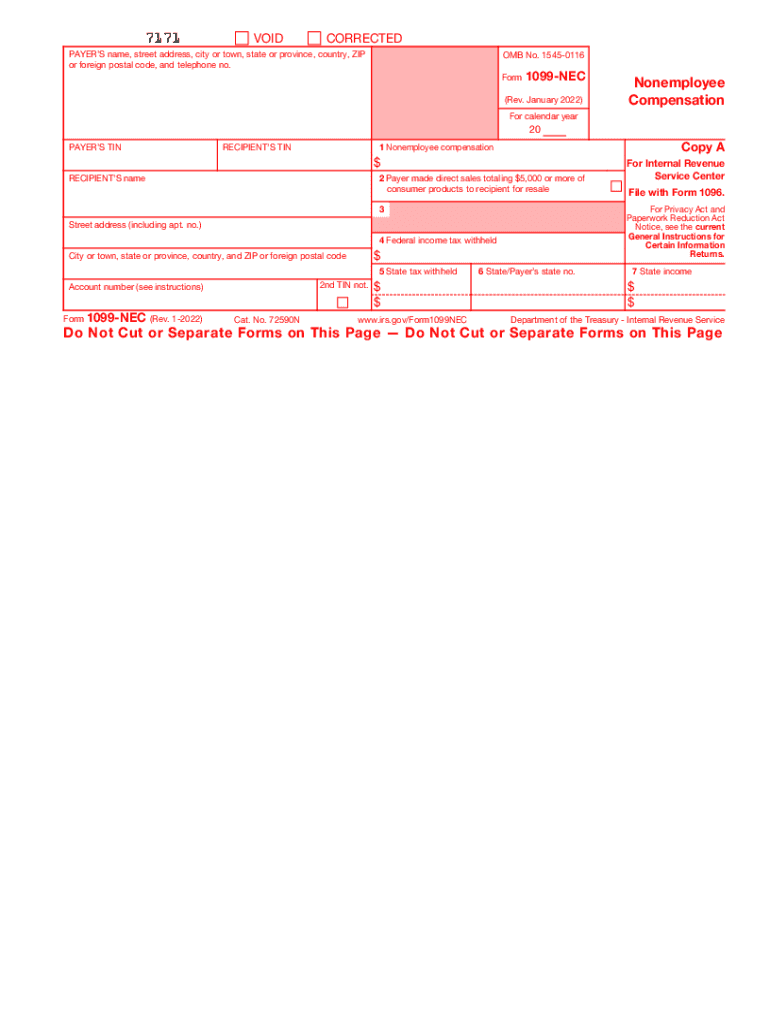

The IRS 1099-NEC, revised in January 2022, is a tax form used in the U.S. to report nonemployee compensation. Payments made to individuals who are not your employees, such as independent contractors, are documented using this form to ensure accurate reporting for federal tax purposes. This revision standardizes reporting practices and aligns with changes in tax codes, making it crucial for businesses that enlist freelance or contract work to stay compliant with IRS regulations.

Key Elements of the IRS 1099-NEC rev. January 2022

The form includes sections dedicated to reporting specific information about both the payer and the recipient. Key elements include:

- Payer’s Details: The name, address, and tax identification number (TIN) of the individual or entity issuing the payment.

- Recipient’s Information: The recipient’s name, address, and TIN to ensure that the income is correctly attributed.

- Compensation Amount: The total amount paid to the non-employee throughout the year, which is disclosed in Box 1.

- Federal and State Withholding: If applicable, information on any federal or state tax withheld is included.

Steps to Complete the IRS 1099-NEC rev. January 2022

Completing the 1099-NEC involves several steps:

- Gather Information: Collect accurate data on both the payee and payer, including names, addresses, and TINs.

- Calculate Payments: Record the total nonemployee compensation paid during the tax year.

- Complete the Form: Fill in each section meticulously, ensuring that figures and details are precise.

- IRS Filing: Ensure that the completed form is filed with the IRS by the deadline.

- Provide Copies: Send copies to both the payee and the IRS, adhering to the given instructions.

Filing Deadlines / Important Dates

The filing deadline for the 1099-NEC is January 31. Missing this deadline could result in penalties. This date applies to both filing with the IRS and furnishing the forms to recipients. Timeliness is critical to avoid complications, such as penalties or erroneous tax filings.

Penalties for Non-Compliance

Penalties occur if the form is filed late, incomplete, or with incorrect information. The penalty amount increases based on how tardily the form is filed. Deliberate neglect incurs a higher penalty, emphasizing the importance of diligence in completing and submitting the form accurately and on time. Ensuring all fields are filled correctly mitigates liability risks and penalties.

Form Submission Methods (Online / Mail / In-Person)

The IRS allows the form to be submitted electronically or via mail:

- Electronic Filing: Often the preferred method due to processing speed and convenience. Tools like DocHub can streamline this process by ensuring the form is completed accurately and securely.

- Mail Filing: If you choose to mail the form, ensure it's sent to the correct IRS address for your location. It is essential to account for mail delivery times to meet the deadline.

- In-Person: While less common, submission at an IRS office is an option, though it is typically reserved for specific circumstances.

Examples of Using the IRS 1099-NEC rev. January 2022

For a clearer understanding, consider the following scenarios:

- Freelance Graphic Designer: A business hires a freelancer to design marketing materials. At year-end, they issue a 1099-NEC for the total amount paid over the year.

- Consultant Services: A consultant provides advice to various companies. Each company issues a 1099-NEC for payments exceeding $600 within the year.

- Independent Contractors in Construction: Payments to a construction worker who is not on payroll are reported using this form.

Business Entity Types (LLC, Corp, Partnership)

Different business structures engaging non-employee workers will use the 1099-NEC:

- LLCs: Must issue the 1099-NEC for contractors paid more than $600.

- Partnerships: Required to report any non-employee compensation which simplifies tax obligation transparency.

- Corporations: Although generally exempt from receiving a 1099-NEC, entities like attorney services or those receiving medical payments are reported.

Digital vs. Paper Version

Both versions are available, but electronic filing is increasingly favored due to:

- Efficiency: Automated error-checking and faster processing times.

- Security: Electronic filings are securely encrypted, reducing data breach risks.

- Convenience: Digital versions allow seamless integration with existing accounting software, easing the processing burden.

Understanding these elements and the full scope of the IRS 1099-NEC, as revised in January 2022, ensures accurate reporting and compliance with IRS regulations. This form is indispensable for many U.S.-based businesses interacting with non-employee service providers, providing a standardized method for reporting income.