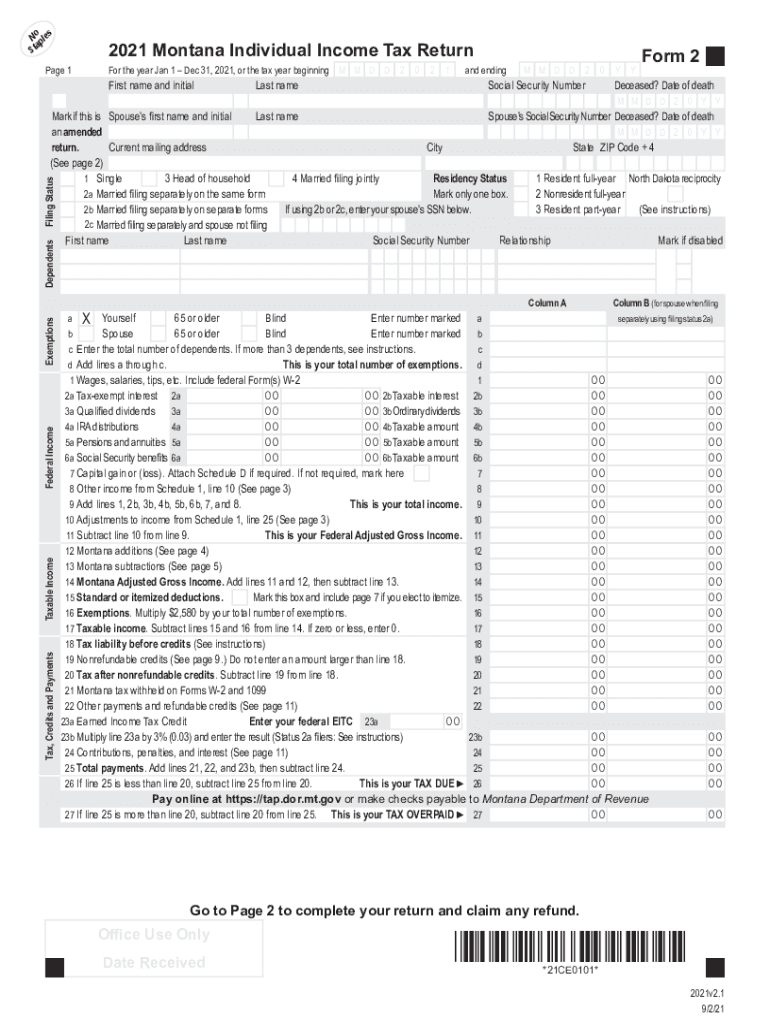

Definition and Purpose of MT Form 2

MT Form 2 is the designated form for the Montana Individual Income Tax Return for residents of Montana. This form is used by individuals to report their annual income, calculate their state tax obligations, and claim any applicable credits or deductions. The form includes sections for personal details, sources of income, allowable deductions, tax credits, and payment calculations. Understanding the purpose of this form is essential for Montana residents to ensure compliance with state tax laws.

Key Sections of the MT Form 2

- Personal Information: Captures taxpayer’s name, address, and social security number.

- Income Sources: Details various types of income, including wages, dividends, and other earnings.

- Deductions and Credits: Lists available deductions and credits to reduce taxable income.

- Tax Calculations: Calculates total tax due or refunds based on provided information.

Steps to Complete the MT Form 2

Completing the MT Form 2 requires accuracy and attention to detail. Below is a step-by-step guide:

-

Prepare Personal Information: Enter your full name, current address, and social security number at the top of the form. Ensure this information matches your IRS records.

-

Report Income: Fill out all sources of taxable income. This includes wages, rental income, and other earnings. Be thorough to avoid discrepancies later.

-

Deductions and Credits: Identify applicable deductions and credits. Common examples include education credits and health insurance deductions.

-

Calculate Tax Liabilities: Use the instructions provided with the form to calculate your tax liability or refund. Double-check calculations for accuracy.

Examples of Information Required

- W-2 Forms: Represents wages earned from employers.

- 1099 Forms: Report various types of income such as freelance or contract work.

Eligibility Criteria for Using MT Form 2

Montana residents required to file a state income tax return must use MT Form 2 if they:

- Earn above a certain threshold of income, as specified by Montana’s tax rules.

- Receive income from multiple sources, including employment, self-employment, or investments.

- Are claiming deductions and tax credits to reduce their taxable income.

Who Should File

- Residents: Individuals residing in Montana for the entire tax year.

- Part-Year Residents: Those who lived in Montana for part of the year and have income from Montana sources.

Important Dates for Filing MT Form 2

Understanding the timeline for filing is crucial for avoiding penalties:

- Tax Filing Deadline: Typically April 15th, aligning with the federal tax deadline unless it falls on a weekend or holiday.

- Extension Requests: Taxpayers can request an extension, which usually grants an additional six months to file.

Filing Extensions

- Must be filed before the original deadline.

- Still, require payment of any expected tax owed by the original deadline to avoid penalties.

Obtaining the MT Form 2

MT Form 2 can be accessed in several ways:

- Online: Available for download from the Montana Department of Revenue’s website. Ensure you download the correct year’s form.

- Mail: Request a paper copy by contacting the state Department of Revenue.

- Tax Software: Platforms such as TurboTax or QuickBooks often include MT Form 2 as part of their state tax filing service.

Where to Find

- Libraries and Post Offices: Some locations may carry printed forms during tax season.

- Accountants: Professional tax preparers can also provide the necessary forms.

Submission Methods for MT Form 2

Taxpayers have various options for submitting their completed MT Form 2:

- Online Filing: Fast and efficient, usually through tax software that interfaces with Montana’s online tax system.

- Mail: Paper forms can be mailed to the address specified on the instructions.

- In-Person: Service centers may accept forms directly, which can be beneficial if clarification is needed.

Online vs. Paper Filing

- Advantages of Online Filing: Quicker processing and receipt confirmation.

- Paper Filing: Preferable for those without reliable internet access.

Penalties for Non-Compliance with MT Form 2

Failing to file or pay taxes on time can result in significant penalties:

- Late Filing Penalty: Imposed if the form is not filed by the deadline, unless an extension has been granted.

- Late Payment Penalty: Applied to taxes not paid by the due date; interest may also accrue.

Avoiding Penalties

- File early and ensure all information is correct.

- Consider using certified mail if filing a paper form to confirm receipt.

Legal Use of MT Form 2

MT Form 2 not only fulfills a legal obligation but also protects taxpayers from future audits:

- Audit Defense: Properly completed forms can serve as a defense in case of an audit.

- Record Keeping: Maintaining an accurate copy helps in future financial planning and in case of discrepancies with the IRS or state authorities.

Legal Considerations

- Accuracy: It's vital to double-check all entered data and calculations.

- Consultation: Seek professional tax assistance if complexities arise in income or deductions.