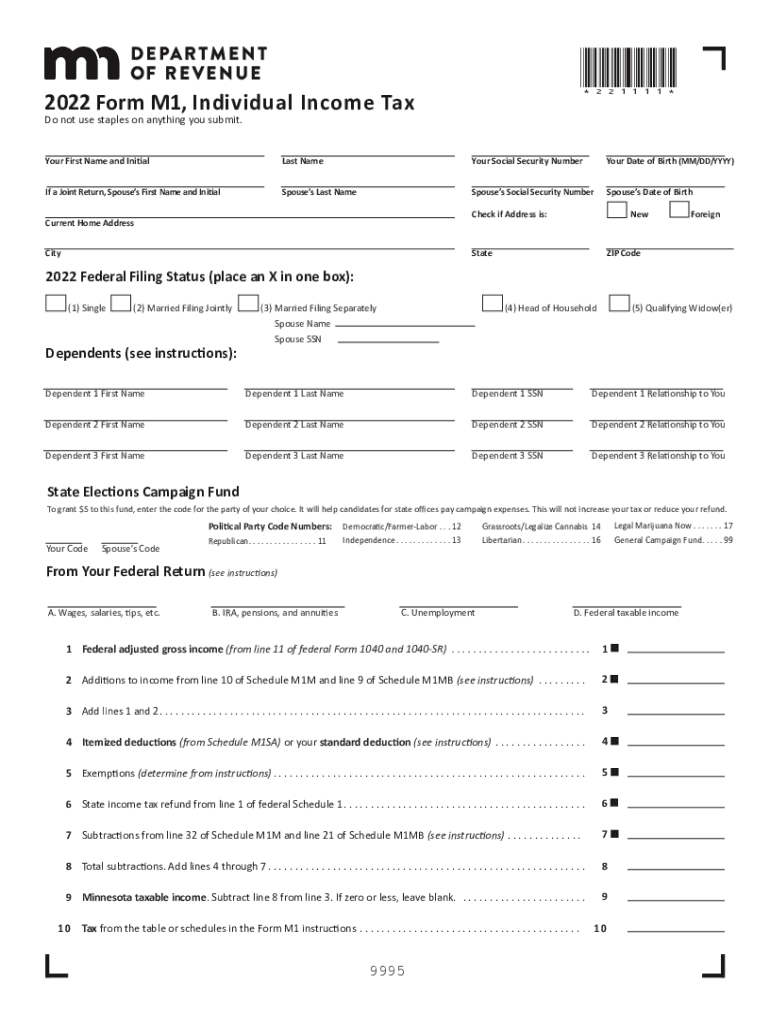

Definition and Meaning of Tax MN

"Tax MN" refers to the tax regulations and forms specific to the state of Minnesota, particularly the Minnesota Individual Income Tax. These tax requirements are pertinent for residents and those who earn income within the state. Minnesota taxation laws are detailed in the Form M1, designed to assist taxpayers in determining their state income tax obligations. This form includes important sections such as personal information, income details, deductions, credits, and filing status. Understanding the definition and scope of Tax MN is essential for complying with Minnesota's taxation policies and ensuring accurate filing.

How to Use the Tax MN Form

To effectively utilize the Minnesota Individual Income Tax, or Form M1, start by gathering all relevant personal and income information for the tax year. This includes wage statements, investment records, and information on dependents if applicable. Once you have this data, follow these steps:

- Fill out your personal information, including name, address, and Social Security number.

- Determine your filing status, which can be single, married filing jointly, or head of household, among others.

- Enter your income details, encompassing wages, salaries, tips, and other forms of income such as dividends or pensions.

- Claim any deductions or credits you are eligible for to reduce your taxable income.

- Calculate the tax due or any refund you might receive based on the computed taxable income.

- Ensure all sections are complete and any required signatures are provided.

The Tax MN form provides a structured guide for accurately reporting income and claiming deductions, which is crucial for complying with Minnesota tax laws.

How to Obtain the Tax MN Form

To acquire the Minnesota Individual Income Tax form, several options are available:

- Online Resources: Visit the official Minnesota Department of Revenue website to download the latest version of Form M1 and its corresponding instructions.

- Tax Software: Use tax preparation software such as TurboTax or QuickBooks, which typically include state-specific tax forms like Form M1.

- Local Libraries and Tax Centers: Many libraries and community centers in Minnesota may provide physical copies during tax season.

Obtaining the form is the first step in preparing your Minnesota state tax return, ensuring you have the official documents required for proper filing.

Steps to Complete the Tax MN Form

Completing the Tax MN form requires attention to detail and accuracy. Follow these step-by-step instructions:

- Start with Personal Information: Enter your name, address, and Social Security number clearly.

- Filing Status Selection: Choose the appropriate filing status, affecting the tax rates and deductions applicable to you.

- Income Reporting: Accurately report all income sources, including W-2 wages, interest from bank accounts, and any side business earnings.

- Deductions and Credits: Review available deductions and credits in the form instructions to optimize your tax liability.

- Taxes Paid: Document any taxes already paid throughout the year to reconcile against your calculated state tax.

- Verification: Double-check all entries for errors and omissions, ensuring totals align with your supporting documents.

- Signatures: Add your signature to validate the provided information.

Completing these steps diligently helps in submitting an accurate tax return, minimizing errors that could otherwise lead to audits or penalties.

Why File the Minnesota Individual Income Tax

Filing the Minnesota Individual Income Tax is crucial for several reasons:

- Legal Requirement: As a Minnesota resident or income earner, state law mandates accurate income reporting and tax payment.

- State Services Funding: Your tax contributions support public services, infrastructure, and educational initiatives within Minnesota.

- Avoid Penalties: Filing on time prevents late fees and interest charges, aligning with state compliance standards.

- Potential Refunds: Opportunities exist to receive a refund for overpaid taxes earlier in the tax year.

Fulfilling these obligations ensures that you adhere to state laws and contribute to the well-being of the Minnesota community.

Who Typically Uses the Tax MN Form

The Tax MN form is primarily utilized by:

- Minnesota Residents: Individuals living within the state for the entire tax year.

- Non-Residents with Minnesota Income: Those earning income in Minnesota but residing elsewhere.

- Military Personnel: Members stationed in different locations but legally domiciled in Minnesota.

- Dual Tax Filers: Individuals required to file both federal and Minnesota state taxes due to income thresholds.

Knowing the user category helps streamline the process, ensuring accurate compliance with state tax regulations.

Important Terms Related to Tax MN

Understanding key terminology associated with Tax MN enhances comprehension and accuracy:

- Filing Status: Reflects family situation (single, joint), influencing tax rates.

- Tax Credits: Reductions to the tax amount based on eligibility.

- Deductions: Specific allowances subtracted from gross income.

- Withholding: Taxes deducted directly from the paycheck.

Familiarity with these terms aids in precise completion of Form M1, affecting the overall tax outcome.

State-Specific Rules for Tax MN

Minnesota state has unique rules impacting how taxes are calculated and filed:

- State Tax Rates: Minnesota uses a progressive tax system, with rates escalating based on income levels.

- Subtractions: Specific subtractions apply before calculating Minnesota taxable income, differing from federal provisions.

- Credits: Offers refundable and nonrefundable credits unique to Minnesota taxpayers.

- Residency Determinants: Defines resident status that affects filing requirements.

Knowing these state-specific guidelines helps align your filings with Minnesota tax regulations and reduces potential tax liabilities.