Definition and Purpose of the 2210-K Form

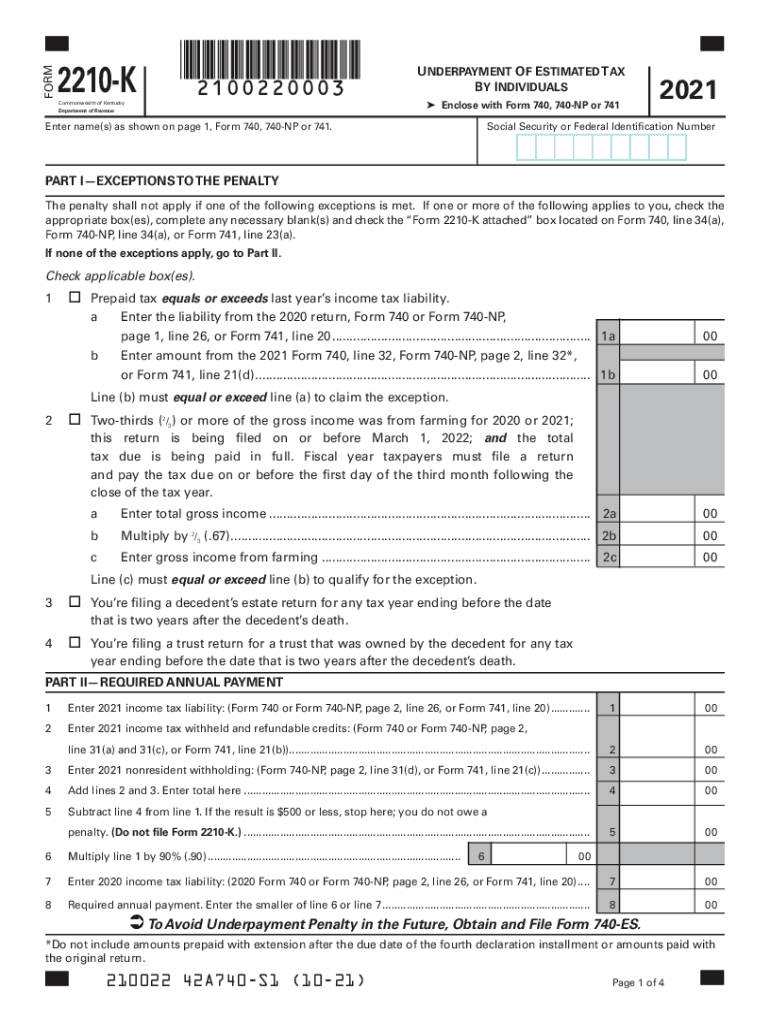

Form 2210-K is a tax document specifically used by individuals in Kentucky. Its primary purpose is to determine whether taxpayers owe a penalty for underpayment of estimated tax. This form provides essential guidance on various exceptions to the penalty and helps taxpayers calculate the required annual payment. Understanding the form's purpose can aid individuals in complying with Kentucky's tax regulations and avoiding penalties.

How to Use the 2210-K Form

To utilize the 2210-K Form effectively, individuals must follow several key steps. Firstly, gather all relevant financial data, including income and payments made during the tax year. Next, enter personal details and calculate tax liabilities using the form's guidelines. Finally, review the requirements for any applicable exemptions or adjustments before submitting the form. Following these steps ensures accurate completion and compliance with state tax laws.

Steps to Complete the 2210-K Form

- Gather Information: Start by collecting all necessary tax documents, including W-2s, 1099s, and records of estimated tax payments.

- Calculate Tax Liability: Use current tax rates to calculate total tax liability. Include deductions and credits as applicable.

- Complete Personal Information: Fill in personal details such as name, address, and Social Security number.

- Determine Penalties: Follow the form's instructions to determine any penalties for underpayment or exemptions that might apply.

- Review: Carefully review all entries to ensure accuracy.

- Submit: Submit the completed form to the Kentucky Department of Revenue by the stipulated deadline.

Important Terms Related to the 2210-K Form

- Estimated Tax Payments: Periodic payments made during the tax year to cover income tax liability.

- Underpayment Penalty: A financial charge assessed when estimated tax payments are less than required.

- Exemptions: Specific conditions under which penalties can be waived, often involving error corrections or changes in income.

Key Elements of the 2210-K Form

The 2210-K Form includes several critical parts:

- Personal Information Section: Details personal data like the taxpayer's name and Social Security number.

- Liability Calculation: Computes total tax liability for the year.

- Penalty Analysis: Identifies whether any penalties apply and calculates their amounts.

- Exemptions and Adjustments: Sections dedicated to assessing eligibility for penalty exemptions and required adjustments.

Filing Deadlines and Important Dates

The 2210-K Form must be filed according to Kentucky's tax calendar. The general deadline for submission aligns with the state's income tax filing deadline, typically on or around April 15. If seeking an extension, ensure that all estimated taxes are paid by this date to avoid penalties.

Required Documents for the 2210-K Form

- Income Statements: W-2, 1099, and other income reports.

- Payment Records: Documentation of estimated tax payments made throughout the tax year.

- Previous Year’s Tax Return: For reference and to verify income history and deductions.

Penalties for Non-Compliance

Failure to file the 2210-K Form or pay the required estimated taxes can result in significant penalties. The penalty amount depends on the extent of the underpayment and the duration before payment is received. It's essential to understand these potential penalties to mitigate financial liabilities effectively.

Taxpayer Scenarios

Various taxpayer scenarios require the use of the 2210-K Form:

- Self-Employed Individuals: Often need to pay estimated taxes quarterly, necessitating this form for compliance.

- Retirees: May require form assistance if their income sources change, impacting tax liabilities.

- Students: Often overlooked, students with side earnings or scholarships may need this form to address unexpected tax charges effectively.

By understanding these topics and effectively applying the 2210-K Form, Kentucky residents can ensure compliance with tax laws and minimize financial penalties.