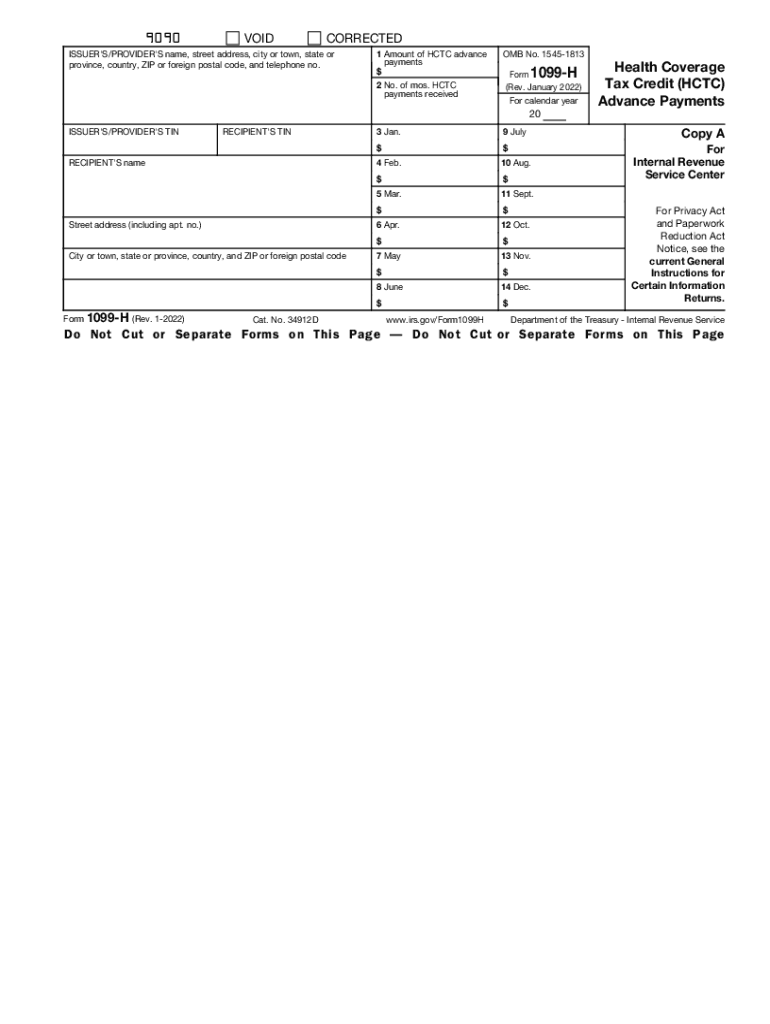

Definition and Meaning of Form 1099-H

Form 1099-H, Health Coverage Tax Credit (HCTC) Advance Payments, is a tax document used to report payments made towards health insurance premiums for eligible recipients. These payments are made under the Health Coverage Tax Credit program and aim to assist individuals with their health insurance costs by covering a portion of their premiums. The form details the total amount of HCTC payments made on behalf of the recipient during the tax year and the number of months these payments were received.

How to Use Form 1099-H

Form 1099-H is utilized by taxpayers to report health coverage tax credits on their tax returns. Recipients use the form to verify the amount of the HCTC advance payments they received and to reconcile these payments with their allowable credit on their tax return. It's crucial for taxpayers to compare the amount shown on Form 1099-H with the amount they've claimed on their taxes to ensure accuracy and avoid discrepancies.

How to Obtain Form 1099-H

Eligible taxpayers typically receive Form 1099-H automatically if advance payments have been made on their behalf during the tax year. The issuer, usually a federal agency, is responsible for sending out these forms to the eligible participants. Should a taxpayer not receive the form by early February, they are advised to contact the issuing agency to request a copy.

Steps for Contacting the Issuer

- Gather any relevant information, such as identification numbers and prior correspondence.

- Contact the agency directly and provide the required information.

- Request a reissued form and confirm the delivery address.

Steps to Complete Form 1099-H

Completing Form 1099-H requires attention to specific fields that detail HCTC payments. Here's an outline of the important steps:

- Review Recipient Information: Ensure that the name and taxpayer identification number (TIN) on the form match personal records.

- Verify Payment Amounts: Cross-check the total payments received across the listed months.

- Reconcile on Tax Return: Enter the specified amounts from Form 1099-H on the appropriate section of the tax return to properly reconcile.

Who Typically Uses Form 1099-H

Form 1099-H is generally used by individuals who receive HCTC advance payments. Common users include:

- Trade Adjustment Assistance (TAA) recipients

- Pension Benefit Guaranty Corporation (PBGC) payees

- Reemployment Trade Adjustment Assistance (RTAA) participants

These groups qualify for the benefit through predefined eligibility criteria established by federal guidelines.

Key Elements of Form 1099-H

The form includes several critical elements:

- Total Payment Amounts: Summation of all HCTC payments within the year.

- Months Covered: Specific months during which payments were made.

- Issuer Information: Contact details of the agency issuing the form.

- Recipient Details: Personal information including the name and TIN of the recipient.

These elements are essential for ensuring the form's accuracy and proper filing.

IRS Guidelines for Form 1099-H

The IRS provides detailed instructions on how to handle Form 1099-H. Key guidelines include:

- Storage and Record-Keeping: Maintain Form 1099-H for at least three years.

- Filing Requirements: Ensure the amounts match what's reported on your tax return.

- Discrepancy Handling: Contact the issuer for any inconsistencies before filing taxes.

Filing Deadlines and Important Dates

Form 1099-H should be received by recipients by January 31 of each year, aligning with the IRS's reporting calendar. Taxpayers should ensure that they reconcile their forms and file their taxes by April 15, the typical deadline for tax returns, unless an extension has been granted.

Form Submission Methods

The 1099-H form itself does not require submission when filing a tax return; it's primarily for reconciliation purposes. However, taxpayers must accurately incorporate the information into their returns, which can be filed:

- Online: Using the IRS's e-file system or tax software.

- By Mail: Sending paper tax returns to the appropriate IRS office.

- In-Person: Visiting an IRS office for direct submission.

Eligibility Criteria

Qualifying for receiving Form 1099-H is contingent on eligibility for HCTC payments, which typically includes:

- Those affected by international trade reforms.

- Retirees receiving PBGC payments.

- Individuals enrolled in certain state-qualified health plans.

Checking eligibility against current HCTC guidelines is imperative for prospective recipients.