Definition and Meaning of the Missouri Shared Care Credit

The Missouri Shared Care Credit is a specific tax credit available in the state of Missouri, designed to support caregivers who look after elderly individuals aged 60 and above who cannot live independently. This credit provides financial relief by offsetting part of the caregiver’s tax liability, reducing the financial burden associated with caregiving responsibilities. It is a nonrefundable tax credit, which means that while it can decrease the amount owed in taxes, it does not result in a refund beyond the tax obligation.

Essential Details

- Eligibility: Available to caregivers registered in Missouri.

- Credit Limit: Up to $500 per tax year.

- Purpose: To alleviate financial burdens on caregivers.

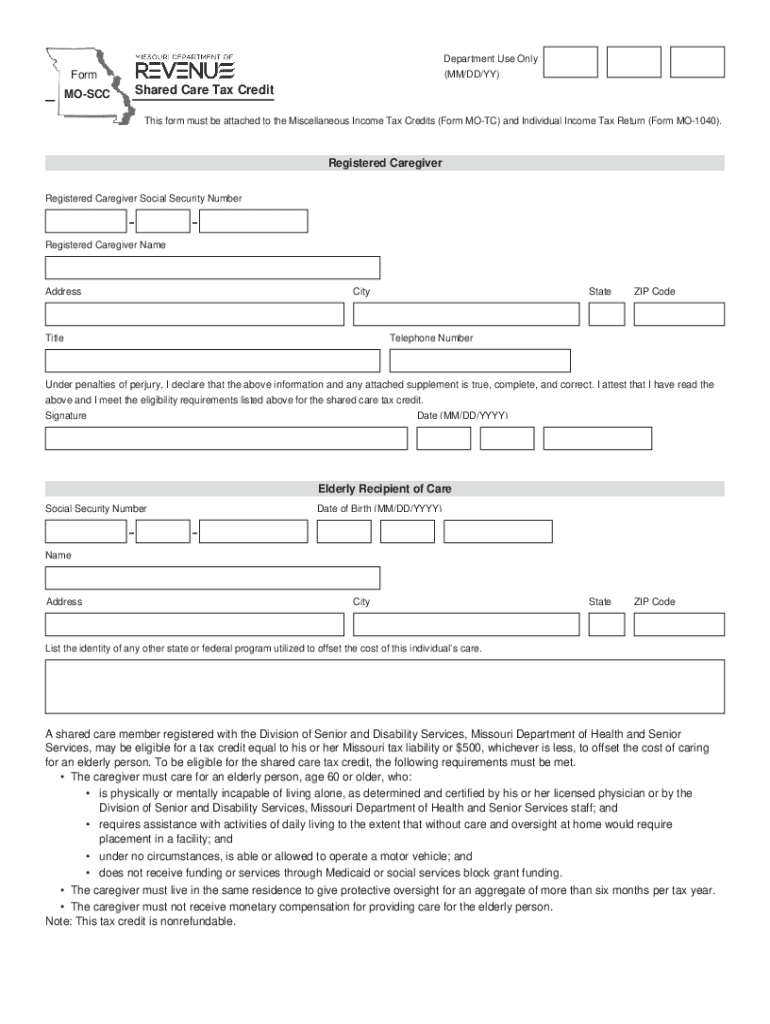

Steps to Complete the MO SCC

Filling out the Missouri Shared Care Credit form requires careful attention to detail to ensure accurate submission. The following is a structured guideline to assist you through the process.

- Gather Necessary Documents: Include identification, proof of residence, and any relevant caregiving agreements.

- Verify Eligibility: Confirm that the person cared for is aged 60 or older and unable to live alone.

- Download the Form: Obtain the latest version of the MO SCC form from the Missouri Department of Revenue website.

- Fill Out Personal Information: Enter your full name, address, and Social Security number.

- Care Recipient Details: Provide information about the cared-for individual, including their age and living situation.

- Attach Required Certifications: Such as a physician’s statement or a statement from a state social services worker.

- Review and Submit: Double-check all entries for accuracy before submission by mail or electronically.

Possible Errors

- Missing information, incorrect Social Security numbers, or omitted signatures can delay processing.

How to Obtain the MO SCC

Online and Physical Copies

- Online Access: Downloadable from the Missouri Department of Revenue’s official website.

- In-Person Pick-Up: Available at local tax offices or by requesting a mailed copy.

Important Terms Related to the MO SCC

Understanding certain terms related to the Missouri Shared Care Credit can ensure a smoother application process and aid in leveraging its benefits effectively.

- Caregiving Agreement: A documented agreement outlining the caregiving duties and responsibilities.

- Nonrefundable Credit: Reduces tax liability but does not offer a refund beyond tax obligations.

- Certification: Documented proof from qualified professionals validating the eligibility for the credit.

Legal Use of the MO SCC

The MO SCC must be used in compliance with Missouri state laws to ensure validity and protection against legal repercussions.

Compliance Requirements

- Accurate Information: Must accurately represent the caregiving situation and financial details.

- Legitimate Claims: Claims should only be made for eligible individuals and situations as outlined by Missouri law.

Key Elements of the MO SCC

The Missouri Shared Care Credit form includes several critical components to be aware of for a successful application.

Principal Components

- Eligibility Section: Determines whether the caregiver and recipient qualify for the credit.

- Financial Impact: Details the maximum deduction available and how it applies to state tax obligations.

- Certification Requirements: Documentation proving the need for care.

State-Specific Rules for the MO SCC

Missouri has its own set of rules and guidelines governing the MO SCC, making it crucial for applicants to familiarize themselves with state-specific requirements.

Requirements

- Residency: Applicants must be Missouri residents.

- Care Recipient Criteria: The person receiving care must meet specific age and dependency criteria.

Examples of Using the MO SCC

To grasp the practical applicability of the MO SCC, understanding real-life examples can be beneficial.

Scenario Examples

- Family Members: A daughter caring for her elderly mother, meeting the necessary age and dependency criteria, applies for the credit to reduce her state tax burden.

- Professional Caregivers: A registered nurse providing home care as part of a private agreement may also qualify if all conditions are met.

Understanding these scenarios underscores the utility of the MO SCC in alleviating some of the financial challenges associated with caregiving.