Definition and Purpose of the IT-214 Form 2021

The IT-214 form is a specific document utilized by taxpayers in New York State to claim a real property tax credit. This form is primarily designed for both homeowners and renters, enabling them to request a credit based on the property taxes they have paid or the rent they have expended. By submitting this form, eligible individuals can receive financial relief, helping to alleviate some of the costs associated with property ownership or rental expenses.

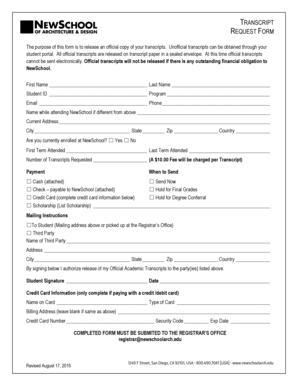

The form asks for essential personal information, such as the taxpayer's name, address, and Social Security number. It further requires details that verify residency, income levels, and property ownership status. These data points are crucial to determine eligibility and calculate the actual credit amount that may be claimed. Understanding the purpose of the IT-214 form also involves recognizing its significance in promoting financial equity among residents in New York State.

Steps to Complete the IT-214 Form 2021

Completing the IT-214 form accurately is essential to ensure successful submission and potential credit. Follow these steps to avoid mistakes:

-

Gather Necessary Information

- Personal details: Full name, address, and Social Security number.

- Income details for the tax year: You will need to document your total income to demonstrate eligibility.

-

Verify Eligibility

- Review the criteria specified in the form instructions. Confirm that you meet the residency and income requirements for claimants.

-

Fill Out the Form

- Start the IT-214 form by entering your personal details at the top.

- Proceed through the sections, inputting relevant information regarding property taxes or rental expenses.

-

Calculate the Credit Amount

- Use the provided calculation sections to determine the amount of credit for which you are eligible based on the inputs regarding taxes paid or rent.

-

Review and Sign

- Before submission, review all information for accuracy. Ensure that your signature and date are included if required.

-

Submit the Form

- Follow the submission methods outlined to send the form, whether electronically or via traditional mail.

Failure to adequately complete any section of the form may result in delays or denial of the claim, so attention to detail is crucial.

Key Elements of the IT-214 Form 2021

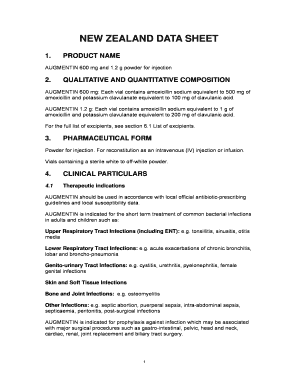

The IT-214 form comprises several key sections that guide taxpayers in providing necessary information for claiming a tax credit. Understanding these elements will contribute to simpler completion and more accurate submissions:

-

Personal Information Section

- This includes fields for entering your name, address, and Social Security number, critical for identity verification.

-

Residency Criteria

- Information confirming your residency status, such as duration of residence, is essential for determining eligibility.

-

Income Information

- This section details the necessary income disclosures that influence credit eligibility. The form often requires your total household income for accuracy.

-

Calculation of Credit

- Taxpayers must understand how to compute the credit amount correctly. This section typically provides guidance on how to determine the value based on the amount paid in property taxes or rent.

-

Signature and Submission

- Many forms require a signature certifying the truthfulness of the information provided, which adds a layer of accountability.

By focusing on these key components, individuals can ensure they have included all necessary data required for their claim, leading to a smoother processing experience.

Important Terms Related to the IT-214 Form 2021

Understanding the terminology used in the IT-214 form is vital for accurately interpreting and completing the document. Here's a breakdown of essential terms:

-

Eligibility: The criteria that must be met for a taxpayer to qualify for the property tax credit, encompassing factors like residency and income limits.

-

Tax Credit: A dollar-for-dollar reduction in the amount of tax owed, which can significantly benefit taxpayers if they qualify.

-

Residency: Defines the status of a taxpayer who lives in New York State, affirming their eligibility for state tax benefits.

-

Income: This refers to the total earnings that may impact eligibility thresholds for claiming the credit, including wages, salaries, and any other income sources.

-

Claim: The formal request made by a taxpayer to receive the credit through submission of the IT-214 form.

Familiarity with these terms can improve the understanding of the form's requirements and processes, ultimately facilitating a more effective filing experience.

Who Typically Uses the IT-214 Form 2021

The IT-214 form is targeted toward specific sets of individuals within the New York State population:

-

Homeowners: Individuals who own property and are eligible for a tax credit based on the amount of property taxes paid can use this form.

-

Renters: Those who are not property owners but pay rent for their residence may also qualify for a credit, provided they meet the income and residency requirements outlined in the instructions.

-

Low to Moderate Income Residents: The form is particularly significant for low to moderate-income families, providing crucial financial aid amid rising housing costs.

-

Senior Citizens: Older adults who may qualify for additional tax benefits tied to property ownership or rental can also benefit from correctly utilizing the IT-214 form.

By understanding who can utilize the IT-214 form, efforts can be concentrated on assisting those individuals in accessing potential tax relief programs.