Definition and Meaning of W-4 in Spanish

The W-4 form, known as "Formulario W-4" in Spanish, is a crucial document that employees use in the United States to indicate their tax situation to their employers. This form determines the amount of federal income tax withheld from an employee's paycheck. Both English and Spanish versions are essential for inclusivity, allowing Spanish-speaking employees to understand their tax obligations fully. The W-4 is a year-by-year form that employees can update as their personal or financial situations change, ensuring that the correct amount is withheld throughout the year.

The W-4 form focuses on several key areas:

- Personal information: Basic data such as name, address, and social security number.

- Filing status selection: Choice between single, married, or head of household, which affects tax withholding.

- Allowances or exemptions: Adjusting the amount withheld based on personal circumstances, such as dependents.

- Additional withholding: Employees can specify extra amounts to be deducted if they anticipate owing additional taxes.

It is important for employees to accurately complete the W-4 to avoid overpaying or underpaying their taxes, leading to potential tax refunds or liabilities when filing their annual tax returns.

Steps to Complete the W-4 Spanish Form

Completing the W-4 Spanish form involves several steps that ensure accurate calculation of federal income tax withholding. Employees should follow these steps for a thorough understanding of the process:

-

Obtain the Form:

- The W-4 Spanish form can be downloaded from the IRS website or obtained from an employer.

-

Fill Out Personal Information:

- Enter your name, address, social security number, and filing status. If you're married and filing jointly, both spouses should consider which filing status to select.

-

Claim Dependents:

- Specify the number of dependents to claim. For each dependent, enter the corresponding dollar amount that affects tax withholding.

-

Adjust Withholding:

- If you expect to owe additional taxes, specify those amounts in the appropriate section for extra withholding. This is particularly useful if you have other income sources not subject to withholding.

-

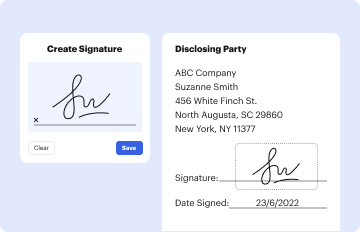

Sign and Date:

- Once the form is filled out accurately, do not forget to sign and date it. This confirms your understanding and agreement with the information provided.

By following these steps, employees can ensure that their federal income tax withholding aligns with their personal financial situation, reducing the chance of surprises when filing taxes.

Who Typically Uses the W-4 Spanish Form

The W-4 Spanish form is essential for various groups of individuals working within the U.S. workforce. Understanding who typically uses this form helps clarify its importance:

-

Employees: All employees, regardless of their primary language, must complete a W-4 to determine their federal tax withholding. Spanish-speaking employees may particularly benefit from the Spanish version for better comprehension.

-

New Hires: New employees must fill out the W-4 before beginning work to ensure correct tax rates apply from the first pay period.

-

Individuals with Changing Tax Situations: Employees who have experienced significant life changes—such as marriage, divorce, or the birth of a child—are encouraged to update their W-4 to reflect their new circumstances.

-

Seasonal Workers: Temporary or seasonal workers must understand their tax obligations to accurately fill out the W-4 for the duration of their employment.

Employers must recognize the significance of providing the W-4 in Spanish as a means of supporting Spanish-speaking employees in understanding their tax responsibilities.

Key Elements of the W-4 Spanish Form

The W-4 Spanish form contains several critical components that serve specific functions in determining tax withholding. Understanding these elements is vital for accurate completion:

-

Employee's Information Section: This includes personal details necessary for processing, such as name, address, and social security number.

-

Filing Status: Employees must select their appropriate filing status—whether single, married filing jointly, or head of household—as this influences the tax withholding calculation.

-

Dependents Section: This area allows the employee to claim dependents, impacting the withholding amount. The more dependents claimed, the less federal income tax is withheld.

-

Extra Withholding Section: Employees can specify any additional amounts they wish to have withheld from their paychecks, which is helpful for those anticipating owing taxes.

-

Signature Requirement: The form must be signed and dated by the employee, verifying that all information provided is correct to the best of their knowledge.

Each of these key elements plays a role in ensuring that the W-4 accurately reflects an employee's tax situation and enables proper federal withholding.

IRS Guidelines for the W-4 Spanish Form

The IRS provides specific guidelines for completing and submitting the W-4 Spanish form. Adhering to these guidelines is essential for compliance and avoiding potential issues:

-

Form Updates: The IRS regularly updates the W-4 form. Ensure to use the most current version, especially for the 2024 tax year, by checking the IRS website for the latest information.

-

Filing Frequency: Employees can update their W-4 as often as necessary, especially if personal circumstances change, such as marriage or the birth of a child.

-

Submission Method: Completed forms should be submitted to the employer's human resources or payroll department, not directly to the IRS.

-

Record Keeping: Employees should keep a copy of their W-4 for personal records. This documentation will be useful for reviewing tax situations and making any necessary adjustments in the future.

Staying informed about these IRS guidelines ensures that employees remain compliant with federal tax laws when using the W-4 Spanish form.