Understanding the Minnesota M99 Form

The Minnesota M99 form is specifically designed to allow residents of Minnesota to claim a tax credit for military service in a combat zone. This form plays a vital role for those who served in active-duty roles, including members of the National Guard and Reservists, as it provides necessary tax relief for military personnel who have served in designated combat zones during 2021. The tax credit amount is set at $120 for each month served in a qualified combat zone, showcasing the state's support and recognition of military service.

Eligibility Criteria for the Minnesota M99 Form

Eligibility for the Minnesota M99 form requires being a Minnesota resident who served in an active-duty role within a designated combat zone during the year 2021. Applicable individuals include active-duty members of the U.S. military, National Guard, and Reservists. Those who wish to apply should provide evidence of their service, verifying the months they spent in the qualifying zone. Relief is not limited only to current servicemembers; certain conditions allow family members to file on behalf of deceased individuals who would have been eligible.

Required Documentation for Eligibility

To successfully complete the M99 form, applicants need to submit various documents as evidence of their eligibility:

- Official military orders indicating service in a combat zone.

- Proof of Minnesota residency, such as a driver's license or utility bill.

- Documentation of active-duty status from relevant periods within 2021.

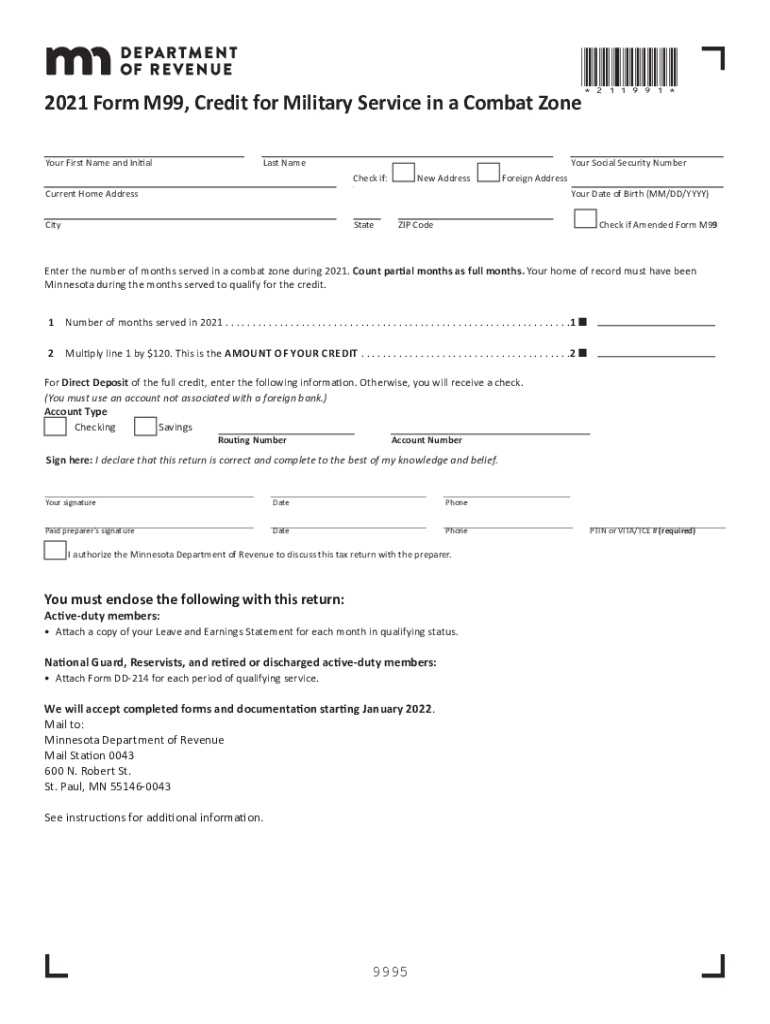

Steps to Complete the Minnesota M99

Completing the Minnesota M99 form involves a series of steps that must be carefully followed to ensure smooth processing and approval of the tax credit:

- Gather Documentation: Compile all necessary documents, including military orders, residency proof, and any prior year tax filings that might support your application.

- Download the M99 Form: Obtain the form through the Minnesota Department of Revenue's official website or request a hard copy if preferred.

- Fill Out Personal Information: Enter personal details such as name, address, social security number, and service information.

- Report Service Details: Input the specific months of active service in a designated combat zone during 2021.

- Calculate the Credit: Multiply the number of eligible months by $120 to determine the total credit amount.

- Submit the Form: Choose between electronic submission or mailing a paper copy to the appropriate tax office.

Step-by-Step Guide for Submission

- Electronic Submission: Access the state's online tax filing system, upload your completed form and documents, and follow prompts to submit. Confirmation of receipt will be emailed.

- Mail Submission: Print the completed form and send it along with copies of supporting documents to the given mailing address for the Minnesota Department of Revenue.

Legal Implications and Use of the Minnesota M99

The M99 form is a legislative measure designed to provide financial relief to servicemembers, ensuring compliance with both state and federal tax laws. It is crucial to accurately report your service and ensure all information provided is truthful, as inaccuracies can lead to penalties or the disallowance of the claimed credit. The form adheres to established guidelines under the ESIGN Act, allowing for electronic completion and submission, with electronic signatures considered legally binding.

Filing Deadlines and Important Dates

Awareness of the critical deadlines associated with the Minnesota M99 form can ensure claimants do not miss the opportunity for tax credit:

- Tax Filing Deadline: Aligns with the federal tax deadline, typically April 15th of the following year.

- Amend Filing Dates: If needed, amendments to the originally submitted form can be filed within three years from the original due date.

Automated System Reminders

To aid applicants, the Minnesota Department of Revenue's online system provides automated reminders and notifications, ensuring that aware users can meet all filing deadlines and requirements efficiently.

IRS Guidelines on Combat Zone Tax Benefits

The IRS provides specific guidelines on tax benefits for those serving in combat zones. This includes the exclusion of certain income from taxation and eligibility to claim credits such as those outlined in the M99 form, which complements federal benefits by offering additional state-level financial relief.

Key Elements Defined by the IRS

- Combat Pay Exclusion: Certain types of pay received in combat zones may be excluded from taxable income.

- IRA Contributions: Contributions based on combat zone pay are exempt from the gross income limit.

Examples of Taxpayer Scenarios Utilizing the Minnesota M99

Real-world scenarios depict various possible applications of the M99 form:

- Active-Duty Army Personnel: Jones, who served eight months in a combat zone, awards him a credit of $960 ($120 x 8) on filing the M99.

- National Guard Reservist: Sarah served three months while on temporary active duty, entitling her to a $360 credit.

Filing on Behalf of Deceased Individuals

In certain cases, a surviving spouse or family member may file a claim using the M99 form for fallen servicemembers. Documentation proving the servicemember's death and their eligible service period must accompany such filings.

Variants and Alternatives to the M99 Form

While the M99 is unique to Minnesota, comparable forms and credits might exist in other states, potentially differing in criteria, credit amounts, and eligible service years. Military personnel frequently moving across state lines should check local tax laws for similar credits offered in other jurisdictions.

State-Specific Differences and Consistencies

Each state may have different definitions of filing requirements, service recognition, and documentation needs, emphasizing the importance of consulting state-specific guidelines regularly to stay informed.

By adhering to these structured blocks of information, Minnesota residents who served in designated combat zones can efficiently leverage the M99 form to claim their tax credits, ensuring they receive the financial relief designated for their service.