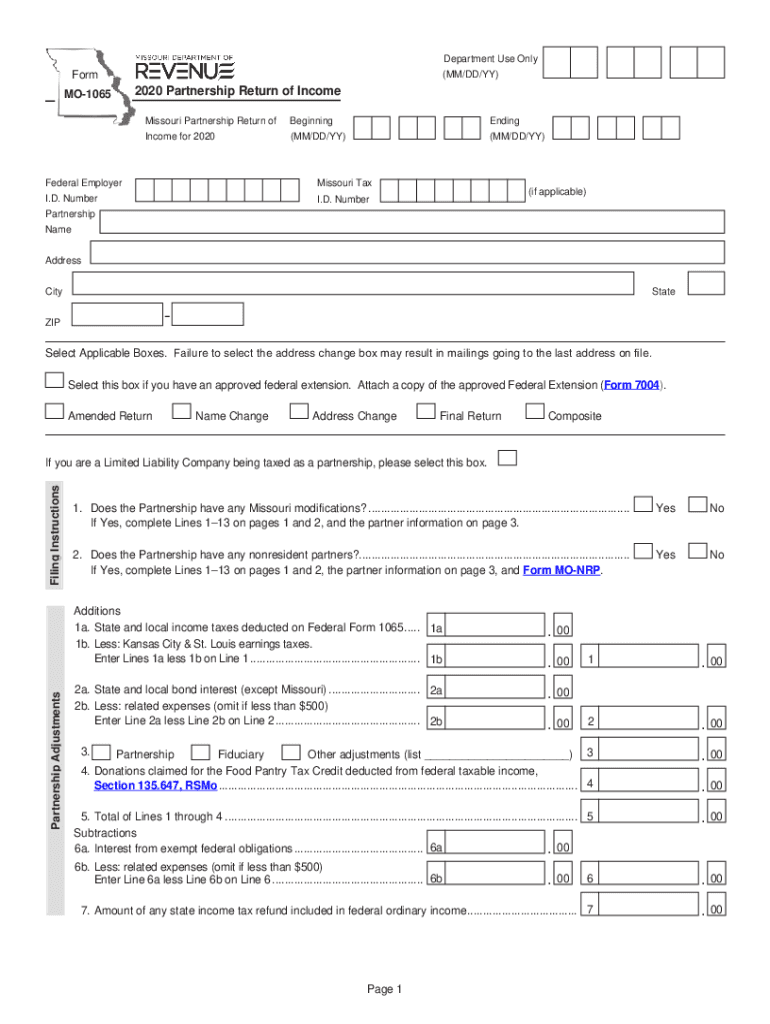

Definition and Meaning of Missouri MO-1065

The Missouri MO-1065 is a tax form specifically designed for partnerships to report their income, modifications, and other relevant tax information to the state of Missouri. Partnerships need to file this form if they have Missouri resident partners, or if they generate any income from sources within Missouri. This form helps the state track partnership earnings and ensures proper tax collection and distribution among partners.

How to Use the Missouri MO-1065

To effectively use Form MO-1065, partnerships should start by gathering all necessary financial documents, including income statements, expense reports, and partner distribution records. The form requires detailed information about the partnership's income, losses, and any modifications or adjustments. Partnerships must carefully review each section, ensuring accurate entries to reflect their financial activities for the year covered by the form.

How to Obtain the Missouri MO-1065

Partnerships can obtain the MO-1065 form through several methods. It is available for download on the official Missouri Department of Revenue website. Businesses can also acquire a physical copy by visiting local Department of Revenue offices. Additionally, partnerships using tax preparation software can typically find and fill out the form within these platforms, as many software solutions include state-specific forms.

Steps to Complete the Missouri MO-1065

- Gather Financial Documentation: Collect all relevant financial documents, including balance sheets and income statements.

- Complete Partner Information Section: Accurately enter details about each partner, including names, addresses, and social security numbers.

- Report Income and Modifications: Fill out sections detailing the partnership’s income, losses, and any state-specific modifications.

- Allocate Partner Earnings: Use the form to properly allocate earned income and losses to each partner based on their partnership agreement.

- Review and Sign the Form: Double-check all entries for accuracy. Ensure that an authorized partner signs the form before submission.

Filing Deadlines and Important Dates

The Missouri MO-1065 form must be filed annually, typically aligning with the federal partnership tax deadline, which falls on March 15th. Extensions may be available, but they require filing a separate request form prior to the deadline. Partnerships should be vigilant about these dates to avoid penalties and ensure compliance.

Required Documents for Missouri MO-1065

When preparing the MO-1065, partnerships should have several documents ready, including:

- Partner agreement illustrating income distribution.

- Income statements and balance sheets.

- Previous-year tax returns for reference.

- Partner social security numbers and relevant identification.

These documents support accurate reporting and ensure all necessary information is included in the submission.

Important Terms Related to Missouri MO-1065

- Partnership Agreement: A document detailing how earnings and taxes are shared among partners.

- Modifications: Adjustments made to income figures for the purposes of Missouri state tax.

- Nonresident Partner: A partner who does not reside in Missouri yet is part of a partnership operating in the state.

Understanding these terms helps filers accurately complete the form and ensure that all relevant sections are addressed properly.

Legal Use and Compliance for Missouri MO-1065

Filing Form MO-1065 is a legal requirement for partnerships generating income in Missouri. Non-compliance can lead to penalties, fines, and potential legal action. Partnerships are responsible for ensuring their filings are accurate and submitted on time. Using reliable accounting practices and professional tax advice is advisable to avoid legal pitfalls.

Examples of Using the Missouri MO-1065

Consider a partnership with three partners, all residing in different states, but conducting business in Missouri. The partnership must file the MO-1065 to report its income and distribute earnings to each partner. If the partnership makes $300,000 in Missouri, this income must be accurately reflected and distributed appropriately according to the partnership agreement. Each partner will then handle their state-specific tax obligations.

IRS Guidelines for Partnerships

The Internal Revenue Service (IRS) provides specific guidelines that influence how partnerships file their taxes, including the harmonization of state filings like the MO-1065. Partnerships should align their federal return, Form 1065, with the state-specific requirements to maintain consistency and accuracy in reporting. Additionally, following IRS rules helps streamline the filing and adjustment process for federal and state submissions.

Penalties for Non-Compliance

Failing to file the Missouri MO-1065 can result in financial penalties and interest charges on unpaid taxes. Partnerships may face additional scrutiny from the Missouri Department of Revenue, which could lead to audits and further compliance checks. It's crucial for partnerships to understand these risks and take proactive measures to ensure timely and accurate filing.

Form Variants and Alternatives to Missouri MO-1065

Missouri offers several tax forms depending on the entity type. While MO-1065 caters specifically to partnerships, other business structures might require different forms. For example, corporations typically use the MO-1120 form. Understanding the specific obligations and forms for each business type reduces errors and ensures proper compliance with state regulations.