Definition & Meaning

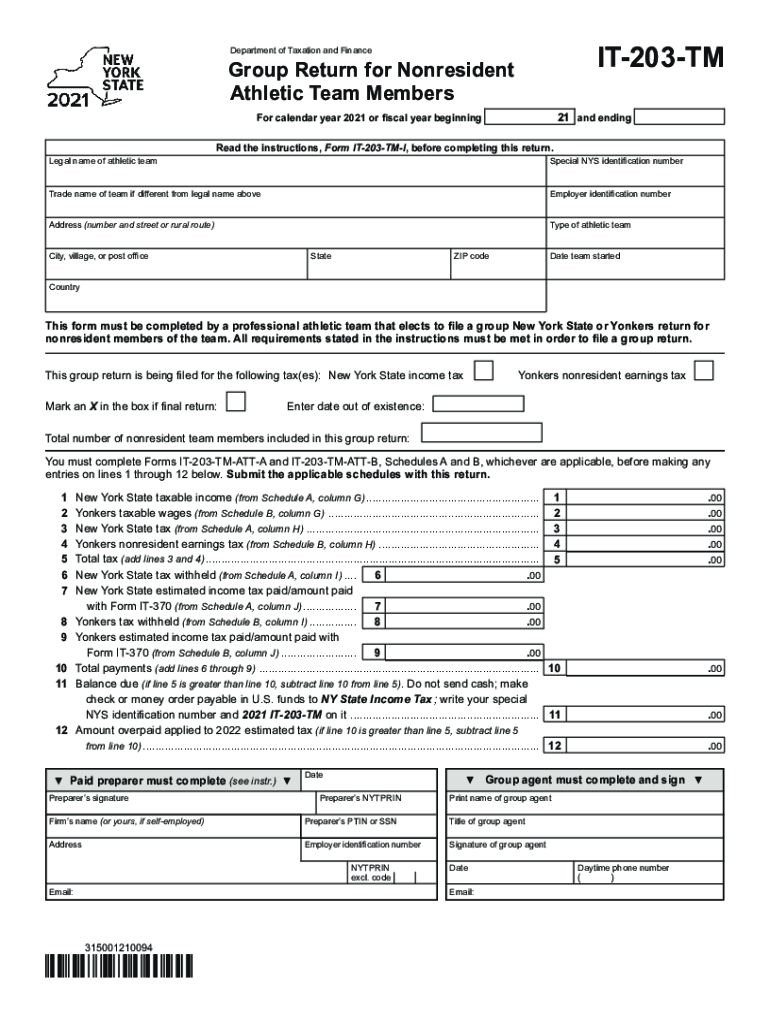

Form IT-203-TM is the Group Return for Nonresident Athletic Team Members for the tax year 2021, issued by the New York State Department of Taxation and Finance. It is designed for nonresident professional athletic team members, allowing these individuals to file a group return for their New York State income tax and Yonkers nonresident earnings tax. This form streamlines the tax filing process for athletes who earn income from activities conducted within New York State but maintain residency outside of it.

Who Typically Uses form IT-203-TM

Form IT-203-TM is predominantly utilized by professional athletic teams in which members are nonresidents of New York but earn income through games or activities performed in the state. This includes players, coaches, and team staff associated with leagues such as the NBA, NFL, or MLB, who might play games in New York despite residing elsewhere. It simplifies filing obligations, enabling team administrators to consolidate tax responsibilities into a single managed return.

How to Obtain Form IT-203-TM

Obtaining Form IT-203-TM can be efficiently achieved through multiple channels:

- Online Access: The form is downloadable directly from the New York State Department of Taxation and Finance official website. This method provides the most updated version and accompanying instructions.

- Professional Assistance: Tax professionals or accountants specializing in team finances may also provide this form as part of their services.

- State Tax Offices: Physical copies can be collected from New York State Tax Offices, providing an option for those preferring hard copies or in-person consultations.

Steps to Complete Form IT-203-TM

Filing Form IT-203-TM involves several key steps to ensure accurate submission:

- Team Identification: Start by filling in team details such as name, address, and Federal Employer Identification Number (FEIN).

- Income Reporting: Record all New York-sourced income, including salaries and bonuses earned by nonresident team members.

- Tax Calculation: Calculate the applicable New York State and Yonkers nonresident earnings taxes.

- Payment Details: List all tax prepayments already made or any credits to be applied.

- Signatures and Authorization: Ensure the form is signed by an authorized team representative to validate the return.

Required Documents

When filing Form IT-203-TM, ensure you have all necessary documentation:

- Team Member Lists: Include names and roles of all nonresident team members covered by the form.

- Income Statements: Provide detailed accounts of earnings stemming from New York State activities.

- Payment Records: Document any tax payments made throughout the fiscal year relevant to team activities in New York.

Legal Use of Form IT-203-TM

The legal utilization of Form IT-203-TM serves to comply with state tax obligations for nonresident athletic teams earning within New York. This form ensures that appropriate income taxes are withheld and reported, protecting both the individuals and team from liabilities associated with unreported earnings.

- Regulatory Compliance: Adheres to New York State taxation laws, ensuring compliance with nonresident tax regulations.

- Audit Readiness: Provides a formal record in case of state audits to substantiate tax filings and payments.

Filing Deadlines / Important Dates

Compliance with deadlines is critical to avoid penalties:

- Annual Deadline: The form must be submitted by April 15 of the year following the tax year being reported. This aligns with standard tax filing deadlines for individuals regardless of residency.

- Extension Possibilities: If more time is needed, filing for an extension can push the deadline to October 15. However, any taxes due must be paid by the original deadline to avoid interest.

Penalties for Non-Compliance

Failure to properly file Form IT-203-TM can result in significant penalties:

- Late Filing Fees: Delayed submissions may incur financial penalties, calculated based on the outstanding tax balance.

- Interest on Outstanding Payments: Taxes not paid by the deadline accrue interest, increasing the overall financial burden.

- Legal Action: Prolonged non-compliance may lead to legal actions initiated by New York State to recover overdue taxes.

Ensuring timely and accurate filing prevents these situations, underscoring the importance of adhering to all procedural and legal prerequisites.