Definition & Meaning

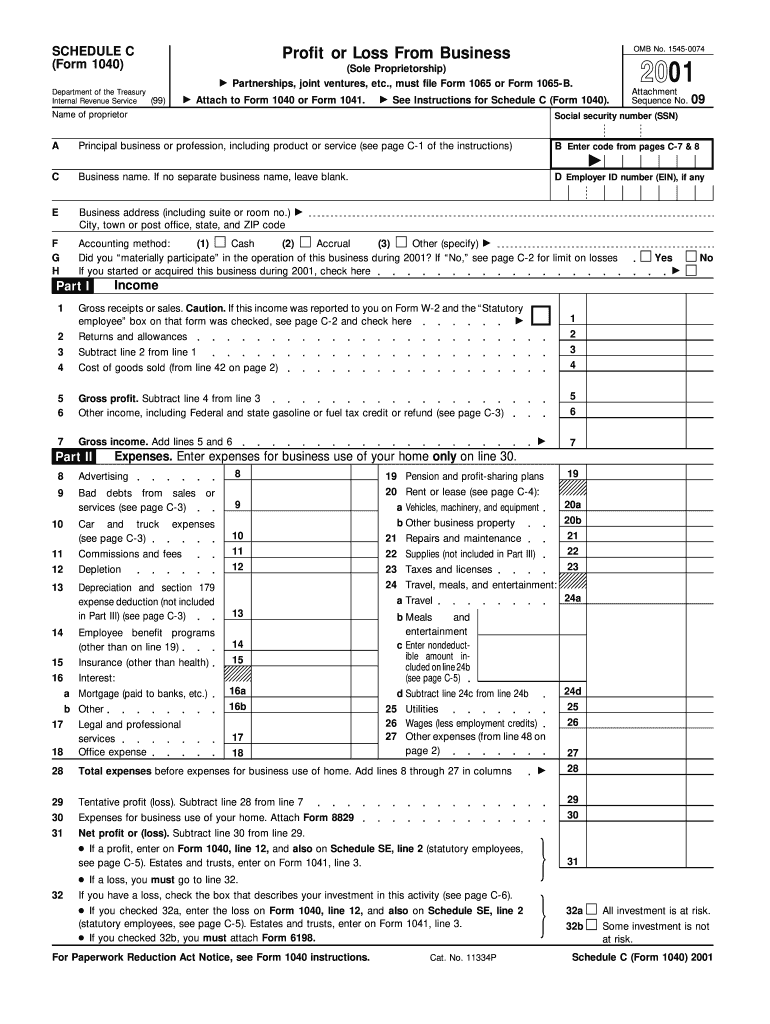

The Schedule C (Form 1040) is utilized by sole proprietors to report profit or loss from their business operations on their individual tax return. This form includes specific sections for detailing business income, expenses, and cost of goods sold, among other financial elements. As it pertains to a sole proprietorship, this form becomes an integral component in defining the business's financial activity and is mandatory for inclusion when filing the IRS Form 1040.

Schedule C outlines the total business income and deducts allowable business-related expenses to determine net profit or loss. It's important as it directly impacts the taxpayer's total income level and, consequently, the amount of tax owed. Businesses selling products must also calculate the cost of goods sold, which includes inventory purchases and other costs associated with producing goods.

How to Use the Sample Schedule C Form

To use a sample Schedule C form effectively, first, gather all necessary financial documents related to the business's income and expenses throughout the tax year. Record the gross receipts on the form, along with any returns or allowances. Subtract returns from gross receipts to find net sales. Also, gather documentation of returns and allowances for absolute accuracy.

Next, meticulously document all business expenses in their respective categories. This includes advertising, car and truck expenses, and supplies, among others. Deduct these expenses from the income to calculate the business's net profit or loss. Ensure the correct categorization and input of each entry—financial mistakes can lead to audits or penalties.

How to Obtain the Sample Schedule C Form

The Schedule C form is readily accessible through the IRS website, where it’s available for download. Alternately, this form can be obtained through tax preparation software like TurboTax or by visiting a local IRS office. For convenience, tax practitioners and accounting firms can also supply print or digital copies of the form.

Taxpayers must ensure they use the correct version for the corresponding tax year. Updating and confirming accuracy before submission is crucial to avoid complications or compliance issues.

Steps to Complete the Sample Schedule C Form

-

Identify Business Information:

- Provide the business name, address, and applicable EIN.

- Enter the principal business or professional activity code, applicable if you’ve registered a business name.

-

Record Income:

- Enter gross receipts or sales.

- Subtract returns and allowances.

- Note other income related to business operations.

-

List Expenses:

- Categorize and enter operating expenses such as rent, salaries, and utilities.

- Include any depreciable property deductions and vehicle expense deductions.

-

Calculate Cost of Goods Sold:

- For product-selling businesses, determine the beginning and ending inventories.

- Subtract remaining inventory from purchased materials to calculate COGS.

-

Determine Net Profit or Loss:

- Deduct total expenses from the gross income.

- Enter the net values onto your Form 1040.

Key Elements of the Sample Schedule C Form

Schedule C is structured into various sections that ensure comprehensive coverage of all business financial activities. Critical components include:

- Gross Receipts/Sales: Total income received from operations before expenses.

- Expenses: Detailed breakdown of costs necessary for business operations.

- Cost of Goods Sold (COGS): Calculations relevant for businesses involved in sales and production.

- Net Profit or Loss: The final profit or loss figures post expenses, subject to tax.

Each element plays a crucial role in accurately assessing the financial viability of the business and determining the taxpayer’s income.

Who Typically Uses the Sample Schedule C Form

The primary users of Schedule C are sole proprietors who operate as a single entity owner under a business structure with no legal separation between the owner and the business. Freelancers, independent contractors, and consultants are common users as their business income typically does not pass through other business structures like S-Corps or LLCs, which would require alternative forms.

Additionally, small business owners with straightforward business operations that don't necessitate complex corporate taxation structures frequently file with Schedule C.

IRS Guidelines

The IRS provides specific guidance on completing Schedule C accurately and effectively, emphasizing the importance of accurately documenting all income and business expenses. Correct categorization and adherence to limits for deductible expenses are essential, with the IRS mandating detailed records for each entry to substantiate amounts claimed.

Moreover, guidelines necessitate retaining all related documents for a minimum of three years in case of audit or verification. Taxpayers are encouraged to review the IRS Schedule C instructions for any updates annually before filing.

Filing Deadlines / Important Dates

Filing the Schedule C form is aligned with the tax filing deadline for individual tax returns, typically April 15. Sole proprietors must ensure their Schedule C is complete and accompanies the Form 1040. If utilizing available extensions, such as filing Form 4868, documentation would permit additional time—typically until October 15 to file returns.

It’s crucial to meet these deadlines, as missing them can result in penalties and interest charges on any unpaid tax amounts. Taxpayers should plan filings in advance to avoid the stress of last-minute submissions.