Definition and Purpose of ET-133

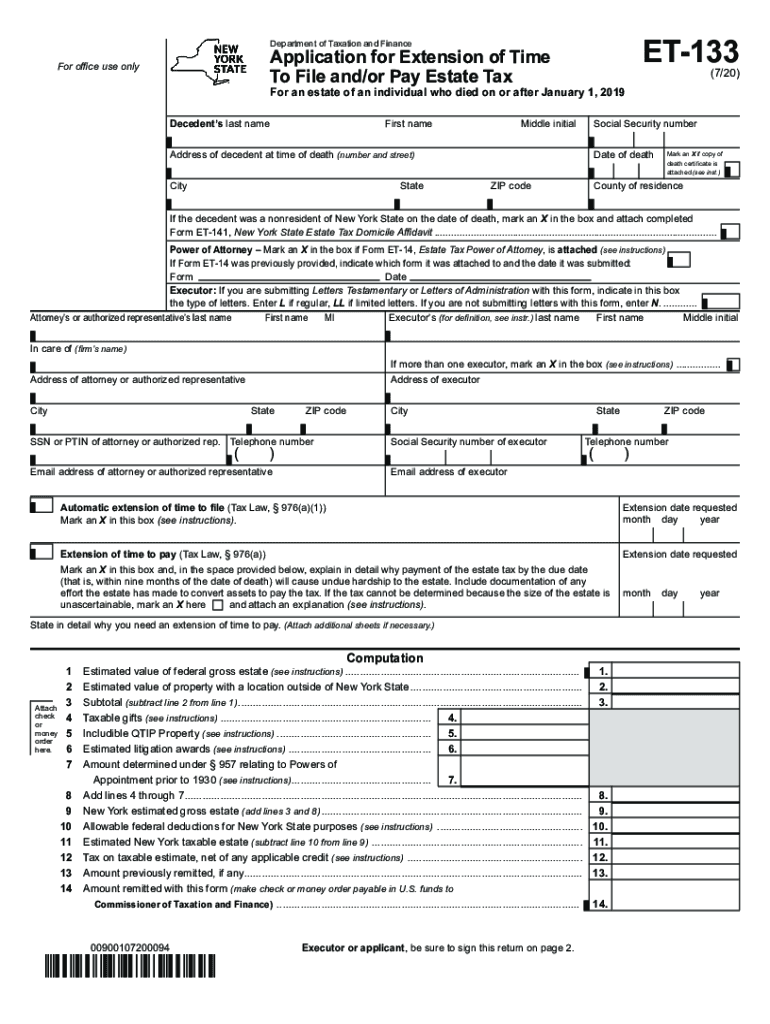

The ET-133 form is an application for requesting an extension of time to file and/or pay estate tax in the United States. This form is essential for estates of individuals who passed away on or after January 1, 2019, allowing for additional time to organize and submit the necessary financial documentation. The primary function of the ET-133 is to bridge the gap for executors who need a reprieve in gathering required estate data or amassing the funds to pay the estate tax owed.

Key Elements of the ET-133

- Decedent Information: Essential details about the deceased individual, including full name, Social Security Number, and date of death.

- Executor Details: Identifying the executor responsible for managing the estate, their contact information, and any professional affiliations.

- Estate Financial Summary: An overview of the estate's value, including assets, liabilities, and potential deductions, which are crucial for calculating tax obligations.

- Extension Request and Reasoning: Specific sections dedicated to expressing the need for an extension, whether due to cash flow issues, complex asset management, or other factors.

- Tax Computation: Detailed calculations of the estate tax liability, including any previous payments or credits applied.

Steps to Complete the ET-133

- Gather Required Information: Collect all necessary documentation, such as financial statements, asset appraisals, and supporting tax records.

- Complete Decedent and Executor Sections: Accurately fill in personal details, ensuring all contact information is current.

- Provide Estate Financial Data: Document the estate's asset and liability structure, offering precise valuations.

- Explain Extension Need: Clearly outline the reasons for the extension, ensuring they align with allowable criteria.

- Calculate and Confirm Tax Obligations: Use provided worksheets to compute any owed taxes, verifying all figures for accuracy.

- Review and Sign: After all sections are completed, carefully review the form to ensure no errors or omissions and then sign as required.

Examples of Using the ET-133

Executors might find themselves in scenarios necessitating the ET-133 form. For instance, if an estate has considerable non-liquid assets such as art or real estate, finding quick liquidity to pay taxes might be challenging, similarly when there's a need to resolve complex will instructions or disputes among heirs.

How to Obtain the ET-133 Form

- Download from the IRS Website: The most direct method is accessing it via .gov domains, ensuring the most recent version is used.

- Request by Mail: Individuals preferring physical copies can request it from the IRS mailing services.

- Professional Tax Advisors: Estate planning professionals often have ready access to essential forms and can provide guidance on their completion.

Form Submission Methods

- Online Submission: Many choose to submit via electronic options on the IRS website, benefiting from faster processing times.

- Mail: Traditional filing through postal services remains an option, particularly for those who prefer hardcopy documentation.

- In-Person: Though less common, visiting an IRS office for direct submission ensures any immediate questions can be addressed.

Legal Use and Compliance for ET-133

Utilizing the ET-133 within legal confines is crucial for exemption eligibility and to avoid potential penalties. Ensure compliance by:

- Following Official Guidelines: Stick to provided instructions and adhere strictly to submission deadlines.

- Providing Accurate Information: Misrepresentation or errors can lead to form rejection or increased scrutiny.

- Understanding State-Specific Regulations: Some states might have additional requirements or forms to accompany federal submissions.

Penalties for Non-Compliance

Failure to submit the ET-133 correctly or on time can result in significant consequences:

- Late Payment Penalties: These accrue against owed estate taxes, heightening financial strain.

- Interest Charges: Added to outstanding balances, increasing the total payable over time.

- Potential Legal Action: In extreme cases where neglect is proven, the state or federal authorities might initiate legal proceedings.

Digital vs. Paper Versions

The rise in digital solutions offers enhanced convenience for executors managing estates:

- Digital Submissions: Facilitates immediate acknowledgment and reduces the risk of lost paperwork.

- Access to Integrated Software: Platforms like DocHub allow for direct editing and submission, removing layers of administrative complexity.

- Benefits of Digital Records: Storing records electronically ensures easy retrieval for future reference or audits and provides immediate access for collaborative review processes.

Software Compatibility

Estate management often requires software for seamless processing:

- Tax Preparation Software: Programs like TurboTax or QuickBooks make form completion more straightforward through automation and prefilling capabilities.

- Cloud-Based Editing Tools: Applications like DocHub or Google Workspace improve collaborative work on form preparation across different parties.

State-Specific Rules for ET-133

Each state in the U.S. might impose additional or varying regulations affecting how the ET-133 form is used:

- Estate Values Thresholds: States may have distinct asset valuation limits dictating additional documentation or declarations.

- State vs. Federal Deadlines: Alignment or variance in deadlines between state and federal levels requires attentive management to maintain compliance.

- Local Extensions Policies: Some states offer supplementary extensions processes that can impact overall submissions.

In conclusion, while the ET-133 form presents a structured means to request tax filing extensions, understanding its complexities across state lines, abiding by submission protocols, and leveraging digital tools can significantly ease the process for executors managing intricate estates.