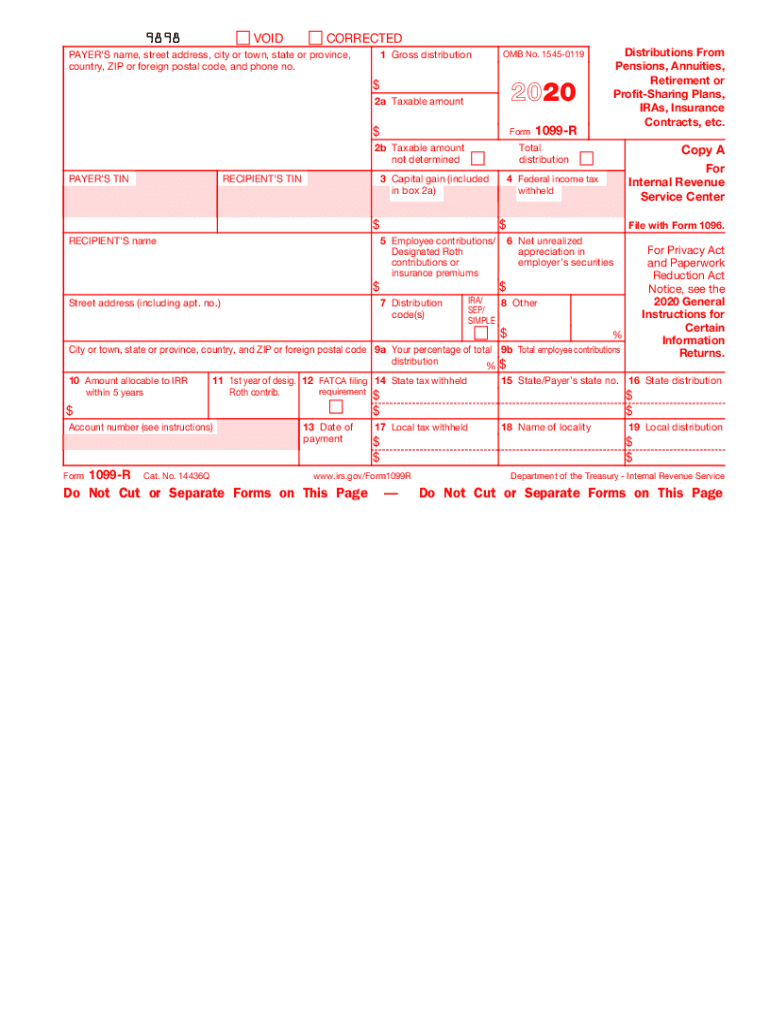

Definition and Purpose of Form 1099-R

Form 1099-R is a tax form used in the United States to report distributions from pensions, annuities, retirement plans, IRAs, insurance contracts, or profit-sharing plans. It plays a vital role in helping taxpayers declare and manage income received from these sources to the IRS. A clear understanding of its purpose allows individuals to ensure proper tax compliance and avoid potential penalties for misreporting.

Key Elements of Form 1099-R

- Payer Information: This includes details of the individual or entity responsible for making the payment, such as a pension fund or financial institution.

- Recipient Information: Essential recipient details include name, address, and taxpayer identification number.

- Distribution Amount: This is the total amount distributed to the recipient during the tax year.

- Taxable Income Details: Distinction between total distribution and the taxable portion.

- State and Federal Tax Considerations: Information on any withholding amounts for federal or state taxes.

- Distribution Codes: Codes that describe the type of distribution, which affect tax treatment.

Steps to Complete Form 1099-R

Completing Form 1099-R requires attention to detail to ensure accuracy for both the payer and recipient. Below are the essential steps involved:

-

Gather Required Documents: Collect relevant forms and information relating to the distribution, such as bank statements and retirement account documents.

-

Fill in Payer Details: Include information about the entity or person responsible for issuing the distribution, like addresses and identification numbers.

-

Input Recipient Information: Accurately enter the recipient's full name, taxpayer identification number, and address.

-

Provide Distribution Amount: Specify the total distribution amount along with the taxable portion if applicable.

-

Note Tax Withholdings: Record any federal and state taxes withheld from the distribution.

-

Assign Distribution Codes: Use the correct code to define the nature of the distribution, crucial for determining tax implications.

IRS Guidelines for Form 1099-R

The IRS provides comprehensive guidelines to ensure proper filing of Form 1099-R. Adherence to these guidelines helps prevent discrepancies and potential penalties:

- The form must be filed for each individual receiving a distribution of $10 or more.

- Ensure the use of official IRS forms or electronic filing systems for paper submissions.

- File Copy A with the IRS and provide Copy B to the recipient.

- Corrections should be made promptly if errors occur after submission.

- Maintain records supporting the reported distributions for at least three years in case of an audit.

Filing Deadlines and Important Dates

Timely submission of Form 1099-R is crucial to avoid late fees and penalties:

- The deadline for sending Copy B to the recipient is January 31st of the year following the distribution.

- Copy A must be submitted to the IRS by February 28th for paper filings or March 31st for electronic submissions.

Who Typically Uses Form 1099-R

Form 1099-R is primarily used by retirees, beneficiaries of deceased individuals' retirement plans, or those receiving disability payments through retirement funds. Employers, pension trustees, or financial institutions responsible for making distributions use this form to ensure tax compliance for amounts distributed.

Penalties for Non-Compliance

Failure to comply with filing requirements for Form 1099-R can result in significant penalties:

- Penalties can range from $50 to $280 per form, depending on the lateness and degree of oversight.

- Willful negligence with non-compliance can incur additional penalties as determined by the IRS.

- Taxpayers can contest penalties if reasonable cause is demonstrated for the non-compliance.

Software Compatibility and Digital Methods

Many taxpayers and businesses use tax preparation software like TurboTax or QuickBooks to manage Form 1099-R filing efficiently:

- Software options often provide guidelines and step-by-step instructions for completing the form.

- Digital submissions typically offer faster processing times and reduce the risk of errors.

- Integration with IRS e-filing systems enhances both convenience and accuracy.

State-Specific Rules for Form 1099-R

Though Form 1099-R is a federal tax form, some states might have specific reporting requirements or exclusions concerning retirement income.

- States might differ in how retirement income is taxed or credited.

- Residents should consult local tax authorities or professional tax advisors to ensure compliance with state obligations.

- Keeping up with state-specific changes can prevent unintended tax liability.