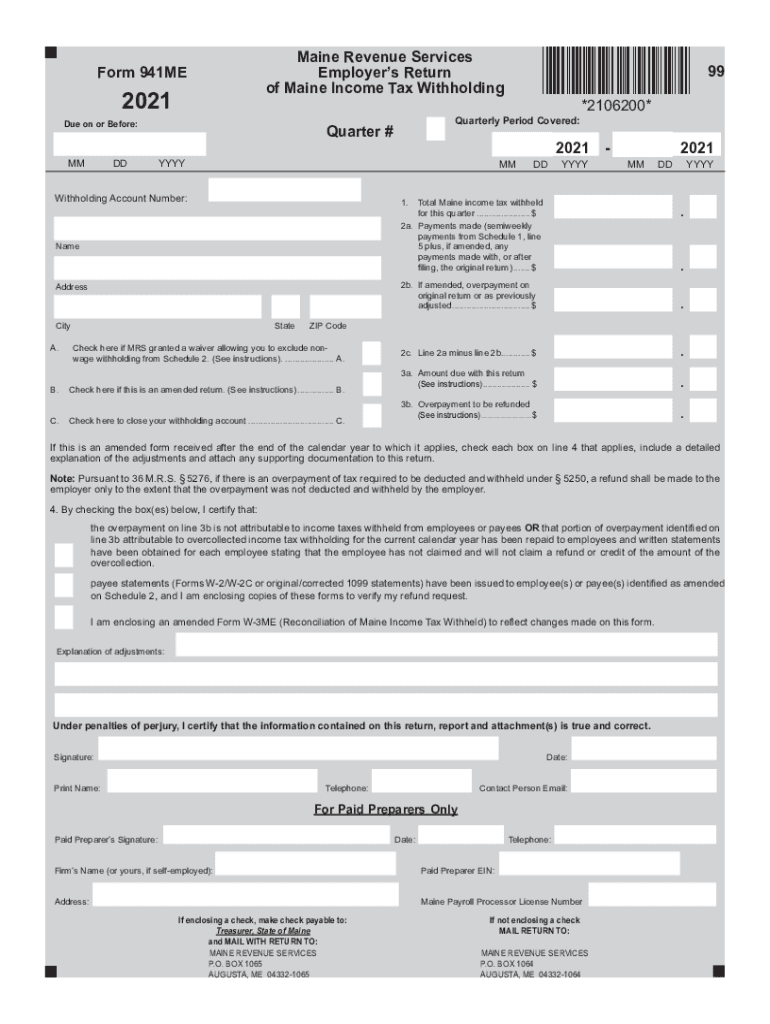

Understanding Form 941ME for Maine Income Tax

Form 941ME is designed for employers in the state of Maine to report their income tax withholding obligations. This document includes various sections aimed at comprehensively detailing the amount of taxes withheld from employee wages.

Sections Included in Form 941ME

-

Total Tax Withheld: This section requires employers to detail the total amount withheld from employee wages. It serves as a critical summary of the deductions that need to be reported to the Maine Revenue Services.

-

Payments Made: Employers must also report any payments already made toward their withholding obligations. This ensures accurate reconciliation of tax liabilities and payments made during a specific period.

-

Overpayments: If any overpayments have occurred, this section allows employers to document the excess amount. Proper reporting ensures that credits can be applied to future tax liabilities or a refund can be issued.

-

Certifications: Employers are required to certify the accuracy of the employee statements provided. This section helps verify that the information reported aligns with the actual deductions made from employee wages.

Form Schedules

-

Reconciling Semiweekly Payments: For employers who pay on a semiweekly basis, this part of the form helps in reconciling payments against the withholdings.

-

Corrections for Employee Withholdings: If mistakes in employee withholdings occur, employers can rectify these issues here. This section is crucial for maintaining accurate records and ensuring compliance with state tax laws.

How to Use Form 941ME

Completing Form 941ME requires careful attention to detail, as incorrect entries can lead to penalties and audits.

Key Steps to Complete Form 941ME

-

Gather Necessary Information: Employers should start by collecting all relevant employee wage and withholding information for the reporting period.

-

Calculate Total Wages and Withholdings: Accurately calculate the total wages paid and the total taxes withheld during the period.

-

Complete Each Section: As detailed in the form sections, fill out the total tax withheld, payments made, and any other relevant sections.

-

Review for Accuracy: Double-check all entries for accuracy to avoid penalties and ensure compliance with state requirements.

-

Submit the Form: Form 941ME can be submitted either electronically or by mail, depending on the employer's preference and state guidelines.

Requirements for Submission

-

Electronic Filing: Adopting electronic submission can streamline the process and provide quicker confirmation of receipt.

-

Manual Submission: If preferring a paper form, ensure it is mailed to the address provided by Maine Revenue Services before the due date.

Important Terms Related to Form 941ME

Understanding specific terminology associated with Form 941ME is critical for accurate completion.

Key Terms Defined

-

Withholding: The amount deducted from an employee’s wages for tax purposes.

-

Overpayment: When more tax is paid than is owed, often resulting in a credit or refund.

-

Certification: An official confirmation submitted by employers to attest to the accuracy of the withholding data.

Legal and Compliance Aspects

Navigating the legal requirements tied to Form 941ME is vital for avoiding any potential compliance issues.

Compliance Obligations

-

Timely Submissions: Ensure all forms are submitted within state deadlines to prevent late fees and penalties.

-

Accurate Reporting: Employers must provide precise withholding figures to align with state law.

Penalties for Non-Compliance

Failure to accurately complete and submit Form 941ME can result in various penalties:

-

Late Filing Penalties: Additional fees levied against employers who fail to submit the form by the deadline.

-

Accuracy-Related Penalties: Fines associated with submitting incorrect withholding information.

Variants and Alternatives to Form 941ME

Though Form 941ME is specifically for Maine, understanding similar forms relevant to other jurisdictions can be beneficial.

Other Relevant Tax Forms

-

Federal Forms: W-2 and W-3 forms are used for federal wage and tax statement reporting.

-

State-Specific Forms: Each state may have unique tax forms that align with their respective laws and regulations.

Software Compatibility and Integration

Leveraging technology can ease the process of managing and submitting Form 941ME.

Recommended Software Tools

-

TurboTax and QuickBooks: These popular tax software programs are compatible with state and federal tax forms, including 941ME, offering streamlined workflows for large and small businesses alike.

-

Cloud-Based Solutions: Implementing secure, online platforms can efficiently manage tax documentation and reporting processes.

Benefits of Digital Processes

-

Reduced Errors: Automation minimizes the risk of errors commonly associated with manual entry and submission.

-

Faster Processing: Digital tools often offer quicker processing times and instant confirmation of form submissions.

In conclusion, Form 941ME is an integral document for Maine employers in managing their state tax obligations. Understanding its structure, requirements, and the steps for completion ensures compliance with state tax laws and facilitates smoother financial operations.