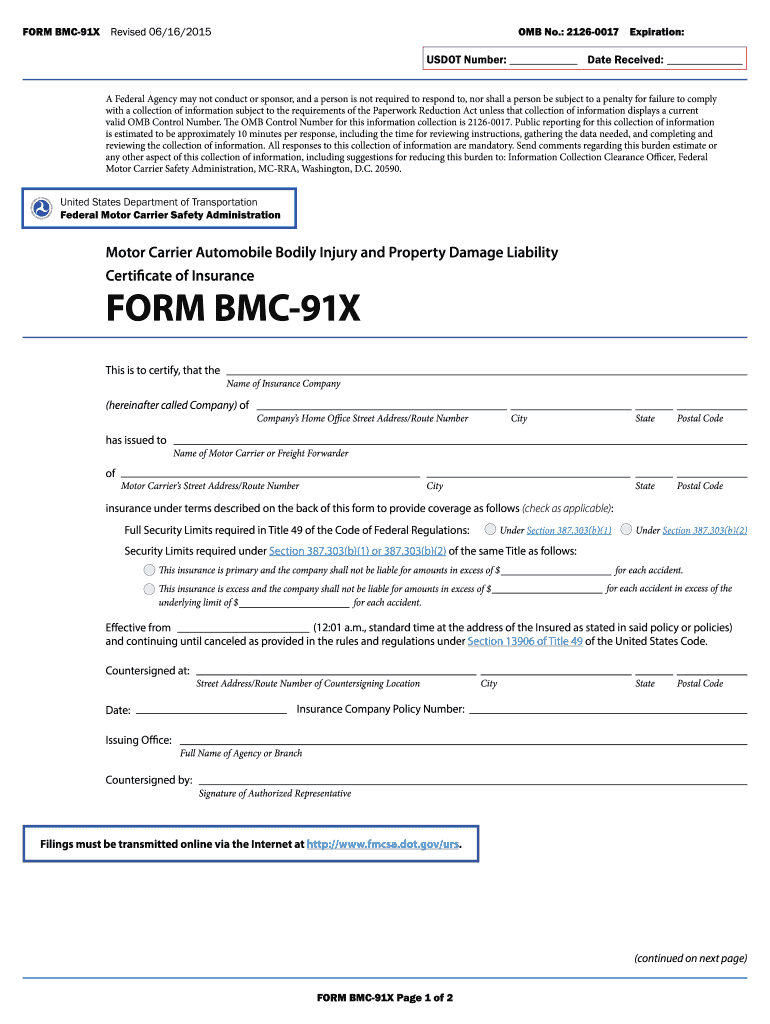

Definition and Purpose of the BMC 91X Form

The BMC 91X form, also known as the Certificate of Insurance, is issued by the Federal Motor Carrier Safety Administration (FMCSA). This form serves as proof that a motor carrier has obtained adequate public liability coverage, as mandated by federal regulations under Title 49 of the Code of Federal Regulations. The BMC 91X assures that third parties can be compensated for bodily injury and property damage resulting from the operation of commercial vehicles. This form is critical for compliance and for the operation of commercial motor vehicles crossing state lines.

Key Features of the BMC 91X Form

- Insurance Details: The BMC 91X includes specifics about the insurance provider, such as the insurance company's name, address, and contact information, alongside policy numbers and coverage limits.

- Mandatory Requirement: Compliance with the FMCSA regulations necessitates the submission of this form, making it an essential part of motor carrier operations.

- Legal Compliance: The BMC 91X serves as a legal instrument that protects motor carriers by ensuring they meet the requisite insurance standards.

Steps to Complete the BMC 91X Form

Filling out the BMC 91X form requires precise information to be compliant with federal regulations. Follow these structured steps to ensure accuracy and completeness.

-

Gather Necessary Information:

- Collect details about your insurance policy, including the insurer's information and coverage limits.

- Have your company’s legal name and physical address readily available. Ensure consistency with your operating authority documents.

-

Complete the Form:

- Fill out all sections of the form, ensuring that each field is completed accurately.

- Include the name of the insurance company providing coverage, the effective date of the policy, and the types of coverage provided.

-

Review for Errors:

- After completing the form, double-check all the entries. Small mistakes can result in delays or penalties.

-

Submission Process:

- Submit the completed form to the FMCSA. Ensure that you keep a copy for your records.

Common Mistakes to Avoid

- Leaving fields blank or misreporting coverage amounts can lead to compliance issues.

- Not keeping copies of submitted forms can complicate future inquiries or verifications.

Important Terms Related to the BMC 91X

Understanding specific terminology associated with the BMC 91X is crucial for accurate completion and comprehension. Here are some key terms:

- Public Liability Coverage: This refers to insurance protecting against claims for bodily injury and property damage incurred during the operation of commercial vehicles.

- FMCSA: The Federal Motor Carrier Safety Administration is responsible for regulating commercial motor vehicle safety and compliance.

- Certificate of Insurance: A document verifying the existence of an insurance policy, outlining the coverage specifics.

By familiarizing yourself with these terms, you can navigate the complexities of the BMC 91X form and related insurance requirements more confidently.

Legal Use of the BMC 91X Form

The BMC 91X form has legal implications that protect all involved parties. Its primary role is to document compliance with federal standards for motor carriers. Failure to submit or accurately complete the BMC 91X can result in significant legal and financial repercussions.

Legal Responsibilities

- Contractual Obligations: Carriers are required to maintain adequate insurance policies and submit documentation as proof.

- Liability Requirements: If an insured party is involved in an accident, having a valid BMC 91X may protect them against legal claims regarding insufficient insurance coverage.

Compliance Maintenance

- Ensure that your insurance remains valid and up-to-date to avoid compliance lapses that could lead to penalties.

- Stay informed on changes in federal regulations that may affect your insurance requirements or the BMC 91X itself.

Filing Deadlines and Important Dates for the BMC 91X

Adhering to deadlines related to the BMC 91X is critical for maintaining compliance with FMCSA regulations. Here are the relevant timelines to keep in mind:

- Initial Filing: New motor carriers must submit the BMC 91X form before commencing operations. This typically needs to occur simultaneously with the application for operating authority.

- Renewal Notifications: Carriers should be aware of their insurance policy renewal dates. Re-filing or amendments may be necessary if there is a change in coverage or an updated policy.

- Grace Periods: While the FMCSA may offer temporary grace periods for specific situations, relying on these for continued operation is risky.

Keeping Track of Deadlines

- Set reminders for filing according to your business’s operational calendar.

- Regularly check for updates from the FMCSA regarding potential changes in regulations or requirements for using the BMC 91X form.

By staying informed and proactive regarding deadlines, motor carriers can avoid compliance pitfalls, ensuring smooth operational processes.